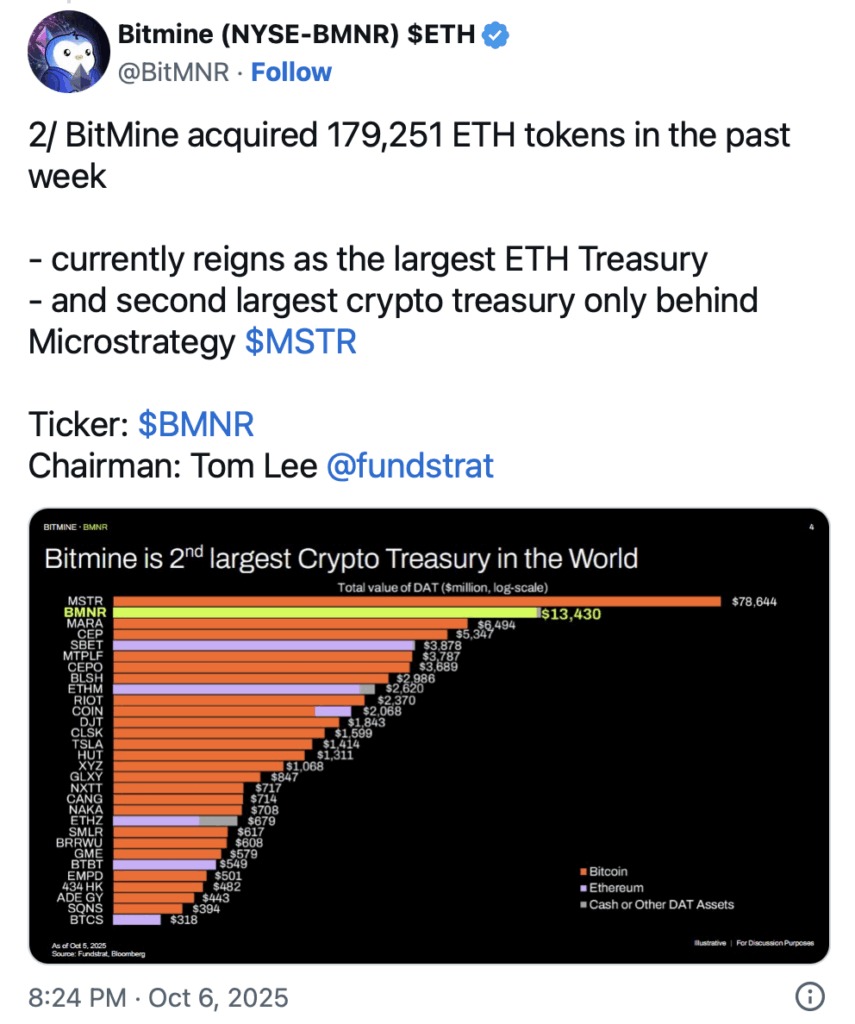

- BitMine expanded its ETH treasury to $13B, one of many largest institutional holdings on the planet.

- The transfer indicators rising confidence in Ethereum’s upgrades and its DeFi dominance.

- Analysts anticipate continued institutional accumulation might push ETH to new highs this 12 months.

Tom Lee’s blockchain funding firm, BitMine, has made a daring transfer—piling closely into Ethereum (ETH) and pushing its crypto treasury to a record-breaking $13 billion. For analysts, this isn’t simply numbers on a stability sheet, it’s a loud vote of confidence in Ethereum’s long-term function because the spine of decentralized finance and good contract innovation. The timing couldn’t be sharper, coming proper when curiosity in DeFi is climbing once more.

This huge soar in ETH holdings speaks volumes about institutional sentiment. BitMine’s pivot towards Ethereum isn’t nearly stacking cash, it might additionally assist spark extra mainstream adoption, setting the stage for wider acceptance of blockchain property past hypothesis.

Why BitMine Is Loading Up on ETH

In response to insiders, BitMine started quietly ramping up ETH purchases earlier this 12 months, driving on favorable market waves. Ethereum’s regular upgrades—just like the transition to Proof of Stake and the upcoming Proto-Danksharding (EIP-4844) rollout—possible performed an enormous function in shaping their bullish stance.

Their technique traces up with a wider development. World establishments are now not limiting themselves to Bitcoin alone; the success of Ethereum-based ETFs abroad has made ETH the following logical selection. By pushing its holdings to $13 billion, BitMine now ranks among the many largest institutional Ethereum holders worldwide. That form of accumulation not solely strengthens ETH’s standing however might additionally cut back volatility within the medium time period, making the asset extra enticing to risk-averse buyers.

Market Reactions Paint a Optimistic Image

The market didn’t keep quiet. Following the information, Ethereum noticed a fast uptick in buying and selling volumes and a noticeable value bump inside 24 hours. In fact, crypto nonetheless dances to the tune of worldwide macro tendencies, however merchants largely view BitMine’s transfer as a bullish spark. Analysts argue that if establishments preserve shopping for at this tempo, Ethereum might hit new highs earlier than the 12 months is out.

For BitMine, that is greater than a portfolio adjustment—it’s a positioning play. By leaning laborious into Ethereum, they may encourage different funds to take the same route. As funding companies chase publicity to blockchain infrastructure as a substitute of short-term hypothesis, Ethereum’s function because the go-to good contract platform appears stronger than ever.

Ethereum’s Larger Image

What’s clear is that Ethereum isn’t simply driving one other hype cycle—it’s proving its endurance. With BitMine’s aggressive technique including credibility, the token is more and more seen as a crucial constructing block for decentralized finance and Web3 development. If this momentum carries ahead, the following wave of adoption may very well be much less about hype and extra about actual, institutional-scale dedication.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.