In short

- International crypto market cap hit an all-time excessive of $4.35 trillion on October 6, with Bitcoin surging previous $126,000 and Ethereum crossing $4,500.

- Spot Bitcoin and Ethereum ETFs have attracted over $70 billion in inflows since January 2025, with final week alone seeing $4.5 billion in report flows.

- Technical indicators present blended indicators: bullish momentum stays robust, however there are indicators of exhaustion.

October resides as much as its nickname. “Uptober”—the crypto group’s time period for what’s traditionally been Bitcoin’s most bullish month—has arrived with fireworks, catapulting the whole crypto market previous $4.35 trillion in whole worth on Monday. Bitcoin smashed by means of its earlier all-time excessive over the weekend, peaking at $126,080 earlier than settling round $124,100, whereas Ethereum sailed previous $4,500.

Regardless of a comparatively small correction at this time, with Bitcoin falling roughly 2.5% to $122,000, the general trajectory stays clear. And the rally comes at a peculiar second: the U.S. federal authorities entered a shutdown on October 1, but slightly than sparking panic, it appears to have accelerated the so-called “debasement commerce” as buyers flee towards onerous belongings. Conventional markets are displaying cracks—the S&P 500 has wobbled amid political uncertainty—however crypto is prospering.

So, for these optimists, right here’s the historic view of markets throughout Uptober: Bitcoin has closed October in optimistic territory 10 out of the previous 12 years, boasting an 83% success charge with common month-to-month beneficial properties ranging between 14% and 22%.

This 12 months’s rally has institutional fingerprints throughout it: spot Bitcoin and Ethereum ETFs have hoovered up greater than $70 billion in inflows since January 2025, validating cryptocurrencies as mainstream funding automobiles. Final week alone noticed $3.24 billion rush into Bitcoin ETFs—the second-largest weekly influx on report.

Bitcoin’s market cap briefly topped $2.5 trillion, making it the world’s seventh most useful asset and surpassing the whole GDP of the UK. However this is the query: Can the social gathering proceed, or are we approaching overbought territory?

Bitcoin (BTC) worth: Sturdy however doubtlessly nearing exhaustion

Bitcoin’s present worth motion exhibits energy, however technical indicators reveal some yellow flags beneath the floor. The cryptocurrency has climbed roughly 11% over the previous seven days, pushing from round $112,000 initially of October to its peak above $126,000. It’s presently buying and selling at round $122K after a post-all-time-high correction.

For long-term development evaluation, we will likely be utilizing the seven-days setup as an alternative of the standard every day charts.

From a shifting common perspective, Bitcoin is buying and selling comfortably above each its 50-day and 200-day exponential shifting averages, or EMAs. The 50-week EMA is trending larger across the $100,000 zone, whereas the 200-day EMA sits a lot decrease close to $65,000. When the 50-week EMA trades above the 200-week it usually indicators a longer-term uptrend stays intact. This configuration gives Bitcoin with a sturdy security internet; even when short-term momentum falters, the general bull construction stays wholesome so long as the coin does not collapse beneath that 200-day line. (It’s value noting that development adjustments are noticed on shorter timeframes earlier than they mirror on lengthy timeframes).

However the Common Directional Index, or ADX, paints a extra nuanced image. ADX measures the energy of a development no matter course, with readings above 25 confirming a strong development is underway. Presently, Bitcoin’s ADX is hovering simply round that restrict—barely scraping into “trending” territory with 24 factors within the weekly setup. This implies that whereas the transfer larger has been sharp, conviction could also be waning. Merchants usually view ADX readings between 20-25 as borderline, the place false breakouts grow to be extra widespread. Consider it like a automotive with the engine working sizzling—you are shifting quick, however you would possibly have to ease off the fuel quickly.

Additionally, take into account that, traditionally, Bitcoin has proven a sample of going three years in inexperienced, one 12 months in horrible, cruel, purple. So bulls could also be beginning to present extra indicators of exhaustion as 2025 nears its finish.

The Relative Energy Index, or RSI, sits round 61, which locations Bitcoin within the upper-neutral zone. RSI measures momentum on a scale of 0-100, with readings above 70 thought-about overbought and beneath 30 oversold. At 61, Bitcoin is not technically overbought but, however it’s knocking on the door. This can be a important juncture: If shopping for momentum continues and RSI pushes above 70, it may set off profit-taking from merchants seeking to lock in beneficial properties. Conversely, if it holds slightly below 70, there’s nonetheless room to run towards that psychological $130,000 degree analysts are eyeing.

One other sign to comply with is the Squeeze Momentum Indicator (the little grey plus indicators that seem beneath the worth chart above). When markets are in squeeze mode, belongings often commerce in a compression zone earlier than exploding both up or down. That is the third week of the squeeze, so bulls will little doubt be praying the explosion is favorable, as a result of if it isn’t, a correction may take the worth of BTC again close to $100K.

Elementary drivers: Why establishments are piling in

The technical setup is barely half the story. Elementary components are offering rocket gas for this Uptober rally.

First, institutional adoption seems to have reached important mass. The overall quantity of crypto belongings below administration by establishments reached a brand new all-time excessive as investor curiosity within the crypto ecosystem beneficial properties. Alternate-traded merchandise and different funding automobiles have remodeled crypto from a speculative fringe asset right into a reliable portfolio allocation for pension funds, household places of work, and wealth managers. The mere existence of ETF inflows creates a self-reinforcing cycle: extra shopping for strain pushes costs larger, which attracts extra institutional curiosity, which creates extra shopping for strain.

Second, the U.S. authorities shutdown that started October 1 might be bullish for crypto. Whereas Wall Road frets about fiscal chaos, crypto buyers see validation for Bitcoin’s “digital gold” narrative. The shutdown highlights sovereign debt issues and political dysfunction, driving buyers towards belongings that exist outdoors conventional monetary methods. Gold has additionally rallied throughout this era, however Bitcoin’s beneficial properties have outpaced the yellow steel for the reason that shutdown.

Third, macroeconomic circumstances stay supportive. Markets are pricing in potential Federal Reserve rate of interest cuts later this month, which might decrease the chance price of holding non-yielding belongings like Bitcoin. After a interval of aggressive charge hikes that weighed on crypto all through 2022-2023, the easing cycle seems to be resuming. JP Morgan analysts have projected Bitcoin may attain $165,000 by year-end 2025, whereas Commonplace Chartered maintains a daring $200,000 goal.

Fourth, regulatory readability continues to enhance. The passage of complete crypto laws within the U.S. and the implementation of the Markets in Crypto-Property (MiCA) framework in Europe have lowered regulatory uncertainty, even when compliance burdens have elevated. Institutional buyers crave clear guidelines—they’ll work inside strict laws, however they cannot tolerate ambiguity.

The altcoin query: Is that this a solo Bitcoin rally?

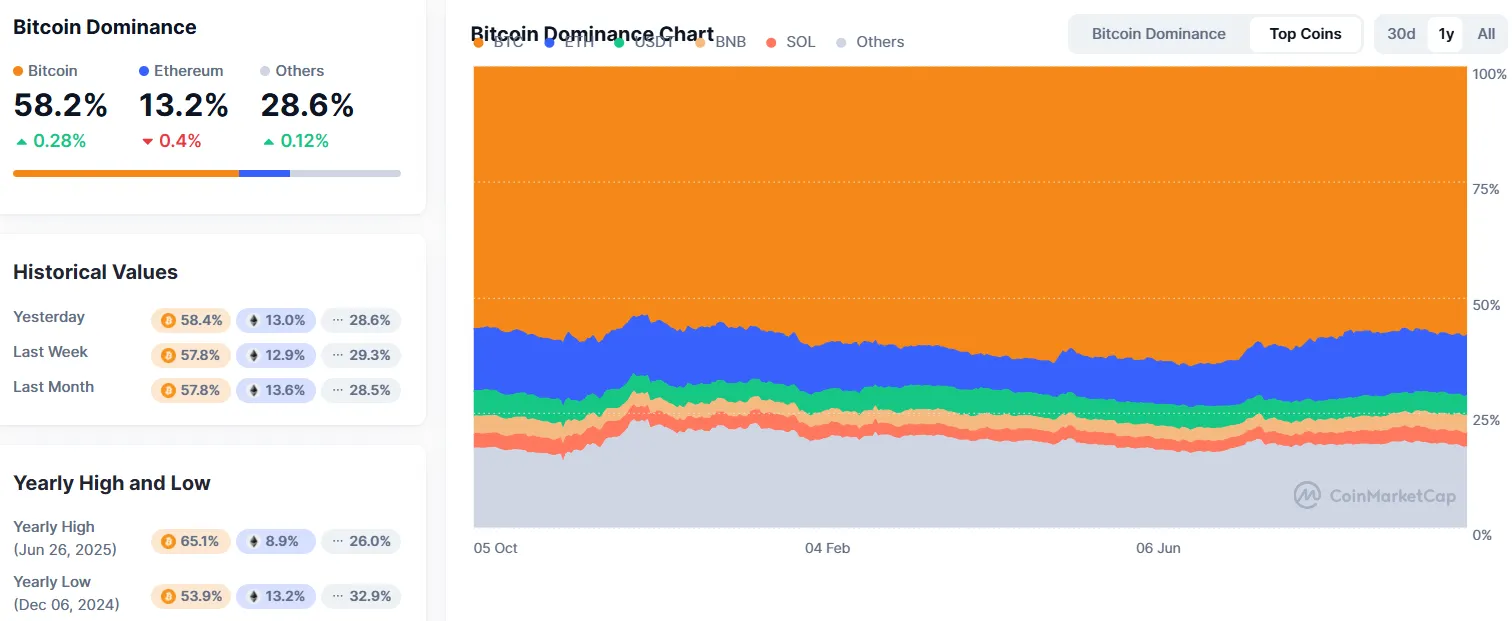

One revealing facet of this rally is its distribution. Bitcoin dominance—its share of whole crypto market cap—has been climbing, lately pushing above 58%. In different phrases, the rally is being led by Bitcoin slightly than altcoins, which usually signifies institutional slightly than retail participation. Establishments overwhelmingly want Bitcoin’s liquidity and regulatory readability over smaller tokens—even when that’s starting to alter.

That mentioned, Ethereum and main altcoins are taking part. Ethereum’s worth will increase match or exceed Bitcoin’s beneficial properties on sure days. DeFi tokens have additionally proven energy, with protocols on Ethereum, Solana, and Avalanche seeing elevated exercise. BNB, Binance Chain’s native token, can also be up this week alongside Aster and PancakeSwap, its two flagship tasks.

One other altcoin sector to observe intently is AI-related tokens. With over $35 billion invested in AI-crypto integrations in response to Coinmarketcap, tokens that present knowledge analytics, automated buying and selling, and DeFi operations are attracting critical capital. That is one space the place retail enthusiasm intersects with real technological innovation.

Nevertheless, it is very important keep in mind the place we’re. That is crypto. Traditionally, Bitcoin-led rallies can proceed for weeks earlier than altcoins explode larger in a euphoric “alt season.” That section tends to mark the ultimate stage of bull markets earlier than main—and after we say main, we imply main—corrections. We’re not there but, however it’s one thing to observe.

Threat components: What may derail Uptober?

No rally is with out dangers, and a number of other components may throw chilly water on the social gathering.

Regulatory uncertainty stays regardless of current progress. The U.S. Securities and Alternate Fee continues to scrutinize sure tokens and DeFi protocols. It might appear unlikely now, contemplating President Trump’s professional crypto stance, however a high-profile enforcement motion may set off sudden volatility. Equally, geopolitical tensions—commerce wars, conflicts, sanctions, and tariffs—may restrict market entry or set off risk-off sentiment that pushes buyers again towards money.

Macro components may shift shortly. If inflation knowledge is available in hotter than anticipated, the Federal Reserve would possibly delay charge cuts, strengthening the greenback and pressuring danger belongings together with crypto. Conversely, if financial knowledge deteriorates sharply, the risk-off rotation may overwhelm crypto’s safe-haven narrative.

Lastly, technical resistance ranges matter. Bitcoin faces formidable resistance each time it enters worth discovery territory. If consumers cannot push by means of convincingly, a “double prime” sample may type, inviting important profit-taking. Ethereum’s $4,600-$4,700 zone represents an analogous make-or-break degree.

What to anticipate for the remainder of October

Primarily based on historic patterns and present circumstances, a number of eventualities seem believable.

Bullish situation: Bitcoin consolidates briefly between $122,000-$126,000 earlier than pushing towards $130,000-$135,000 by mid-to-late October. Ethereum and the remainder of the altcoins comply with as normal with extra depth. ETF inflows stay sturdy, ADX readings strengthen above 30 confirming highly effective traits, and altcoins start catching up in a broad-based rally. This could align with Uptober’s historic sample and present basic drivers.

Impartial situation: Bitcoin and Ethereum commerce sideways in vast ranges—BTC between $118,000-$126,000, ETH between $3,800-$4,500—as buyers digest speedy beneficial properties. ADX readings stay weak, indicating uneven, directionless buying and selling. Quantity tapers off as retail merchants await clearer course. This consolidation section would truly be wholesome, establishing for an additional leg larger in November.

Bearish situation: Bitcoin fails to carry $122,000 assist and retraces towards $118,000-$114,000. Ethereum drops again beneath $3,800. Revenue-taking accelerates as overbought RSI readings set off algorithmic promoting. A detrimental macro catalyst—disappointing financial knowledge, escalating geopolitical tensions, or a safety breach—may speed up the decline. Nevertheless, so long as main assist zones maintain, the broader bull construction would stay intact.

The most certainly consequence sits between bullish and impartial: continued beneficial properties however at a slower, extra sustainable tempo. Explosive strikes should not sustainable—markets have to breathe. Anticipate durations of consolidation punctuated by makes an attempt at larger highs.

Good cash ought to look ahead to every day closes above $126,000 with rising ADX as affirmation of continued bullish momentum. Conversely, every day closes beneath $122,000 with declining quantity would recommend the rally is working out of steam.

Uptober has delivered up to now, however the month is simply starting. With institutional flows working sizzling, technical indicators displaying room to run, and historic seasonality on crypto’s aspect, the setup favors bulls. However volatility is crypto’s fixed companion—danger administration and real looking expectations stay important even throughout probably the most bullish months.

Disclaimer

The views and opinions expressed by the creator are for informational functions solely and don’t represent monetary, funding, or different recommendation.

Every day Debrief E-newsletter

Begin day-after-day with the highest information tales proper now, plus authentic options, a podcast, movies and extra.