Be part of Our Telegram channel to remain updated on breaking information protection

The Aster worth jumped 3% within the final 24 hours to commerce at $2.06 on a 51% improve in buying and selling quantity to $1.49 billion.

This surge within the ASTER worth was fueled by information that Binance listed the token as we speak with a “seed tag,” signaling it’s an modern however high-risk asset. Buying and selling started at 12:00 UTC in USDT, USDC, and TRY pairs, whereas deposits opened at 9:00 UTC.

Binance will record @Aster_DEX (ASTER) with a Seed Tag utilized.

Extra info 👉 https://t.co/kfCXUFCYPe pic.twitter.com/yNosuuNN7T

— Binance (@binance) October 6, 2025

AFter spot buying and selling began, ASTER was faraway from Binance’s Alpha Market, and customers can have 24 hours to maneuver their tokens from Alpha to Spot accounts. The token, constructed on BNB Chain, had soared 1,500% in September after Binance founder Changpeng Zhao, aka CZ, endorsed it.

Earlier within the day there was controversy when DefiLlama introduced it might delist Aster’s perpetual quantity knowledge, surprising each traders and merchants. The sudden transfer got here after DefiLlama flagged “integrity issues” about Aster’s reported buying and selling exercise, sparking deeper questions across the platform’s transparency and quantity origins.

DefiLama eliminated Aster from web site after “suspicious exercise”

Assertion:

“We have been investigating Aster volumes and lately their volumes have began mirroring Binance perp volumes virtually precisely”@HyperliquidX is 👑 https://t.co/S1HjVS705M pic.twitter.com/ArsrU4FhhN— Bullish (@TheBullishTradR) October 6, 2025

The choice to take away Aster’s perpetual futures knowledge stemmed from findings that its buying and selling volumes confirmed an “virtually excellent” correlation with centralised trade Binance.

Specialists stated this uncommon sample raised purple flags and might be a sign of information manipulation or potential wash buying and selling to look extra well-liked than it truly is.

We have been investigating aster volumes and lately their volumes have began mirroring binance perp volumes virtually precisely

Chart on the left is XRPUSDT on aster, you possibly can see the quantity ratio vs binance is ~1

Chart on the correct is XRP perp quantity on hyperliquid, the place there’s… pic.twitter.com/MwVD7rRyEn

— 0xngmi is hiring (@0xngmi) October 5, 2025

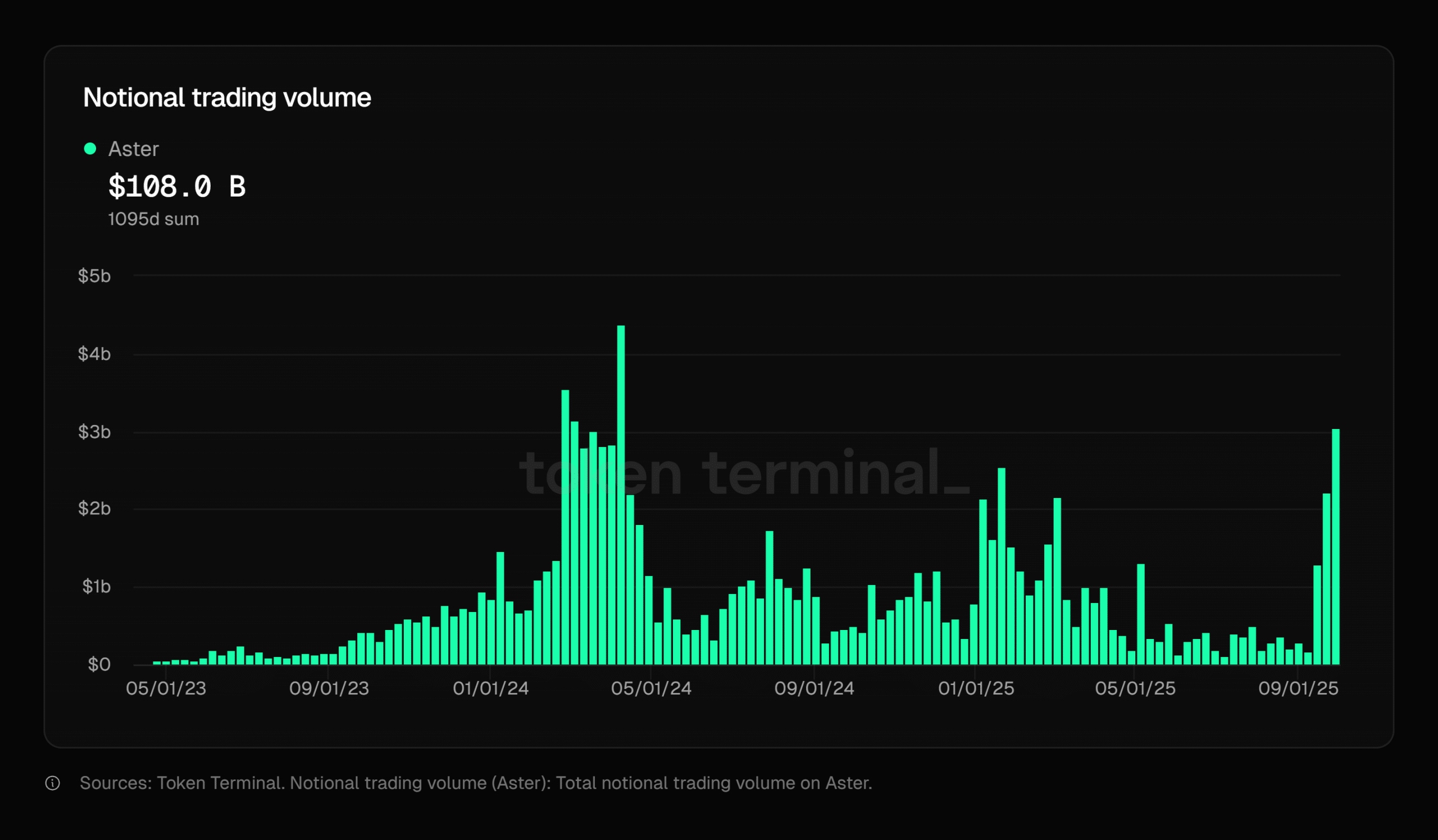

Aster Buying and selling Quantity Tops $108 Billion As Exercise Rises

Aster, a decentralized perpetual trade, has reached a complete buying and selling quantity of $108 billion, in line with knowledge from Token Terminal. The milestone exhibits how rapidly Aster is rising as extra merchants use its platform in 2025.

The chart exhibits that Aster’s buying and selling quantity has gone by a number of huge spikes since mid-2023. The biggest jumps got here in early 2024 and once more in September 2025. The latest rise means that merchants are returning to Aster as curiosity in decentralized buying and selling will increase.

From March to Could 2024, Aster noticed robust every day volumes between $2 billion and $4 billion. Though buying and selling slowed in mid-2025, exercise has now picked up sharply. Analysts say this might be due to new partnerships and extra liquidity being added to Aster’s swimming pools.

The $108 billion whole quantity highlights how decentralized finance (DeFi) continues to mature. Many customers now desire DeFi for its transparency and management over funds.

Aster Value At Key Inflexion Level

Technical evaluation for ASTERUSDT exhibits the value sitting simply above $2.04, having tumbled after the delisting shock. The chart reveals a consolidation zone between the help line close to $1.85 and the resistance across the latest excessive at $2.43.

Aster’s worth is clinging to a rising help trendline, and every time it has bounced from this space, fast recoveries have adopted. Nonetheless, the most recent candles present hesitation, with the value stalling just below the earlier excessive.

ASTERUSDT Evaluation Supply: Tradingview

The present RSI sits at 64.86, suggesting the coin just isn’t but overbought, however the uptrend is fragile.

The subsequent strikes are essential. If ASTER maintains its rising help and breaks above $2.43, it might goal a big transfer increased, presumably as much as $3.85, a possible 89% achieve. This situation would possible want robust purchaser curiosity and confidence returning to the market.

On the flip aspect, a confirmed breakdown beneath help might push the coin worth again towards $1.50 or decrease, as help patrons lose conviction.

Merchants are waiting for readability. So long as the Aster worth stays above the rising help and regains belief, a rebound is feasible. However any new indicators of integrity points might see one other sharp draw back transfer.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection