- Ethereum breaks $4,600 regardless of the Ethereum Basis promoting 1,000 ETH, exhibiting market resilience.

- Derivatives merchants added $700M in recent longs, lifting open curiosity to $41.3B whilst volumes dipped.

- Institutional demand stays robust with $1.3B in ETF inflows and Bitmine’s treasury climbing to 2.6M ETH.

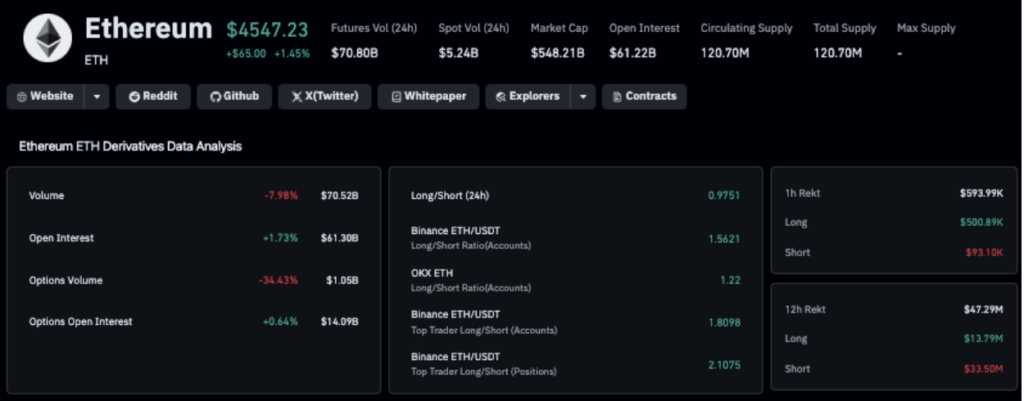

Ethereum lastly cracked by means of the $4,600 mark on October 5, notching a 1.4% every day acquire even after the Ethereum Basis confirmed it offered 1,000 ETH on Friday. Usually, insider strikes like that spook the market, however this time the sell-off barely made a dent. In truth, derivatives merchants appeared to take it as a inexperienced gentle, piling into recent lengthy positions as open curiosity climbed 1.7% over the weekend.

At its intraday peak, ETH tapped $4,619 in response to CoinMarketCap, holding its floor even whereas spot buying and selling quantity regarded fairly skinny. The Basis defined the sale was supposed to fund grants, analysis, and donations—nothing uncommon there—however traditionally these sell-offs are likely to weigh on value. That didn’t occur this time, suggesting a fairly robust backdrop of demand and confidence.

Derivatives Information Reveals Speculators Rising Daring

Coinglass numbers revealed ETH open curiosity rose to $41.3 billion within the final 24 hours, whilst buying and selling quantity really dropped practically 8%. That divergence often means speculative merchants are establishing for a sustained transfer, not simply chasing a pump. Even with the Basis’s conversion of 1,000 ETH to stables (about $4.6 million at present pricing), bulls look unbothered, nearly defiant.

New futures positions alone added $700 million to the books on Sunday, and that surge helped value push cleanly by means of resistance. As a substitute of triggering fear-driven exits, the insider transaction appears to have acted as background noise towards the louder rhythm of institutional flows.

Establishments Maintain Pouring In

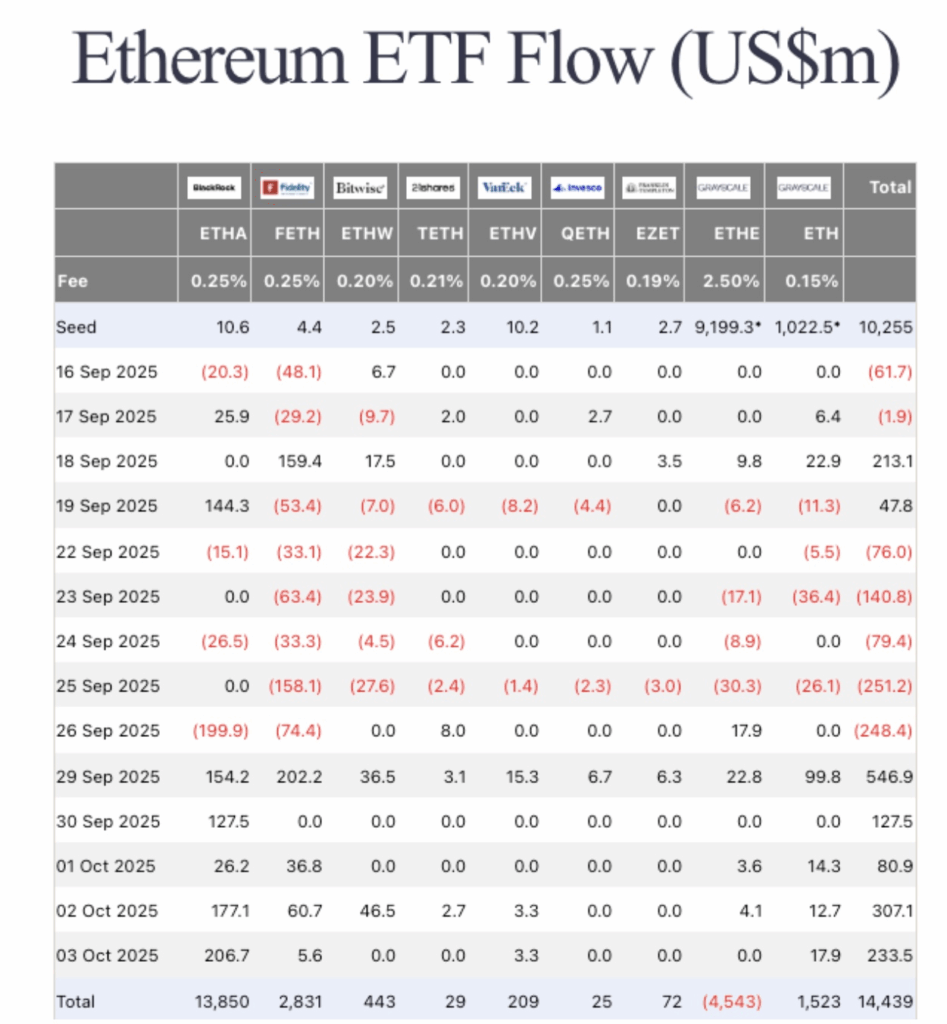

And people flows are onerous to disregard. Ethereum ETFs logged $1.3 billion in web inflows throughout simply 5 buying and selling days final week, per Farside Buyers. That’s not only a blip—it’s regular, constant demand from the identical kind of gamers who anchored Bitcoin’s breakout run. On the similar time, Bitmine (BMNR) has quietly bumped its treasury reserves to 2.6 million ETH, locking in its spot as the most important Ethereum holder on the company aspect.

Put collectively, this exercise has given ETH the liquidity cushion to interrupt resistance and keep there. Basis sell-offs might need been a bearish story previously, however proper now the steadiness of energy is tilting closely towards establishments and ETFs offering a ground beneath the market.

Value Outlook: $4,750 in Sight?

Technically, ETH has cleared an vital hurdle, with the $4,600 zone now performing as help slightly than resistance. If open curiosity retains climbing alongside ETF inflows, the trail seems to be open for a retest of $4,750 within the days forward.

That mentioned, quantity stays skinny in comparison with the dimensions of leveraged bets being positioned, so a sudden pullback can’t be dominated out. Nonetheless, with institutional inflows buzzing and speculators exhibiting no hesitation, Ethereum has managed to show a Basis sell-off into little greater than a velocity bump on its method greater.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.