In short

- Bitcoin broke a brand new all-time excessive of a bit of over $126,000 per coin on Monday.

- Nevertheless, the inventory costs of publicly traded mining corporations are rising even sooner.

- Buyers are flooding into the inventory market and different property over worries that currencies worldwide are being debased.

Bitcoin’s value hit new data Monday, because the so-called debasement commerce has turn out to be extra engaging. However Bitcoin mining firm shares rose even faster, furthering sizable beneficial properties seen throughout the business in latest weeks.

Prime public corporations within the mining house—together with the Nasdaq-listed HIVE Digital, MARA, and CleanSpark—all shot up on Monday forward of the closing bell.

HIVE Digital led the pack with a 25% bounce to just about $6 a share by the shut of buying and selling, with IREN up greater than 14% on the day to $57.75.

MARA completed Monday priced at $21 per share after leaping greater than 9%; CleanSpark rose by the identical quantity and was buying and selling for $17. And Riot Platforms climbed practically 11% on the day to $21.56.

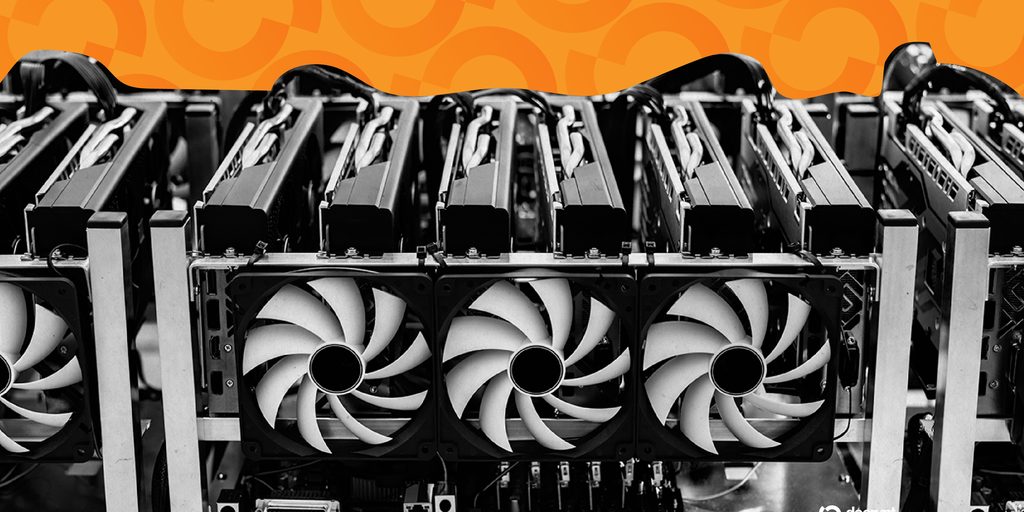

Mining shares are additionally changing into extra engaging as corporations look to high-powered computing to extend income. Google final month introduced it was backstopping a deal between AI compute firm Fluidstack and Bitcoin miner Cipher, giving Google the precise to purchase a 5.4% stake in Cipher.

“Miners are successful as a result of they’re flexing optionality: energy, infrastructure, AI income, and leveraged publicity to Bitcoin rallies, all packaged in shares,” Texas Blockchain Council President Lee Bratcher instructed Decrypt. “That’s giving them an edge over crypto corporations whose publicity is narrower or extra operationally constrained.”

Bratcher added that some miners are holding onto their mined BTC somewhat than promoting it, giving them a profit akin to crypto treasury companies, notably as Bitcoin continues to rise.

“Buyers are more and more viewing miners not simply as Bitcoin proxies, however as house owners of scarce infrastructure: energy contracts, land, grid entry, and cooling capability,” mentioned Bratcher. “When crypto is scorching, that infrastructure turns into extra invaluable, particularly if grid demand turns into tight.”

Bitcoin was lately up a bit of over 2% over a 24-hour interval, in response to CoinGecko, after hitting a brand new all-time excessive of $126,080 earlier Monday. It had dropped down barely to $125,191—nonetheless a 9.5% bounce over the previous week.

U.S. buyers final week plunged a report quantity of funding into Bitcoin ETFs to get publicity to the largest and oldest digital coin. Crypto funding merchandise acquired $5.95 billion in recent money, with essentially the most amount of cash ever hitting Bitcoin funds in a single week: $3.55 billion in complete.

A report from European asset supervisor CoinShares mentioned that the lion’s share of that funding was directed at Bitcoin ETFs buying and selling within the U.S.

Over the previous seven days, the continuing U.S. authorities shutdown and an anticipated October rate of interest minimize from the Federal Reserve has led the worth of Bitcoin, gold, and different cryptocurrencies and valuable metals to rally.

Specialists dub that sort of transfer the “debasement commerce”—when buyers attempt to hedge in opposition to weakening currencies and geopolitical headwinds.

The greenback index, which measures the worth of the buck in opposition to main world currencies, suffered its worst first half of the 12 months because the early Nineteen Seventies as President Donald Trump went full steam forward along with his commerce conflict.

Extra reporting by James Rubin

Day by day Debrief E-newsletter

Begin daily with the highest information tales proper now, plus unique options, a podcast, movies and extra.