- Ethereum ETFs already appeal to billions, however flows stay cyclical and at the moment lack staking options.

- Solana’s market infrastructure is maturing quick, with CME futures reside and choices set for October.

- A US Solana ETF might enhance mainstream entry and liquidity, however sustained on-chain development will resolve if SOL actually outperforms ETH.

Ethereum ETFs went reside within the US in July 2024, with first-day volumes crossing $1 billion and internet inflows of $107 million. Since then, flows have been cyclical, with intervals of sturdy creation adopted by outflows. Whereas ETFs opened mainstream entry by way of brokers and retirement accounts, they haven’t smoothed out ETH’s market cycles. Establishments and treasuries proceed to build up ETH, reinforcing its function because the benchmark Layer-1, although the shortage of staking options in US merchandise limits yield potential in comparison with direct holdings.

Solana’s Rising Market Infrastructure

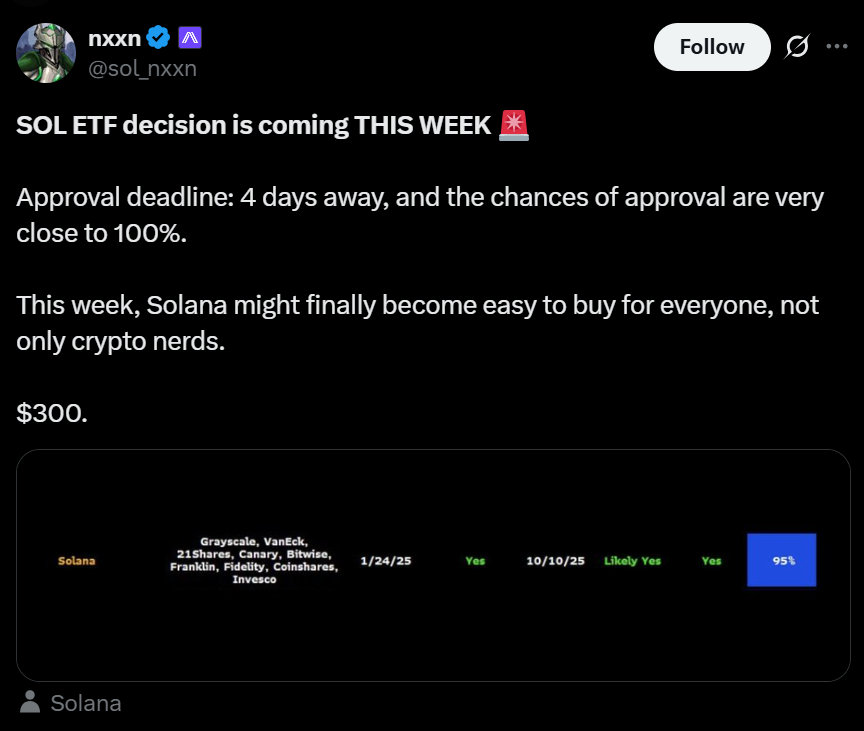

Solana is catching up quick. CME listed Solana futures in March 2025 and plans to launch choices on October 13, giving ETF market makers instruments to hedge successfully. Outdoors the US, Solana already trades in regulated funding wrappers by means of Europe’s 21Shares and Canada’s 3iQ. On-chain, Solana has proven spectacular development: $271M in Q2 income, stablecoin transfers above $59B in January, and greater than $9B USDC provide. Sub-cent charges, quick block occasions, and excessive throughput make it a hub for DEXs, perpetuals, and even memecoins—although outages and regulatory dangers stay issues.

What a US Solana ETF Might Change

ETF approval would give Solana mainstream publicity in brokerage and retirement accounts, a channel that ETH has already benefited from. Market makers would achieve tighter hedging instruments by means of CME futures and choices, enhancing liquidity and narrowing spreads. With the SEC’s new “generic itemizing requirements” for spot-commodity ETPs, the runway for property past BTC and ETH appears to be like wider than ever. Early success in Canada and Europe reveals urge for food for Solana merchandise is actual, however US approval might unlock a lot bigger flows.

The Outperformance Query

In a bull case, sturdy ETF inflows mixed with deepened derivatives markets and sustained on-chain demand might see Solana outpace ETH in complete returns inside six to 12 months post-approval. The bottom case is extra balanced: flows could observe broader threat urge for food, leaving Ether’s institutional familiarity and entrenched ecosystem as benefits. In a bear case, delays or shallow liquidity might stall momentum, leaving ETH to take care of dominance. In the end, the alerts to observe are ETF creations and redemptions, CME open curiosity, stablecoin settlement volumes, and energetic developer exercise. If these align, Solana has a shot at narrowing the hole—however ETH stays the benchmark.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.