The iShares Bitcoin Belief ETF (IBIT) has turn out to be BlackRock’s most worthwhile exchange-traded fund (ETF) when it comes to annual income.

Regardless of launching lower than 2 years in the past, the spot Bitcoin ETF has outpaced longstanding conventional funds. This mirrored a surge in demand for regulated cryptocurrency publicity amid Bitcoin’s (BTC) record-breaking value rally.

Sponsored

Sponsored

BlackRock’s Bitcoin ETF Turns into Its Most Worthwhile Fund Ever

In a latest publish on X, Bloomberg’s senior ETF analyst, Eric Balchunas, identified that IBIT has generated $244.5 million in annual income for BlackRock. The fund has already out-earned each long-established iShares ETFs.

This consists of surpassing the Core S&P 500 ETF (IVV), which is 25 years previous and manages practically seven occasions extra property.

BlackRock earns cash from IBIT by charging a 0.25% administration payment on the fund’s whole property beneath administration (AUM), which presently stands at $97.8 billion. Balchunas additionally added that the product is simply ‘a hair away from $100 billion,’ with solely about $2.2 billion left to go.

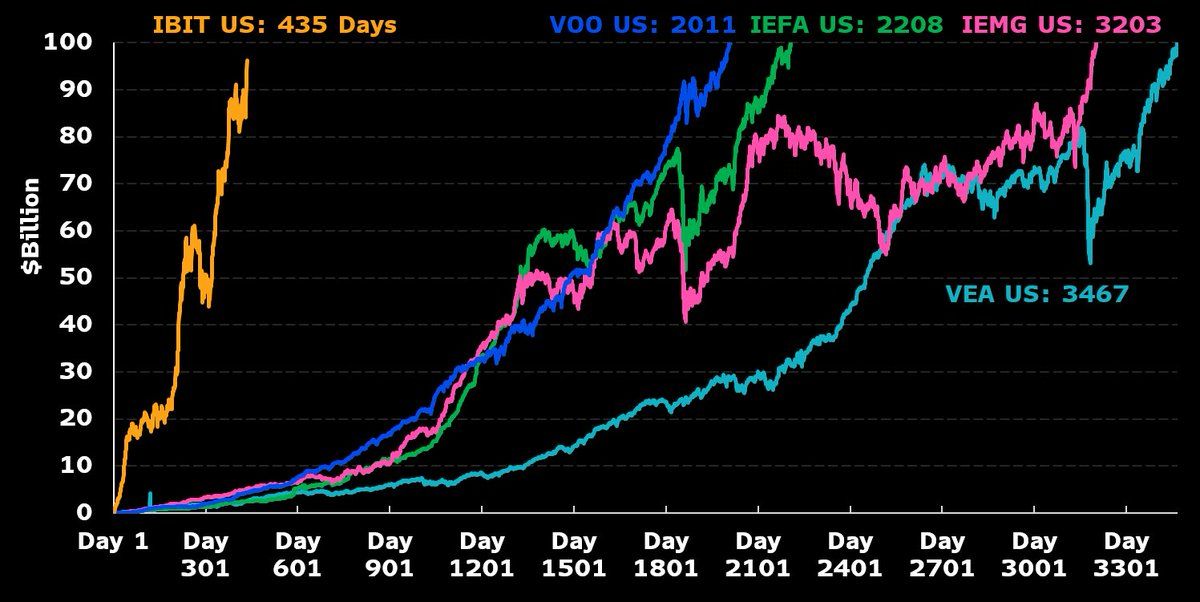

He highlighted the fund’s outstanding progress by evaluating it to different main ETFs, declaring that the Vanguard S&P 500 ETF (VOO) reached $100 billion in property beneath administration after 2,011 days.

In the meantime, IBIT is near conducting the identical feat regardless that it has been available in the market for lower than 2 years, making it one of many fastest-growing ETFs ever.

“World’s largest ETF, Vanguard S&P 500 ETF, took 2,000+ days to hit that mark. IBIT about to do it in < 450 days. Simply quickest ever. First ETF launched in 1993, so we’re speaking 30+yrs of historical past,” Nate Geraci added.

Sponsored

Sponsored

Bitcoin ETF Inflows Hit Report Highs in Uptober

In the meantime, the rising enthusiasm round IBIT comes as Bitcoin and spot Bitcoin ETFs proceed to publish report highs throughout what the crypto group calls ‘Uptober.’ Final week, Bitcoin ETFs noticed $3.2 billion in internet inflows.

This represented the biggest weekly influx of 2025 and the second-highest on report. BlackRock’s IBIT accounted for the lion’s share, attracting $1.78 billion in inflows.

Even on October 6, Bitcoin ETFs recorded $1.19 billion in internet inflows — the primary billion-dollar day since July and the biggest single-day influx of 2025. In accordance with SoSoValue information, of that quantity, $969.95 million got here from BlackRock’s IBIT, reinforcing its dominance as the biggest Bitcoin ETF

To this point in October, whole inflows have reached $2.29 billion in simply six days, in comparison with $3.53 billion whole in September, suggesting this month may turn out to be one of many strongest but for Bitcoin ETFs.

These inflows come amid Bitcoin’s newest value rally. As BeInCrypto beforehand reported, the main cryptocurrency broke above $125,000 over the weekend and surpassed $126,000 shortly afterward to succeed in a brand new all-time excessive.

BeInCrypto Markets information confirmed that on the time of writing, BTC traded at $124,569, up practically 9% over the previous week. This displays sturdy market momentum supported by huge institutional inflows.