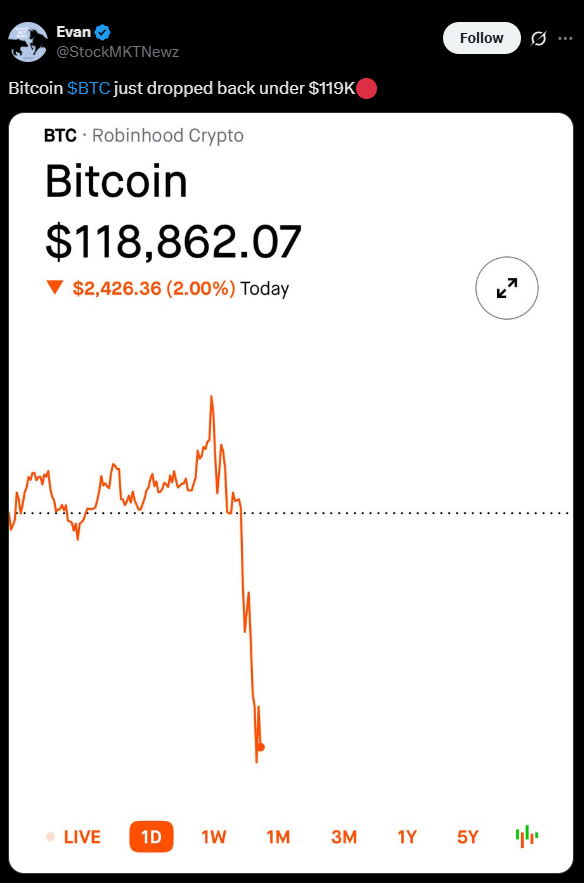

- Bitcoin fell under $119K after Trump threatened new tariffs on Chinese language items.

- ETH, SOL, and XRP adopted with sharp declines amid international risk-off sentiment.

- Gold surged above $4,000, exhibiting traders’ flight to security amid commerce warfare fears.

The crypto market confronted renewed stress Friday after U.S. President Donald Trump introduced plans to impose a “huge improve” in tariffs on Chinese language items, reigniting fears of a commerce warfare. The assertion got here simply hours after China launched new export restrictions on uncommon earth metals, escalating tensions between the 2 superpowers.

Bitcoin, which had lately notched a brand new all-time excessive close to $126,000, shortly plunged to $118,738, shedding greater than 6% in 4 days. Main altcoins adopted swimsuit, with Ethereum (ETH) sliding to $4,112, Solana (SOL) to $211, and XRP seeing an analogous sharp decline. Analysts described the sell-off as a textbook risk-off transfer, triggered by international uncertainty and a rush to safer belongings.

Crypto Shares and Broader Markets Take a Hit

The shockwaves prolonged past crypto markets into associated equities. Circle (CRCL) dropped over 6%, whereas Robinhood (HOOD) and Coinbase (COIN) every fell round 5% amid declining buying and selling volumes and sentiment. Even MicroStrategy (MSTR)—recognized for its huge Bitcoin holdings—slipped about 3%, reflecting broader investor warning.

Conventional markets additionally took successful. The S&P 500 and Nasdaq closed down 1.6% and 1.3%, respectively, whereas WTI crude oil dropped almost 4% to under $60 per barrel, marking its weakest degree since early Might. In the meantime, gold surged greater than 1%, climbing again above $4,000 per ounce, underscoring its enduring function as the popular hedge in instances of geopolitical stress.

Uncommon Earths and Financial Retaliation

China’s transfer to tighten export controls on uncommon earth minerals—important parts in electronics, army {hardware}, and EVs—sparked the U.S. response. Analysts warn {that a} extended standoff might rattle provide chains and gradual international manufacturing output, additional destabilizing danger belongings like cryptocurrencies.

Market strategist George Chen commented that each Washington and Beijing are “utilizing commerce instruments as negotiation leverage,” including that “crypto markets are reacting to uncertainty, not fundamentals.” Merchants worry that if tariffs intensify, liquidity throughout speculative markets might dry up, prompting extra defensive positioning.

Bitcoin’s Position in a Threat-Off Market

Whereas Bitcoin has lengthy been marketed as “digital gold,” Friday’s value motion painted a distinct image. The simultaneous surge in gold and drop in BTC means that traders nonetheless see Bitcoin as a high-risk asset, susceptible to macro shocks.

At press time, Bitcoin hovered round $118,800, down roughly 2% within the final 24 hours. Regardless of the pullback, some analysts view the correction as wholesome consolidation following an overheated rally, with leverage wipeouts and sentiment resets possible paving the best way for stabilization.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.