- Canary Capital amended filings for Litecoin (LTCC) and Hedera (HBR) spot ETFs, a ultimate step earlier than SEC evaluation.

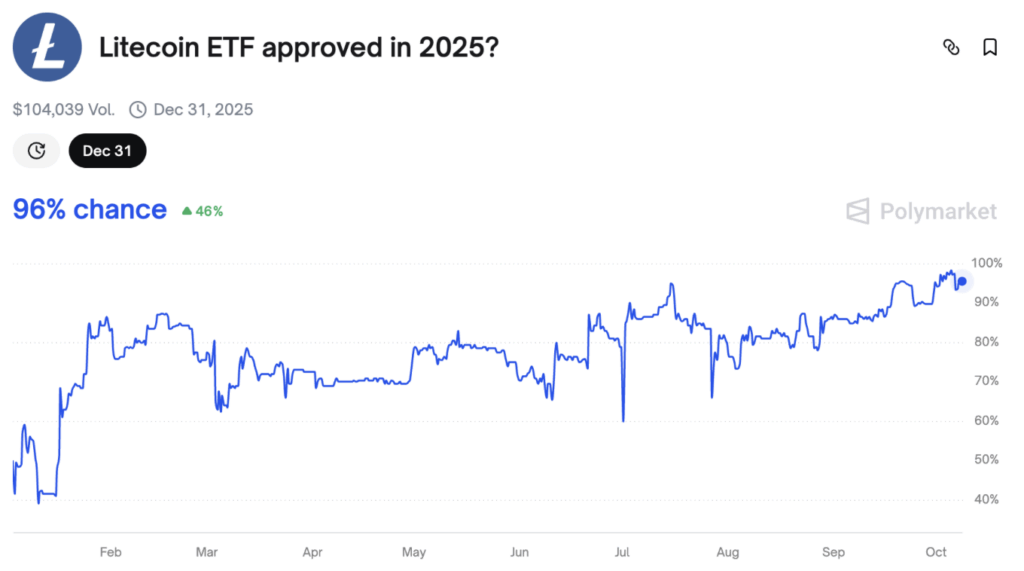

- Polymarket odds present a 96% probability of approval by year-end, fueling bullish sentiment.

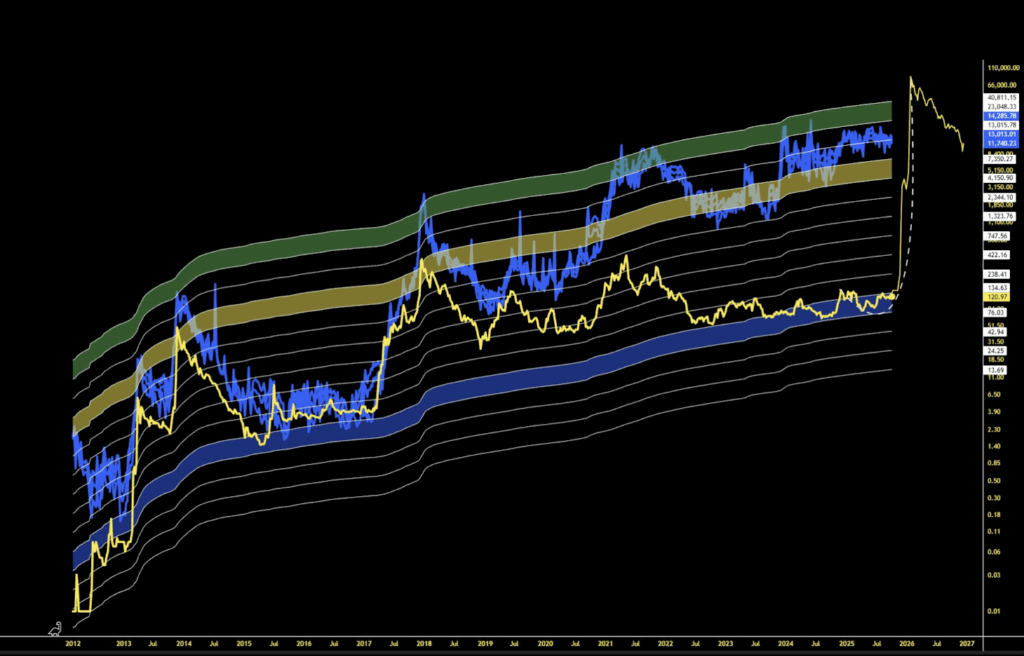

- Historic This fall returns and a bullish chart setup may place LTC for a robust rally into 2026.

Asset supervisor Canary Capital has stirred contemporary pleasure after amending its S-1 filings for proposed Litecoin (LTC)and Hedera (HBAR) spot ETFs. Bloomberg’s ETF analysts famous that these tweaks usually characterize the ultimate housekeeping earlier than the SEC delivers its verdict. If approval lands, it may flip the script for Litecoin specifically, which has spent October bouncing between rallies and pullbacks.

A inexperienced mild from the SEC wouldn’t simply be symbolic—it may open the gates for institutional inflows and gas the following leg of Litecoin’s worth motion. Buyers are already speculating that this choice could possibly be the spark that ignites LTC’s This fall rally.

Will 2025 Lastly See a Litecoin ETF?

The amendments, filed on October 7, 2025, included a administration payment of 0.95% for each ETFs. Whereas greater than most Bitcoin spot ETFs, analysts like Eric Balchunas harassed that charges like this are customary for area of interest or early-stage merchandise. “If flows are available, different issuers will Terrordome that sht with cheaper funds,” he joked, hinting at aggressive stress if demand explodes.

Canary additionally revealed proposed ticker symbols: LTCC for the Litecoin ETF and HBR for Hedera. In keeping with Balchunas and colleague James Seyffart, the inclusion of charges and tickers normally indicators a submitting is coming into its ultimate section. Timing, nonetheless, could also be difficult by the continuing U.S. authorities shutdown, which may stall SEC opinions.

Even so, optimism hasn’t cooled. On prediction markets like Polymarket, merchants are assigning a 96% likelihood {that a} Litecoin ETF will probably be authorised earlier than the tip of 2025—a near-certainty in market phrases.

ETF Optimism and This fall Tailwinds Gas Litecoin

Past filings, market efficiency has proven glints of power. Litecoin briefly touched a six-week excessive final week earlier than easing again, holding onto a portion of its beneficial properties. As of press time, LTC trades round $115.7, down 2.55% on the day, however nonetheless supported by broader bullish setups.

Historical past provides weight to the optimism: This fall has historically been Litecoin’s strongest stretch, with the coin closing within the crimson simply 4 instances over the past 12 years. November, specifically, has been explosive, averaging 148% beneficial properties. October tends to be quieter, however usually lays the groundwork for larger runs into year-end.

From a technical angle, analysts are eyeing an inverse head-and-shoulders sample on LTC’s chart. If confirmed, this basic bullish reversal may mark the start of a contemporary uptrend.

Outlook for Litecoin

Put collectively—the ETF anticipation, seasonal power, and supportive chart patterns—Litecoin appears to be like primed for renewed momentum into the ultimate months of 2025. A confirmed ETF approval may act because the accelerant, whereas technicals and historic cycles present the construction for a rally.

If the SEC comes via, Litecoin is likely to be gearing up for a run that buyers have been ready on for years.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.