Arthur Hayes believes Bitcoin can double into year-end—and he says the catalyst is a White Home blueprint to seize the levers of US financial coverage. In an look on The Rollup, the BitMEX co-founder sketched a path to $250,000 per coin predicated on what he calls a “secret weapon”: a fast consolidation of management over the Federal Reserve (Fed) that may clear the way in which for aggressive credit score creation, yield-curve engineering, and an eventual flood of fiat liquidity into digital property.

Trump’s Fed Plan May Catapult Bitcoin To $250,000

Hayes’ $250,000 year-end Bitcoin name rests on a slim however explosive thesis: Donald Trump can seize practical management of the Federal Reserve inside months, set off yield-curve management by executive-pressure and personnel energy, and unleash a credit score impulse that spills straight into crypto through stablecoins. The BitMEX co-founder framed the pathway not as conjecture however as institutional mechanics. “It simply is math. I really like math,” he mentioned.

On the middle is the Fed’s structure—two our bodies, two vote thresholds, one choke level. Hayes recited the plumbing crisply. “There’s a Fed Board of Governors. There’s seven members on this board. All are presidential appointees confirmed by the Senate and easy majority wins. So that you want 4 votes out of seven to regulate that board.”

With that majority, the White Home good points three levers without delay: the rate of interest paid on reserve balances and phrases on the low cost window; supervisory stance over financial institution regulation; and decisive affect over who runs the 12 regional Reserve Banks—as a result of these presidents have to be accredited by the governors.

Associated Studying

The second physique, the FOMC, has 12 votes; seven governors and 5 district presidents. Stack sympathetic leaders on the districts and the tally follows. “By having 4 within the governors and 7 of the FOMC you’re successfully controlling the central financial institution,” Hayes argued.

Why, then, is Governor Lisa Cook dinner “the ultimate domino”? Hayes ties the timing to Stephen Miran’s current dissent on price coverage amongst sitting governors. He contends Trump already has two aligned votes and a believable third; Cook dinner is the hinge for a fourth.

In his formulation, mounting authorized and political strain might power her departure on a compressed calendar. “I feel it’s earlier than the top of the 12 months,” he mentioned, describing an “imminent” court docket willpower associated to a mortgage- or bank-fraud matter and the probability of a negotiated exit regardless of guilt or innocence:

“That is all politics… what’s she going to get promised within the again finish to step down and exit stage left?” If Cook dinner leaves and a alternative sails by means of whereas the Senate math nonetheless favors confirmations, the Board majority flips. With 4 of seven, the administration can then approve or block district-president alternatives arising on the two- and four-year rotation—“in yearly that led to a one and a 5… all 12 district financial institution presidents are up for reelection,” he famous—giving a path to seven of 12 on the FOMC.

Yield Curve Management And Liquidity

The coverage intent is express: steepen the curve and run the financial system sizzling through regional banks—what Hayes calls “QE for poor folks.” The operational instruments begin on the brief finish. A governor-aligned Board can minimize the speed paid on extra reserves to drag down front-end benchmarks, cheapen funding for banks, and reopen the low cost window with friendlier phrases.

Supervision may be eased to encourage mortgage progress outdoors the money-center complicated. In parallel, an FOMC majority can direct the System Open Market Account to increase—basic balance-sheet coverage—whereas rhetorically committing to pins on the curve. The template, Hayes says, is the Forties.

“A politician can declare exigent circumstances… there are such a lot of issues that [they] might use as an excuse… and subsequently the Fed is justified in combining with the Treasury and fixing the cash provide.”

The impact is curve administration, not simply cuts: “They’re going to steepen the yield curve. And so steepening the yield curve goes to convey the close to finish down,” whereas longer maturities reprice round larger nominal progress and inflation expectations. Even when lengthy charges fall from peak ranges as coverage eases, the slope widens, repairing financial institution net-interest margins and pushing credit score creation into the “coronary heart of America.”

Associated Studying

That is the bridge to Bitcoin. A steepened curve and looser supervision channel new lending by means of regional banks, elevating the cash multiplier and nominal GDP, and pushing inflation. “When the regional financial institution is lending… they’re creating this new mortgage… they should rent extra employees… and clearly inflation grows together with it,” Hayes mentioned.

Liquidity then leaks into Bitcoin by means of stablecoins he expects to proliferate below a dollar-hegemony technique. First comes T-bill carry in tokenized {dollars}; subsequent comes on-chain yield; lastly comes hypothesis. “After getting a stablecoin… now you’ve obtained a greenback checking account… I could make 10–15%… I’m nonetheless broke… I’m going to invest,” he mentioned, pointing to perpetuals venues as the last word launch valve for world retail leverage.

The value name follows from the plumbing. Hayes reiterated a “double into the top of the 12 months” towards $250,000 if the personnel puzzle clicks—Cook dinner exits, replacements are confirmed, district appointments swing, and the Fed’s steadiness sheet plus short-end levers are dropped at heel.

He additionally flagged the political clock: razor-thin Senate margins and the chance {that a} post-2026 Congress might block confirmations. “If Trump has anybody who must be accredited… it higher occur earlier than then,” he warned, including that Powell’s chair time period ending in Could 2026 might compound the realignment if the sooner items are in place.

Hayes’ macro coda is stark: the debt arithmetic forces both inflation or express restructuring, and each are bullish for scarce property. He even entertained revaluing US gold to e-book a trillion-dollar achieve—an admission of greenback devaluation that he mentioned would carry unknowable Treasury-market penalties. Both route, he insists, is hostile to bonds and supportive of Bitcoin. “On the finish of the day, you don’t need to personal bonds… you need to be promoting {dollars} and proudly owning a tough asset like Bitcoin or gold.”

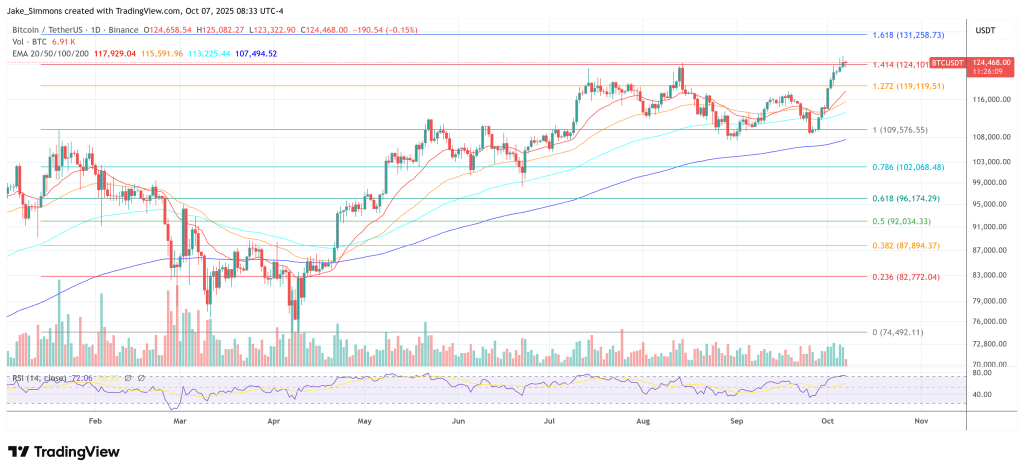

At press time, BTC traded at $124.468.

Featured picture created with DALL.E, chart from TradingView.com