Bitcoin has been experiencing heightened volatility after reaching a brand new all-time excessive of $126,000 earlier this month. The worth has since entered a consolidation part, hovering close to the $120,000 degree as merchants seek for contemporary demand. Market sentiment stays divided — some analysts anticipate Bitcoin to stabilize and put together for an additional leg up, whereas others warn of a attainable drop beneath present ranges as momentum cools.

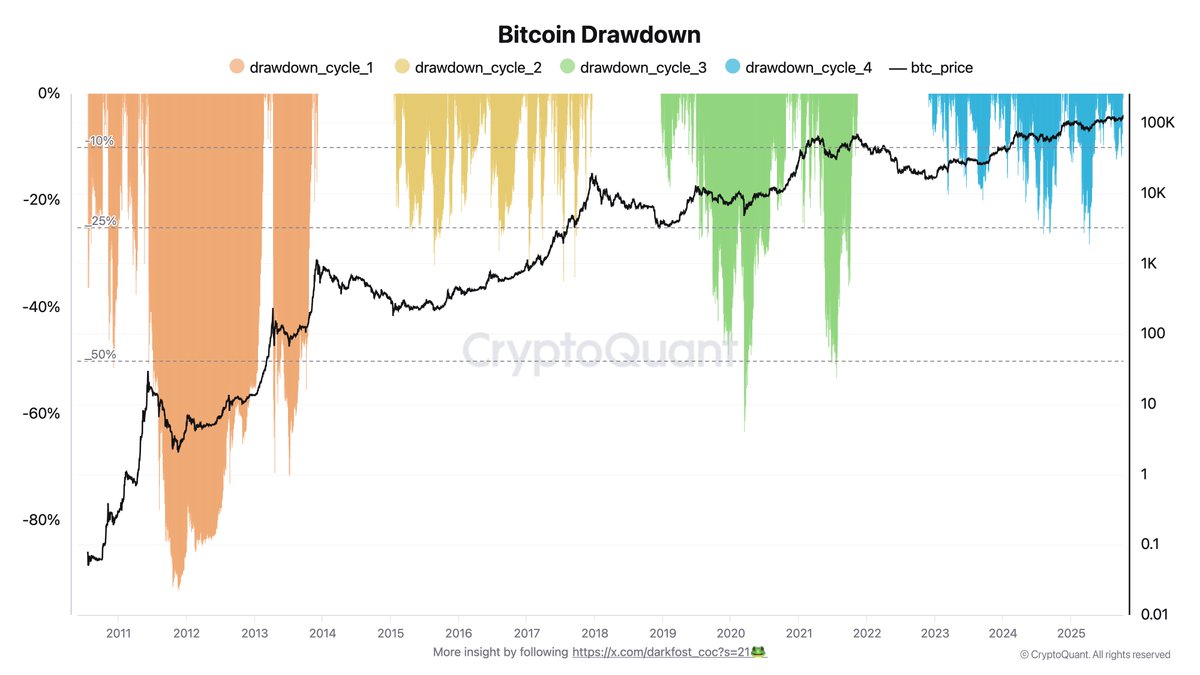

This raises the query that’s echoing throughout the market: May this be the primary really completely different Bitcoin cycle? In accordance with prime analyst Darkfost, conventional patterns could not apply this time. “Some declare {that a} -80% to -90% bear market will happen as normal,” he explains, “however sure information factors recommend that this cycle is being constructed on new foundations.”

Not like earlier cycles pushed by retail hypothesis, this one seems more and more influenced by institutional participation, ETFs, and long-term holders, all contributing to decreased volatility and deeper market maturity. Whereas corrections stay a part of Bitcoin’s DNA, structural modifications in demand and liquidity could also be redefining how this cycle unfolds. Whether or not Bitcoin breaks increased or faces a significant retracement, one factor is obvious — this market is evolving quicker than ever earlier than.

Bitcoin’s Fourth Cycle: A Secure and Mature Market Part

In accordance with prime analyst Darkfost, Bitcoin’s present cycle stands out as probably the most secure in its historical past. Throughout this bullish part, BTC has not skilled a single correction exceeding 28%, a stark distinction to earlier cycles the place violent retracements have been widespread. Most drawdowns have remained inside a modest 10%–20% vary, and solely 4 corrections have surpassed 25%, marking this because the least risky Bitcoin cycle to this point.

For perspective, between 2020 and 2022, Bitcoin endured a number of 50% drawdowns, creating sharp waves of worry and euphoria that outlined the market’s rhythm. At the moment, the image could be very completely different. Volatility has dropped to its lowest ranges because the final bear market, reflecting a brand new degree of market maturity. As Darkfost factors out, this decline in volatility has additionally led to a tightening of the Bollinger Bands’ commonplace deviation, signaling rising value stability and disciplined market habits.

This shift means that Bitcoin’s market construction has essentially developed. It now not mirrors the chaotic, retail-driven cycles of the previous. As a substitute, adoption continues to climb, regulation has turn out to be extra favorable, and, most significantly, the investor base is altering. Giant institutional gamers and company treasuries — significantly in the USA — are getting into the market, absorbing promoting strain that when triggered deep corrections.

In consequence, Bitcoin’s fourth cycle is rewriting the rulebook, constructed on deeper liquidity, stronger palms, and long-term conviction reasonably than hypothesis. This can be the primary cycle the place Bitcoin transitions from a risky asset to a globally acknowledged, maturing retailer of worth.

Worth Consolidation Continues Round $121K

Bitcoin (BTC) is at the moment buying and selling round $121,800, consolidating after a risky week that noticed robust resistance close to the $126,000 all-time excessive. The 4-hour chart exhibits that BTC is transferring sideways inside a slender vary, struggling to reclaim the short-term 50 EMA (blue line), which has now was dynamic resistance.

The rapid help degree sits close to $120,000, whereas the important thing horizontal degree at $117,500 — highlighted in yellow — stays probably the most essential zone to keep up the broader bullish construction. So long as the value holds above this space, the uptrend stays intact, with potential for a renewed push towards the $124,000–$126,000 zone.

Momentum indicators recommend that patrons are nonetheless defending vital help, although market indecision dominates. The 100 and 200 EMAs (inexperienced and purple traces) proceed trending upward, reinforcing mid- and long-term bullish sentiment. Nevertheless, failure to shut above $122,500 within the coming periods might expose Bitcoin to deeper retracements, with eyes on $118,000 as the following demand space.

The chart suggests a wholesome consolidation part after a significant breakout. A decisive transfer above $123K would verify renewed bullish momentum, whereas a breakdown beneath $120K might mark the start of a deeper correction part.

Featured picture from ChatGPT, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.