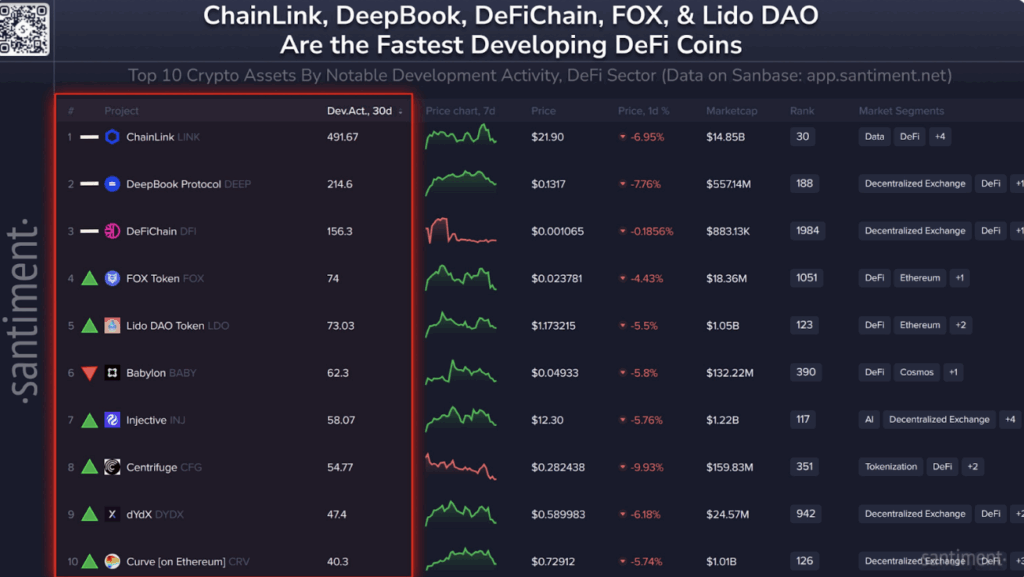

- Chainlink tops Santiment’s dev exercise rating with 491.67 factors.

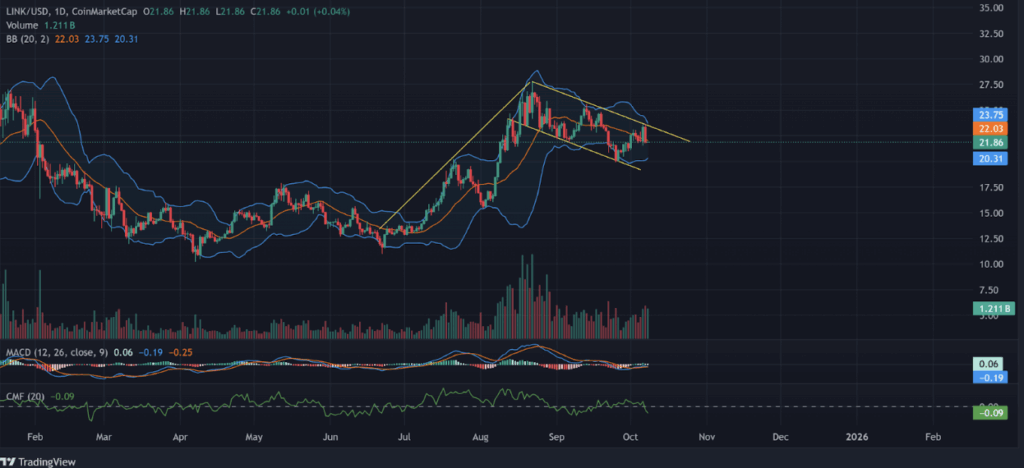

- Worth consolidates between $20.3 assist and $23.7 resistance.

- Tightening volatility hints at a breakout — $26 to $30 upside attainable if bulls take management.

Chainlink (LINK) isn’t letting go of its crown anytime quickly. Santiment’s newest October report reveals the challenge sitting comfortably on the prime of the DeFi improvement exercise rankings. During the last 30 days, LINK logged an enormous rating of 491.67, placing it nicely forward of everybody else within the race.

That form of consistency isn’t simply noise — it reveals builders are actively constructing, updating, and pushing upgrades. For a sector the place hype usually fades fast, Chainlink’s regular climb is a giant deal.

The Remainder of the Area: DEEP, DFI, and Extra

Proper behind LINK, DeepBook Protocol (DEEP) grabbed second with 214.6, proving it’s gaining traction quick. DeFiChain (DFI) got here in third at 156.3, protecting its spot as a strong mid-tier participant.

Additional down, FOX Token (FOX) and Lido DAO (LDO) claimed fourth and fifth, whereas Babylon (BABY) slid barely to sixth at 62.3. Curiously, new faces like Injective (INJ), Centrifuge (CFG), dYdX (DYDX), and Curve (CRV) rounded out the highest ten, hinting at a extra aggressive center pack than we’ve seen in months.

The shakeup suggests dev exercise isn’t simply clustered on the prime anymore — it’s spreading out, with a number of ecosystems pushing ahead on the identical time.

LINK Worth Eyes $23–$30 Vary

Whereas improvement exercise seems to be nice, LINK’s value has been a bit choppier. The token fell round 7% within the final 24 hours, though buying and selling quantity really went up by about 5%. On the charts, LINK is coiling inside a descending channel, pulling again after its sharp rally earlier this quarter.

Key ranges to observe: $23.7 as resistance on the highest finish, and $20.3 as assist under. If bulls handle a breakout above that channel, LINK might simply push towards $26 and even the $30 zone. But when the token slips beneath $20, it dangers dropping additional, probably right down to $17.5.

Bollinger Bands are tightening, which normally means volatility is about to spike. Principally, the market’s winding up for an even bigger transfer.

Indicators and Market Outlook

The MACD nonetheless leans bearish, although indicators of convergence recommend consumers could be gearing as much as step in. In the meantime, Chaikin Cash Circulate (CMF) stays barely adverse, exhibiting modest outflows of capital.

The larger image? As soon as Bitcoin recovers from its brutal dip to $120K, LINK seems to be set to be one of many first DeFi tokens to bounce again. With Chainlink powering a lot of the info infrastructure throughout blockchains, it has a powerful basis to journey the following leg of the market.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.