US-listed spot Bitcoin and Ethereum exchange-traded funds (ETFs) have reignited investor enthusiasm, pulling in additional than $4.5 billion in internet inflows final week.

The robust reversal ended a quick interval of outflows and set the tone for October — a month merchants typically name “Uptober” for its historical past of bullish crypto efficiency.

Sponsored

Sponsored

Bitcoin and Ethereum ETFs Pull In $4.5 Billion

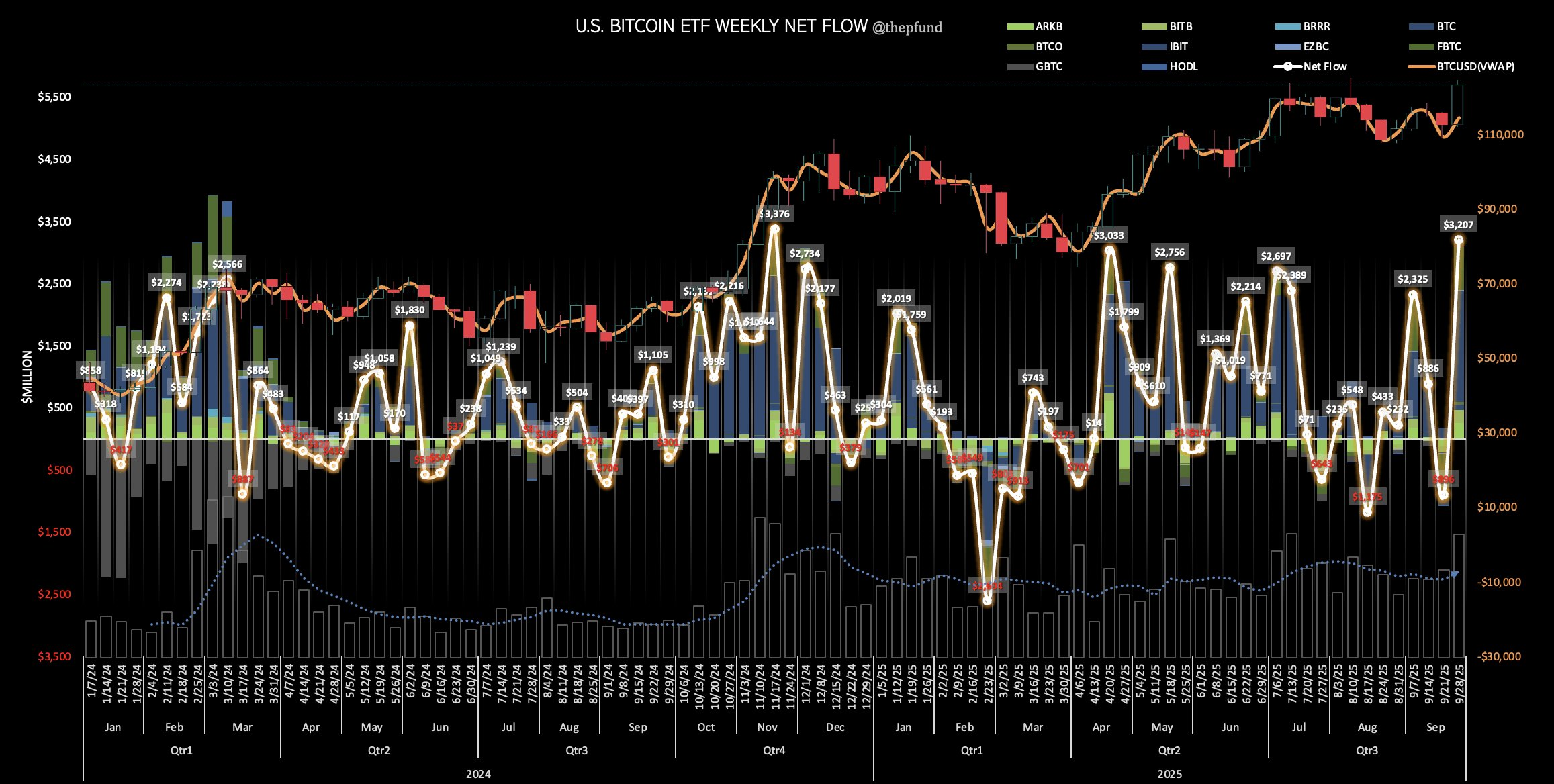

Knowledge from SoSo Worth reveals Bitcoin ETFs introduced in roughly $3.2 billion in internet inflows, marking their second-largest weekly whole on file, simply behind November 2024’s $3.37 billion peak.

In the course of the buying and selling interval, ETF volumes surged to about $26 billion. The sharp enhance signaled stronger investor participation and renewed confidence that an accumulation part could also be underway.

BlackRock’s iShares Bitcoin Belief (IBIT) dominated inflows with $1.78 billion, adopted by Constancy’s FBTC at $692 million. Ark 21Shares added $254 million, whereas Bitwise captured one other $212 million.

The collective surge displays rising institutional conviction and renewed retail curiosity in gaining Bitcoin publicity by way of regulated funding merchandise.

In the meantime, Ethereum ETFs mirrored this momentum, attracting $1.29 billion in inflows and producing almost $10 billion in weekly buying and selling quantity.

Sponsored

Sponsored

BlackRock’s ETHA fund led with $687 million in inflows, adopted by Constancy’s $305 million. Grayscale recorded $175 million, whereas Bitwise added $83 million.

Collectively, these figures point out that buyers are positioning for a broader market restoration fairly than specializing in a single asset.

Institutional Demand Reignites Crypto Rally

The synchronized inflows throughout each Bitcoin and Ethereum ETFs made final week one of many busiest buying and selling intervals in current reminiscence.

This sample suggests institutional portfolios are rotating again into digital property, in search of to seize early upside potential as macro sentiment stabilizes.

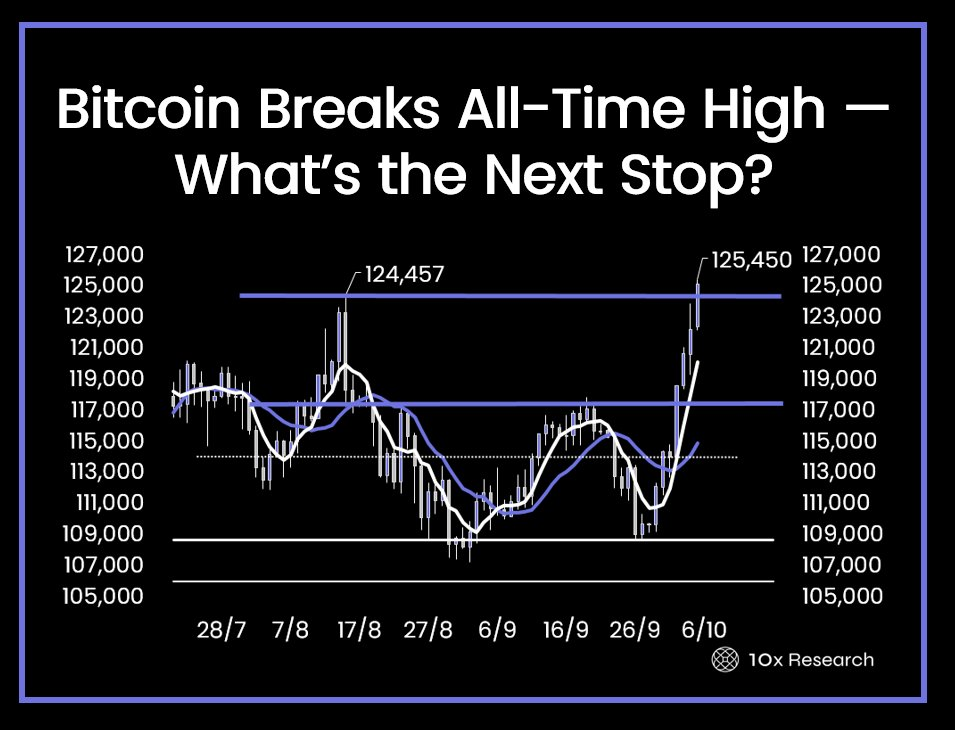

That renewed optimism helped propel Bitcoin to a recent all-time excessive above $125,000. It strengthened the idea that ETF-driven demand is doing greater than fueling short-term hypothesis and could also be establishing a base for a brand new market cycle.

Crypto analysis agency 10x Analysis famous that the dimensions of those inflows is unprecedented. It added that refined shifts in institutional allocation methods level to deeper structural help than in earlier rallies.

“Behind the scenes, billions of {dollars} in ETF inflows and a quiet shift in institutional habits counsel that this breakout could have deeper roots. Even regulators are including gas to the fireplace, with new tax steering that caught company treasuries off guard,” it added.