In accordance with on-chain information, BlackRock’s iShares Bitcoin Belief (IBIT) now holds over 500,000 BTC. This positions BlackRock because the third-largest Bitcoin holder globally, trailing solely Bitcoin’s pseudonymous creator, Satoshi Nakamoto, and crypto alternate large Binance.

With holdings price roughly $48 billion, BlackRock’s affect within the crypto market is increasing quick.

BlackRock’s Aggressive Bitcoin Accumulation

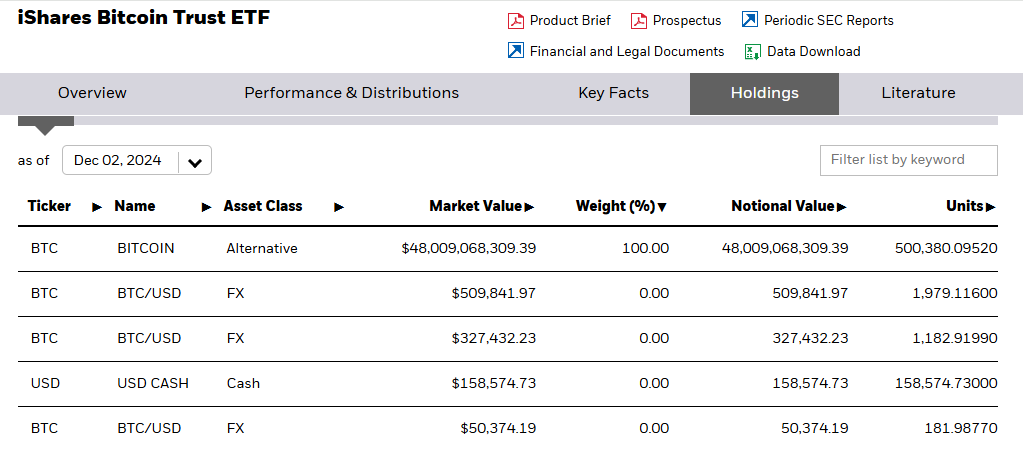

In simply 233 buying and selling days because the launch of IBIT, BlackRock has acquired 2.38% of all Bitcoin that may ever exist. This traction displays its confidence in Bitcoin as a monetary asset. Its collection of purchases displays this momentum, with whole BlackRock Bitcoin holdings reaching 500,380 items as of Monday, December 2.

Lately, the agency made headlines with a $680 million Bitcoin shopping for spree amid a cumulative effort. The purchases proceed to solidify its foothold available in the market. BlackRock’s pivot towards Bitcoin aligns with CEO Larry Fink’s altering perspective. As soon as a skeptic who dismissed Bitcoin as speculative, Fink now describes it as an “impartial asset” with transformative potential.

This shift has pushed BlackRock’s deepening involvement in crypto markets. The agency’s US Head of Thematics and Energetic ETFs, Jay Jacobs, lately mentioned Bitcoin might turn into a $30 trillion market. As BeInCrypto reported, he cited extra room for BTC adoption.

BlackRock’s flagship product, the iShares Bitcoin Belief (IBIT), is a central element of its Bitcoin accumulation technique. IBIT reached $40 billion in AUM (belongings below administration) earlier this yr, shattering velocity data within the ETF business. On its first day of choices buying and selling alone, the fund recorded gross sales exceeding $425 million, signaling immense curiosity from institutional buyers.

4 weeks in the past, IBIT surpassed the efficiency of BlacRock’s gold ETF, proof of Bitcoin’s rising prominence in conventional finance (TradFi). In accordance with information on SoSoValue, IBIT continues to guide the cost within the Bitcoin spot ETF market.

The monetary instrument recorded inflows nearing $340 million on Monday. Its cumulative internet influx was $32.08 billion as of December 2, with Constancy’s FBTC trailing at $11.48 billion.

BTC Institutional Adoption Stirs Decentralization Issues

BlackRock’s Bitcoin technique extends past ETFs. The agency has additionally elevated its publicity to Bitcoin by investments in MicroStrategy, the biggest company holder of Bitcoin. This transfer displays BlackRock’s confidence in Bitcoin’s long-term worth proposition and its intent to dominate the institutional Bitcoin market.

The agency’s initiatives, amongst these of different TradFi gamers, have undeniably legitimized Bitcoin as an asset class. Nonetheless, not all are celebrating.

Critics throughout the crypto neighborhood argue that institutional dominance contradicts Bitcoin’s founding ethos of decentralization. With BlackRock amassing such vital holdings, the agency dangers centralizing management in an area that was designed to empower people over establishments.

“There as soon as was a dream that was Bitcoin… this isn’t it,” one person on X lamented.

To some critics, the rising institutional acquisition of Bitcoin defeats the entire objective of decentralization, with the likes of BlackRock steadily edging to turn into the most important hodlers.

Nonetheless, BlackRock’s rise as a serious Bitcoin holder marks a pivotal shift within the cryptocurrency enjoying discipline. On one hand, it highlights Bitcoin’s mainstream acceptance and potential as a world monetary asset. On the opposite, it raises questions concerning the position of huge monetary establishments in an area historically related to grassroots monetary sovereignty.

With IBIT main the cost and setting benchmarks, the agency is poised to stay a key participant within the crypto business. Nonetheless, the controversy over whether or not this advantages or undermines Bitcoin’s foundational ideas is unlikely to subside.

Disclaimer

In adherence to the Belief Mission pointers, BeInCrypto is dedicated to unbiased, clear reporting. This information article goals to supply correct, well timed info. Nonetheless, readers are suggested to confirm info independently and seek the advice of with knowledgeable earlier than making any selections primarily based on this content material. Please be aware that our Phrases and Circumstances, Privateness Coverage, and Disclaimers have been up to date.