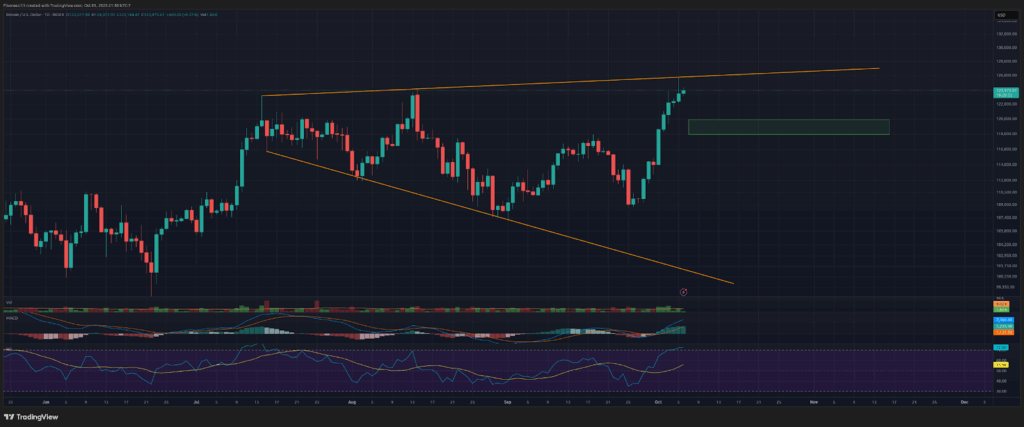

Wow, what a distinction every week makes! Bitcoin began final week out slightly below resistance, then blasted proper on via it, with some very sturdy shopping for strain all through the week. The bulls are again in management after taking out all short-term resistance ranges. Bitcoin value is now in what’s known as a “blue sky breakout”, the place the value reaches a brand new all-time excessive and goes into value discovery mode as all patrons who didn’t promote on the correction are actually in revenue. It has really been a powerful week for the bulls, producing the best weekly closing value bitcoin has ever seen at $123,515.

Key Help and Resistance Ranges Now

Now that the value has reached new highs, figuring out the place resistance might are available is a really tough activity. We now have no prior value ranges to concentrate on, so any ranges we do give you utilizing technical evaluation will likely be extra theoretical than sensible. Utilizing Fibonacci extensions from the latest pullbacks, nonetheless, we are able to see that $131,000 might act as a little bit of a barrier if this breakout continues. Above there, now we have some minor confluence at $135,000 and once more at $140,000. If these ranges are damaged, we are able to look to the two.618 Fibonacci extension from the 2021 excessive to 2022 low, resting at $155,000.

If value pulls again from right here, we are going to look all the way down to the $118,000 stage as assist, with a very good probability that stage will likely be front-run by grasping patrons if we do see any vital dip again down. Closing every week under this stage would open up $114,000 as the following assist stage, the place the bullish development might nonetheless resume if it held. A value closing under $114,000 would flip the general market construction to bearish, and we’d be wanting all the way down to the $105,000 stage for assist, whereas as soon as once more questioning if the market prime is in for the foreseeable future.

Outlook For This Week

Inspecting the day by day chart, we are able to see that the broadening wedge sample is now totally established. Sunday night time noticed the value hit the higher development line resistance of this sample, so it’s doable we see a shallow pullback over the approaching days earlier than the value can escape of this sample. So, be cautious of a dip by Tuesday/Wednesday right here, but when it comes, we should always count on the $120,000 to $118,000 zone to carry as assist. If value can handle to shut a few days above the higher development line later this week, we should always see value acceleration into the $130,000s.

Market temper: Bullish — Bitcoin value moved above all outlined resistance ranges to shut at a brand new all-time weekly excessive. Bulls are actually firmly in management, and the bears are again on their heels.

The following few weeks

Bitcoin doesn’t appear to care concerning the authorities shutdown, and the case might be made that Bitcoin is even stronger due to the shutdown. Over the approaching weeks, we should always count on the bitcoin value to proceed larger. Final week’s shut introduced the weekly RSI again above the 13 SMA, and it’s as soon as once more in bullish posture. The MACD oscillator is near crossing bullish as properly, and can accomplish that if bitcoin closes above $125,000 to finish this week. Each of those oscillators will solely add extra causes for buyers and merchants to stay lengthy bitcoin. Bears might want to see some heavy promoting quantity and costs under $118,000 to be able to attempt to regain management from the bulls over the following a number of weeks. The bears will wish to see a giant miss for October’s CPI report, or another sort of macro bearish occasion, to be able to stand an opportunity of holding again the bulls right here over the approaching weeks.

Bulls/Bullish: Patrons or buyers anticipating the value to go larger.

Bears/Bearish: Sellers or buyers anticipating the value to go decrease.

Help or assist stage: A stage at which the value ought to maintain for the asset, at the least initially. The extra touches on assist, the weaker it will get and the extra probably it’s to fail to carry the value.

Resistance or resistance stage: Reverse of assist. The extent that’s more likely to reject the value, at the least initially. The extra touches at resistance, the weaker it will get and the extra probably it’s to fail to carry again the value.

SMA: Easy Transferring Common. Common value based mostly on closing costs over the desired interval. Within the case of RSI, it’s the common energy index worth over the desired interval.

Fibonacci Retracements and Extensions: Ratios based mostly on what is called the golden ratio, a common ratio pertaining to development and decay cycles in nature. The golden ratio is predicated on the constants Phi (1.618) and phi (0.618).

Broadening Wedge: A chart sample consisting of an higher development line performing as resistance and a decrease development line performing as assist. These development strains should diverge away from one another to be able to validate the sample. This sample is a results of increasing value volatility, usually leading to larger highs and decrease lows.

Oscillators: Technical indicators that change over time, however usually stay inside a band between set ranges. Thus, they oscillate between a low stage (usually representing oversold circumstances) and a excessive stage (usually representing overbought circumstances). E.G., Relative Power Index (RSI) and Transferring Common Convergence-Divergence (MACD).

MACD Oscillator: Transferring Common Convergence-Divergence is a momentum oscillator that subtracts the distinction between two shifting averages to point development in addition to momentum.

RSI Oscillator: The Relative Power Index is a momentum oscillator that strikes between 0 and 100. It measures the velocity of the value and adjustments within the velocity of the value actions. When RSI is over 70, it’s thought-about to be overbought. When RSI is under 30, it’s thought-about to be oversold.