Bitcoin is dealing with a important check after a pointy however modest correction from its all-time highs, falling from $126,000 to round $120,000. Whereas bulls stay answerable for the broader pattern, market sentiment is beginning to present indicators of uncertainty, with some analysts suggesting that Bitcoin could possibly be nearing a cycle prime. Others, nonetheless, keep a extra optimistic view, arguing that the market remains to be in value discovery mode and getting ready for one more leg increased.

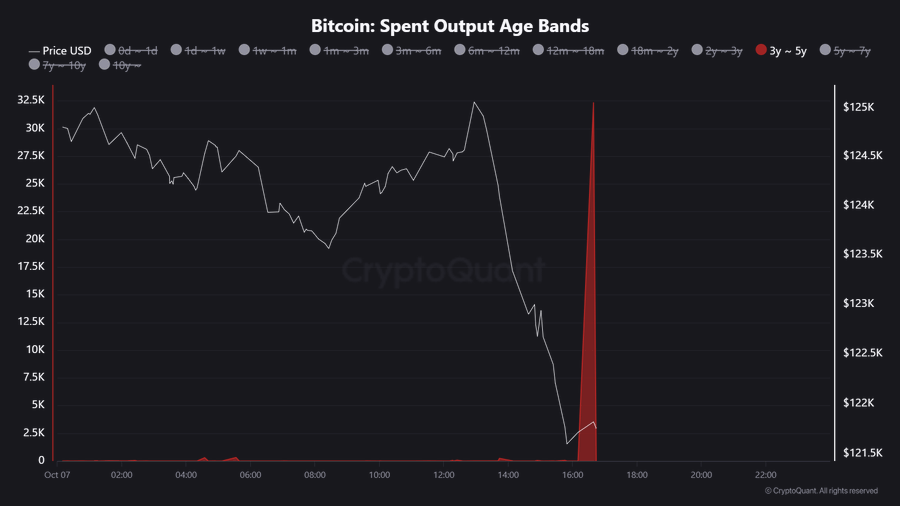

Amid this debate, prime analyst Darkfost has cautioned traders a couple of current wave of deceptive onchain interpretations. Studies circulating throughout social media claimed that over 32,000 BTC, price almost $4 billion, moved onchain from wallets dormant for 3–5 years. Nevertheless, Darkfost clarified that this data is wrong and stems from a misunderstanding of Bitcoin’s UTXO (Unspent Transaction Output) mechanism.

He explains that whereas it seems as if tens of hundreds of BTC had been moved, the precise quantity transferred was far smaller, brought on by how Bitcoin’s transaction construction information exercise. Darkfost’s clarification serves as a reminder to strategy sensational onchain information with warning — particularly throughout risky market phases when concern and euphoria can distort evaluation.

Analyst Clarifies Deceptive Whale Motion Information

Darkfost make clear the confusion surrounding the reported motion of 32,000 BTC from wallets that had been dormant for years. He explains that the whale concerned — recognized as the identical dealer who just lately offered BTC on Hyperliquid to purchase ETH — solely moved 3,000 BTC, not 32,000.

The confusion arises as a result of the whale’s unique UTXO contained 32,321 BTC, which had been inactive for over three years. Since Bitcoin’s UTXO system doesn’t permit partial spending, your entire output needed to be spent to maneuver simply the three,000 BTC. After the transaction, the pockets nonetheless holds 29,321 BTC, which means that solely about 10% of the overall steadiness really modified arms.

Darkfost confirmed that this explicit handle hadn’t proven any outflows in years, including to the intrigue. Whereas giant dormant wallets changing into energetic can typically sign promoting strain, he emphasised that the onchain knowledge should be interpreted fastidiously to keep away from exaggerating market exercise.

On this case, the supposed “large transfer” was merely a technical artifact of Bitcoin’s transaction construction, not a sign of large-scale promoting. Nonetheless, analysts and merchants are preserving an in depth eye on comparable actions, as reactivated whale addresses can typically precede market volatility. Darkfost’s clarification serves as a priceless reminder that context and technical understanding are important when analyzing on-chain knowledge — particularly in instances when misinformation can simply gas panic or hypothesis throughout the crypto market.

Bitcoin Holds Key Help After Sharp Pullback

Bitcoin is at present buying and selling round $122,700, exhibiting resilience after a pointy correction from its all-time excessive close to $126,200. The 4-hour chart reveals that BTC efficiently held above the $120,000 help zone, suggesting that consumers proceed to defend key ranges regardless of short-term volatility. The yellow line at $117,500 stays a vital stage — beforehand a resistance — now appearing as the primary structural help in case of additional draw back.

The short-term transferring averages (blue and crimson strains) present that the worth stays above each the 50-period and 200-period transferring averages, confirming a bullish construction. The current bounce from $121,000 aligns with sturdy demand absorption, which regularly precedes one other upward try. If Bitcoin breaks above $124,500, it may sign renewed momentum towards retesting the $126,000 ATH, doubtlessly main to cost discovery.

Nevertheless, a rejection close to present ranges may result in a deeper retest towards the $120,000–$118,000 vary, the place the subsequent consolidation part could type. General, the chart signifies that Bitcoin’s uptrend stays intact, however bulls want a decisive shut above $125,000 to verify continuation. The market seems to be in a wholesome pause after a steep rally, getting ready for its subsequent decisive transfer.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our crew of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.