Be a part of Our Telegram channel to remain updated on breaking information protection

The gold value surged previous $4k per ounce as Bitcoin tumbled greater than 1% and Peter Schiff mentioned the crypto market is “about to be rugged by gold.”

Gold hit a brand new all-time excessive (ATH) at $4,039.13 after surging over 53% this 12 months and doubling up to now two years, based on TradingView.

Gold value per ounce (Supply: TradingView)

However Bitcoin, generally likened to digital gold, was down 1.3% at $122,475 as of 4:37 a.m. EST, based on CoinMarketCap.

“Wall Road is so bullish on crypto that it’s laborious to think about it going a lot greater from right here,” Schiff wrote on X. “As an alternative, it’s very possible that Bitcoin and all the pieces crypto are about to be rugged by gold.”

Wall Road is so bullish on crypto that it’s laborious to think about it going a lot greater from right here. As an alternative, it’s very possible that Bitcoin and all the pieces crypto are about to be rugged by gold. As gold tops $4k, it’s possible that Bitcoin will dump, taking the remainder of crypto with it.

— Peter Schiff (@PeterSchiff) October 7, 2025

Schiff’s prediction of a broader market dump comes a day after he warned Bitcoin traders to not get too excited in regards to the crypto’s new report value. He mentioned that when it comes to gold, BTC is “nonetheless about 15% under its report excessive.”

Bitcoin additionally made a brand new excessive at this time, buying and selling above $126K. Nevertheless it phrases of gold, it is nonetheless about 15% under its report excessive. I nonetheless suppose it is too early for Bitcoiners to get excited in regards to the rally. Till Bitcoin could make a brand new excessive priced in gold, it is only a bear market rally.

— Peter Schiff (@PeterSchiff) October 6, 2025

“Till Bitcoin could make a brand new excessive priced in gold, it’s only a bear market rally,” he wrote within the put up.

He additionally mentioned that BTC would wish to rise to about $148K to shut its deficit to gold, however famous that “it’s a shifting goal as gold retains rising.”

Creator Adam Livingston additionally reminded traders in an Oct. 7 X put up that BTC has not but surpassed its 2021 ATH value in gold, including that “the bull run hasn’t even began but” and predicting that Bitcoin “goes to MELT FACES” within the remaining quarter of the 12 months.

Bitcoin May Be Value Half Of Gold’s Market Cap After Subsequent Halving, Says VanEck

Livingston is just not alone in his bullish outlook for the crypto. VanEck’s head of digital asset analysis Mathew Sigel can be bullish on Bitcoin, however with a longer-term funding horizon.

In a current X put up, Sigel predicted that BTC might seize half of gold’s capitalization after the following halving occasion, which is slated for 2028.

“We’ve been saying Bitcoin ought to attain half of gold’s market cap after the following halving,” Sigel wrote.

We’ve been saying Bitcoin ought to attain half of gold’s market cap after the following halving. Roughly half of gold’s worth displays its use as a retailer of worth somewhat than industrial or jewellery demand, and surveys present youthful customers in rising markets more and more choose Bitcoin…

— matthew sigel, recovering CFA (@matthew_sigel) October 7, 2025

He mentioned that gold’s worth displays its use case as a retailer of worth, however famous that surveys present youthful traders, particularly in rising markets, choose Bitcoin for this function.

“At at this time’s report gold value, that means an equal worth of $644,000 per BTC,” he added.

Robust Spot Bitcoin ETF Flows Persist, Led By BlackRock

Whereas Schiff may be bearish on Bitcoin, institutional traders proceed to purchase into the crypto through spot ETFs (exchange-traded funds).

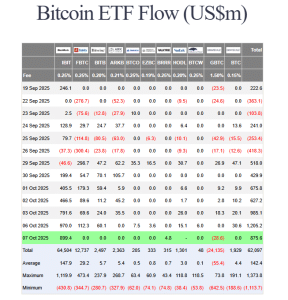

The funds began the week robust, and pulled in over $1.205 billion on Oct. 6, information from Farside Buyers exhibits. This was their second-highest internet every day inflows since their inception at first of 2024.

US spot BTC ETF flows (Supply: Farside Buyers)

BlackRock’s spot Bitcoin ETF (IBIT) skilled the vast majority of these inflows, with $970 flowing into the fund on the day.

Within the newest buying and selling session, one other $875.6 million flowed into the US spot Bitcoin ETFs. IBIT as soon as once more posted the very best inflows, with $899.4 million being added to the product’s reserves yesterday.

The one different fund to report internet every day inflows within the newest buying and selling session was Valkyrie’s BRRR. In the meantime, Grayscale’s GBTC recorded $28.6 outflows.

IBIT has been the popular US spot Bitcoin ETF for traders, and has develop into probably the most worthwhile BlackRock ETF. The fund can be closing in on $100 billion in belongings.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection