- Bitcoin jumped 12% final week, blasting previous $125,500 for a brand new all-time excessive.

- U.S. shutdown fears, weak jobs knowledge, and Japan’s political shift fueled the rally.

- Treasury bond auctions and Powell’s speech might take a look at Bitcoin’s momentum this week.

Bitcoin got here roaring again final week, climbing greater than 12% and wiping away the sluggish losses of September. Not like the summer time months, when altcoins like Ethereum and Solana typically stole the highlight, this time it was Bitcoin driving the market larger. ETH and SOL managed modest features of round 13%, however BTC set the tempo with a pointy and decisive run that reminded merchants the place the actual weight nonetheless lies.

U.S. Shutdown and Weak Jobs Knowledge Gasoline BTC Rally

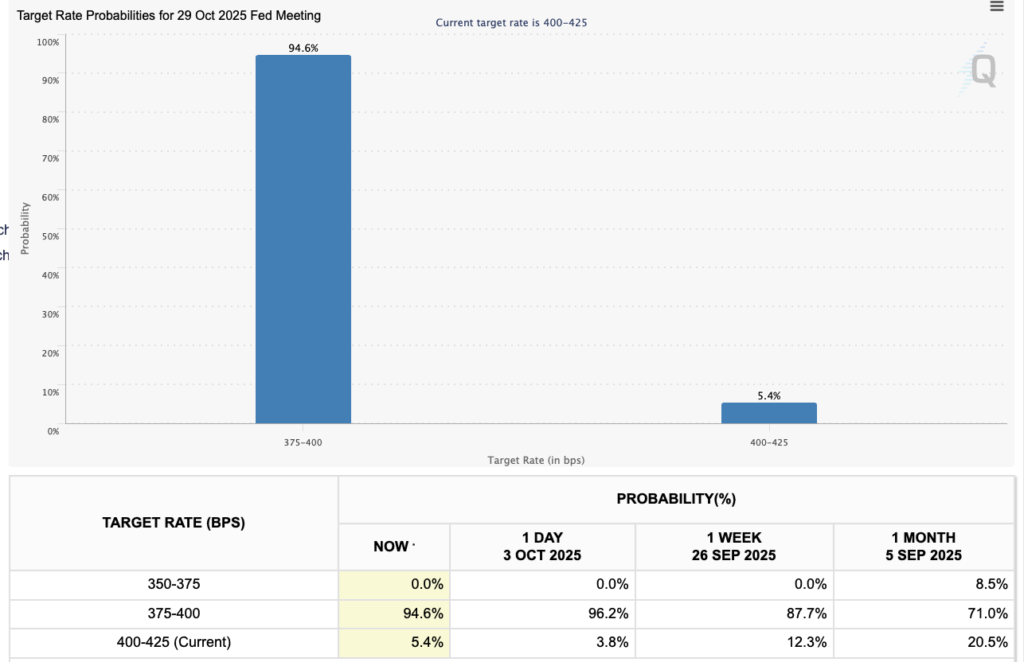

The rally actually kicked off with the U.S. authorities shutdown midweek. When authorities workers are despatched house and federal spending grinds to a halt, buyers instantly begin factoring in financial uncertainty—and that often factors to price cuts from the Federal Reserve. The FedWatch device confirmed odds of a price minimize in October taking pictures as much as 98% after the shutdown was confirmed. At almost the identical second, Bitcoin leapt from $112,000 and didn’t look again. Weak labor numbers added gas to the hearth. The ADP jobs report missed badly, exhibiting a lack of 32,000 as an alternative of the anticipated achieve. With unemployment already climbing and non-farm payrolls weakening, markets are actually betting on as many as 4 price cuts earlier than subsequent summer time.

Japan’s Political Shift Provides to Bitcoin Bullish Momentum

It wasn’t simply U.S. politics shaping the transfer. Over in Japan, Sanae Takaichi’s election as chief of the Liberal Democratic Occasion set expectations for softer financial coverage and a weaker yen. That added one other layer of world liquidity optimism. By Friday night time into the weekend, Bitcoin briefly shot previous $125,500, hitting a contemporary all-time excessive. Merchants framed the transfer as a direct play on simpler circumstances worldwide—low cost cash, weaker currencies, and a central financial institution pivot simply over the horizon. Nonetheless, the rally rests on fragile footing if the U.S. shutdown drags on and liquidity dries up too rapidly.

Treasury Bond Auctions May Check Bitcoin’s Liquidity

This week might be difficult. The U.S. Treasury plans to public sale almost $250 billion in short-term bonds, which is able to drain liquidity even with out authorities spending in play. That places Bitcoin’s fast 10% three-day leap to the take a look at. Can bulls maintain the road if surplus money begins getting soaked up? Powell’s Thursday speech looms massive, however most analysts say expectations of an October minimize are already baked in. The wild card now’s Congress, the place shutdown-related choices and discuss of federal worker cuts might rattle markets. For now, Bitcoin seems to be sturdy, however merchants know effectively—volatility by no means stays quiet for lengthy.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.