The Bitcoin Coinbase Premium Hole has continued to be at a notable inexperienced degree not too long ago, an indication that institutional merchants are shopping for the asset.

Coinbase Premium Hole Is Constructive Proper Now

In a brand new put up on X, CryptoQuant neighborhood analyst Maartunn has talked in regards to the newest pattern within the Bitcoin Coinbase Premium Hole. This indicator measures the distinction between the BTC value listed on Coinbase (USD pair) and that on Binance (USDT pair).

The previous cryptocurrency change is the first hub for US-based buyers, notably massive institutional entities, whereas the latter is utilized by merchants worldwide. As such, the Coinbase Premium Hole primarily represents the distinction in conduct between American whales and world ones.

When the worth of the metric is optimistic, it means the worth of the asset listed on Coinbase is larger than that on Binance. Such a pattern implies customers of the previous are making use of a better shopping for strain (or decrease promoting strain) than these of the latter.

However, the indicator being beneath the zero mark implies Binance customers are those collaborating in a better quantity of accumulation, as they’ve pushed the asset to a better value on the platform.

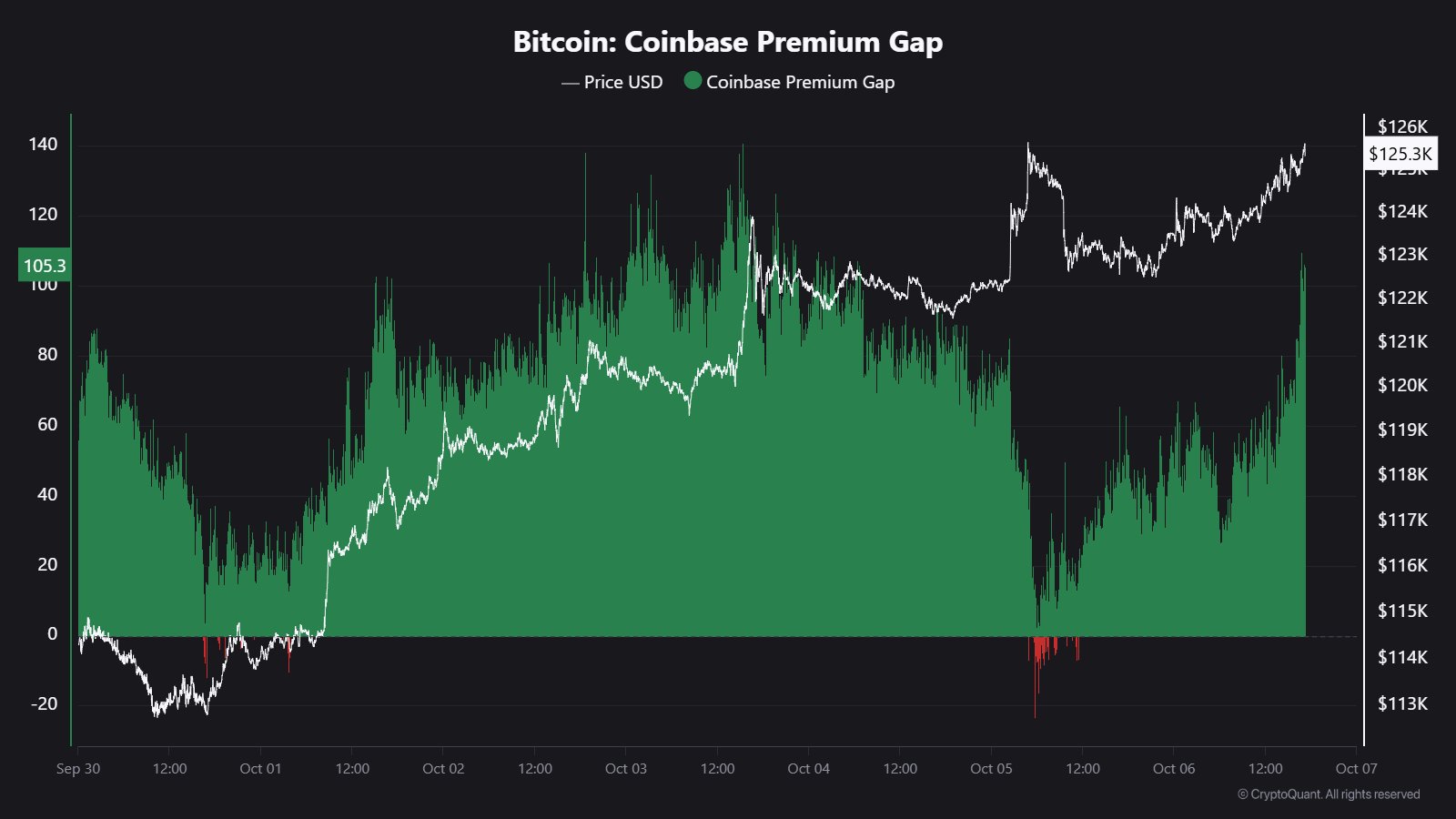

Now, right here is the chart shared by Maartunn that exhibits the pattern within the Bitcoin Coinbase Premium Hole over the previous week:

Seems like the worth of the metric has simply witnessed a big inexperienced spike | Supply: @JA_Maartun on X

As displayed within the above graph, the Bitcoin Coinbase Premium Hole has remained at principally optimistic ranges for the previous few days, suggesting that patrons on Coinbase have been extra aggressive at shopping for the cryptocurrency than Binance customers throughout this rally.

The metric reached its excessive on October third, when BTC traded at a premium of $140 on Coinbase. Through the weekend, the indicator noticed some cooldown, with it even briefly turning crimson throughout the all-time excessive (ATH) break on Saturday, nevertheless it has surged once more within the new week and recovered to a notable optimistic degree of $105.

Thus, it appears that evidently regardless of Bitcoin now getting into ATH exploration mode, US-based establishments are solely persevering with to build up extra of the cryptocurrency. These buyers have been one of many principal drivers available in the market since final 12 months, so if the Coinbase Premium Hole continues to stay inexperienced, the rally may probably maintain for longer.

Talking of institutional demand, one other metric that may correspond to purchasing/promoting from the cohort is the netflow for the spot exchange-traded funds (ETFs). These funding automobiles noticed huge web inflows throughout the previous week, offering additional proof of institutional accumulation.

The ETF netflow in comparison with the availability issuance | Supply: @therationalroot

Because the above chart shared by cycle analyst Root exhibits, the most recent week of spot ETF inflows was 8.8 instances the brand new Bitcoin provide that miners minted within the interval.

BTC Worth

Bitcoin breached above $126,000 on Monday to set one other new ATH, nevertheless it has since cooled off a bit, with its value coming again to $124,300.

The pattern within the value of the coin over the past 5 days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, BitcoinStrategyPlatform.com, CryptoQuant.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of high expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.