Solana’s social metrics reveal a troubling pattern after the altcoin didn’t maintain its 40% value improve. On November 5, SOL traded at $161.93, and 17 days later, it reached a brand new all-time excessive.

Nevertheless, regardless of this rally sparking renewed enthusiasm amongst holders, the dearth of continued momentum factors to weakening bullish sentiment. With this decline, the query stays: what’s subsequent for SOL’s value?

Solana Sentiment Turns Bearish

The influence of Solana’s falling bullish sentiment is obvious in its market cap place. Two days in the past, SOL was the fourth most respected cryptocurrency by way of market cap. Nevertheless, it has since misplaced that spot to Ripple (XRP), a token that has been outperforming different property within the high 100.

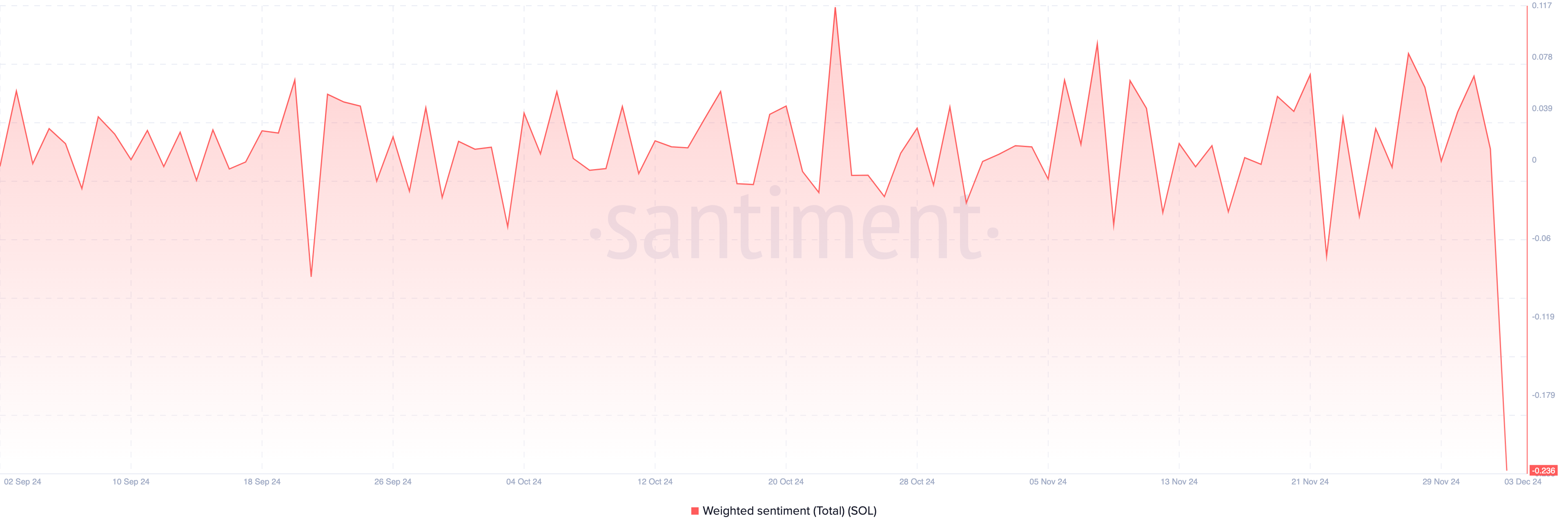

Following the event, Solana’s social metrics, together with the weighted sentiment, declined. The Weighted Sentiment gauges the broader market’s notion of a cryptocurrency.

When it’s optimistic, it implies that the majority remarks concerning the altcoin are bullish. However, whether it is adverse, it signifies that most feedback relating to the cryptocurrency are bearish. Based on Santiment, Solana’s weighted sentiment has plummeted to adverse territory, suggesting that the majority market members aren’t bullish on SOL’s short-term value motion.

If this pattern continues throughout the subsequent few days, demand for the cryptocurrency would possibly proceed to wane. Social dominance is one other indicator that implies that SOL’s value might face an extra downturn.

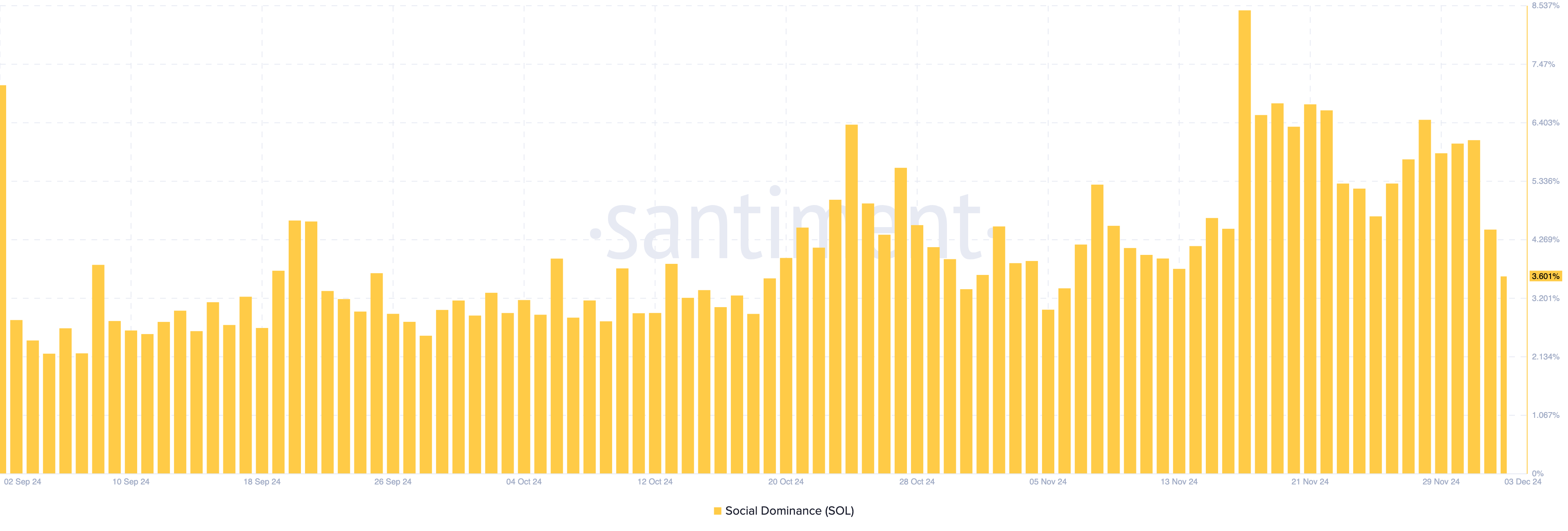

Social dominance measures the extent of debate round a cryptocurrency in comparison with different property out there. When the metric rises, it means the conversations concerning the asset in query have elevated, which is normally bullish.

Nevertheless, in SOL’s case, the metric has declined from 8.42% on November 17 to three.60% right this moment. Contemplating the decline on this studying, Solana’s value might discover it difficult to rally again to its all-time excessive within the brief time period.

SOL Worth Prediction: Not But Time to Bounce

From a technical standpoint, the 50-period Exponential Shifting Common (EMA) on the 4-hour chart has crossed above the 20 EMA. For context, the EMA is a technical indicator that identifies bullish and bearish traits.

When the shorter EMA crosses above the longer one, the pattern is bullish. But when it’s the different means round, the pattern is bearish. This crossover, termed a dying cross, signifies a bearish pattern.

Moreover, SOL’s value buying and selling under each key indicators helps this bearish outlook. This positioning means that the latest bounce could also be a fakeout. If confirmed, Solana’s worth might doubtlessly decline additional to $213.15.

However, if the Solana social metrics flip bullish, this pattern would possibly change. In that state of affairs, SOL would possibly bounce with a probable goal of $264.64.

Disclaimer

In keeping with the Belief Mission tips, this value evaluation article is for informational functions solely and shouldn’t be thought of monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market situations are topic to vary with out discover. At all times conduct your personal analysis and seek the advice of with an expert earlier than making any monetary choices. Please be aware that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.