Be part of Our Telegram channel to remain updated on breaking information protection

Morgan Stanley Wealth Administration’s International Funding Committee (GIC) has suggested shoppers managing $2 trillion to allocate as much as 4% of consumer portfolios to Bitcoin, and likened the main crypto to “digital gold.”

”That is big,” mentioned Bitwise Chief Govt Officer (CEO) Hunter Horsley in a publish on X. ”GIC guides 16,00 advisers managing $2 trillion in financial savings and wealth for shoppers. We’re coming into the mainstream period.”

That is big.

New Particular Report from Morgan Stanley GIC:

“we goal to assist our Monetary Advisors and shoppers, who could flexibly allocate to cryptocurrency as a part of their multiasset portfolios.”

GIC guides 16,000 advisors managing $2 trillion in financial savings and wealth for… pic.twitter.com/RBWFxlRNkS

— Hunter Horsley (@HHorsley) October 5, 2025

In an October report launched final week, the agency’s GIC beneficial that advisors allocate between 2% to 4% of consumer portfolios to BTC, relying on danger urge for food.

It known as Bitcoin ”a speculative and more and more common asset class” however positioned it within the class of “actual property.” It additionally likened Bitcoin to digital gold.

Morgan Stanley Recommends 2% Allocation For Extra Conservative Portfolios

Morgan Stanley beneficial that advisors allocate as much as 4% of “Opportunistic Development” portfolios to Bitcoin. Such portfolios are structured for traders with a better danger tolerance searching for increased returns.

For extra conservative portfolios, it beneficial that advisors allocate as much as 2%. For portfolios optimized to for wealth preservation and earnings, it beneficial a 0% allocation to BTC.

Morgan Stanley mentioned portfolio managers who add crypto to their portfolios ought to rebalance them “on a daily, periodic foundation,” ideally quarterly.

“Such rebalancing will dampen the potential for swelling positions, which may imply outsized portfolio-level volatility and cryptocurrency danger contributions in durations of macro and market stress.”

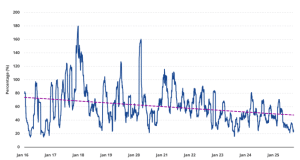

Whereas Bitcoin’s 30-day trailing volatility has fallen over the previous few years, Morgan Stanley mentioned it ”may expertise extra elevated volatility and better correlations with different asset lessons in durations of macro and market stress.”

Bitcoin 30-day trailing volatility (Supply: VanEck)

The GIC advice comes as Bitcoin soared to a brand new all-time excessive (ATH) of $125,559.21 over the weekend. It has since retraced to commerce at $123,549.71 as of 1:32 a.m. EST after falling 1% up to now 24 hours, in line with CoinMarketCap knowledge.

Even with the current correction, the crypto market chief is up over 11% over the previous month. Fueling that rally is a surge in inflows into spot Bitcoin ETFs and a drop within the quantity of BTC on exchanges to a six-year low.

Bitcoin ETFs Have Made It Simpler To Purchase BTC, Morgan Stanley Says

Morgan Stanley additionally famous “product innovation” within the crypto and monetary sectors. This contains the launch of spot Bitcoin ETFs (exchange-traded funds) within the US in January final yr, which the agency says opened up “the potential for allocating to the rising asset class in a multiasset portfolio.”

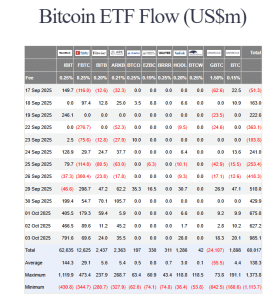

Simply final week, US spot BTC ETFs pulled in over $3 billion, knowledge from Farside Buyers reveals.

US spot BTC ETF flows (Supply: Farside Buyers)

The very best day final week was on Friday, when traders pumped $985.1 million into the merchandise.

The preferred of those merchandise has been BlackRock’s iShares Bitcoin ETF, which trades below the ticker image “IBIT.” A lot of the inflows seen final week had been into IBIT, which now holds over 3% of BTC’s provide and has recorded $62.635 billion in cumulative inflows since launch.

Good chart from @JSeyff of the breakdown of choices open curiosity by issuer, IBIT utter domination. Choices tends to be extra winner take all vs ETF aum which is extra unfold round pic.twitter.com/kVBoMMAUix

— Eric Balchunas (@EricBalchunas) October 2, 2025

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection