- XRP worth patterns and RSI are mirroring 2017 and 2021, hinting at one other breakout cycle.

- Ripple is rolling out zero-knowledge privateness instruments to draw establishments and broaden XRP’s utility.

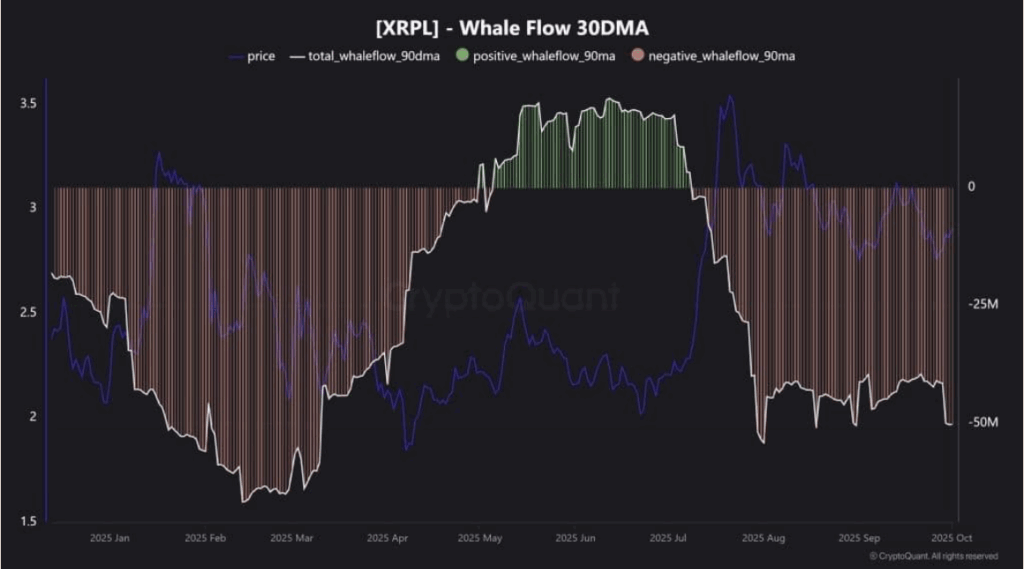

- Whale flows stay combined — some displaying accumulation, others signaling warning.

XRP’s newest chart motion is giving merchants déjà vu. Worth patterns and RSI are beginning to appear to be the setups seen in 2017 and once more in 2021 — each of which kicked off main rallies. Even with a small dip of about 1% within the final day, the token continues to be regular round $3, holding its spot because the third-largest crypto by market cap.

The massive query floating round now: are we one other cyclical breakout? Weekly worth motion has XRP consolidating close to acquainted Fibonacci ranges, the identical form of construction that got here proper earlier than its explosive runs prior to now. In each 2017 and 2021, XRP examined the mid-band earlier than ripping greater, solely to face rejection on the high vary. The newest climb to $3 in late 2024 appears to have accomplished that sample as soon as extra.

And right here’s the place it will get fascinating — the RSI proper now’s below 70, the precise zone that fueled earlier surges. If momentum builds, XRP could possibly be setting the stage for an additional leg up, history-style.

RippleX Plans Privateness Instruments to Woo Establishments

Whereas charts are lining up, Ripple’s builders are additionally pushing one thing new. J. Ayo Akinyele, Ripple’s Head of Engineering, confirmed that recent privateness instruments are on the best way. These will use zero-knowledge proofs to permit personal however nonetheless compliant transactions on the XRP Ledger.

RippleX has already outlined that the rollout will occur in phases, with its Multi-Function Token (MPT) commonplace deliberate for 2026. The thought is to unlock tokenized real-world belongings and compliant DeFi alternatives — one thing that would make XRP a much bigger magnet for institutional liquidity.

If establishments actually purchase into this privateness framework, it may act because the gas XRP wants for its subsequent large liquidity wave.

Whale Exercise Sends Combined Indicators

In the meantime, whale conduct isn’t giving a transparent sign. Whale Alert flagged a large 18.74 million XRP switch — price practically $56 million — to an unknown pockets. That form of motion often factors to accumulation.

However on the similar time, CryptoQuant’s knowledge exhibits that whales have been pulling capital out over the previous few months. So whereas some are stacking, others appear hesitant, possibly getting ready for volatility. That blend of warning and accumulation makes the short-term outlook murky, though technicals lean bullish.

Outlook: Sample or Fakeout?

All in all, XRP’s setup appears eerily just like its previous cycles. Add Ripple’s upcoming privateness instruments into the image, and establishments may find yourself driving the following wave. However the uncertainty from whale flows is one thing to keep watch over — it’s not all inexperienced lights but.

For now, XRP is balanced between historical past repeating itself and whales staying cautious. If bulls take management and establishments step in, although, that $3 degree would possibly simply be the beginning of one thing greater.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.