- Litecoin (LTC) surged 15% to $130, reclaiming a $10B market cap as ETF optimism fuels bullish momentum.

- Analysts see potential for a breakout above $140, focusing on $200 short-term and as much as $750 if a long-term sample confirms.

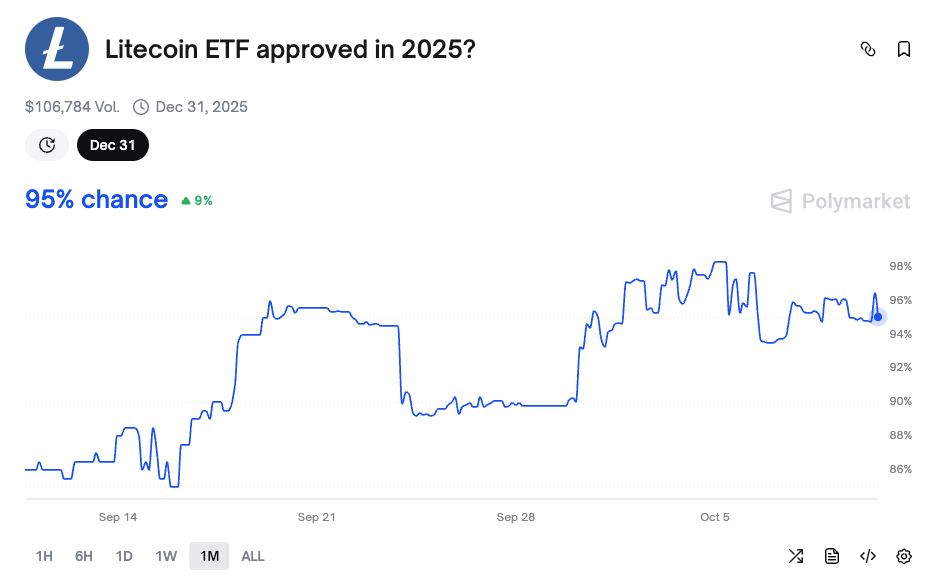

- ETF approval odds have soared to 95%, signaling rising confidence in institutional adoption for Litecoin.

Litecoin is quietly stealing the highlight once more. Whereas a lot of the crypto market takes a breather, LTC simply pulled off a 15% transfer to hit $130, sliding again into the highest 20 cash by market cap with a cool $10 billion valuation. The rally comes as speak of a possible Litecoin ETF approval grows louder, pushing investor optimism to ranges not seen in years.

In line with market information, Litecoin’s value has been grinding increased for almost two weeks now, and the chart’s beginning to present some severe promise. Merchants are eyeing that $135–$140 zone like hawks—it’s been a wall of resistance for months, but when it lastly breaks, there’s a transparent runway to $200 and past.

Bulls Eye $200 Quick-Time period, $750 Lengthy-Time period

Proper now, LTC’s value is holding just below key resistance, with momentum indicators flashing inexperienced. The shorter-term shifting averages have crossed above the long-term ones, a setup that often screams “bullish shift.” The RSI’s sitting at round 62—nonetheless beneath overbought territory—so there’s room for an additional leg up earlier than cooling off.

Crypto analyst Captain Faibik identified that Litecoin may really be breaking out from a seven-year symmetrical triangle sample. Yeah, seven years. If that’s true, the implications may very well be large. Analysts say a confirmed breakout might set off a multi-year rally that sends LTC to $750 and even increased in the long term. That may sound wild—however in crypto, stranger issues have occurred.

ETF Hype Sparks Recent Optimism

A giant a part of this momentum comes down to at least one factor: ETF fever. The Litecoin ETF deadline is correct across the nook, and optimism has gone via the roof. Main gamers like Grayscale, CoinShares, and Canary Capital have already filed or up to date their purposes with the SEC. Canary’s latest submitting updates have merchants satisfied that one thing’s brewing behind the scenes.

On Polymarket, the percentages for a Litecoin ETF approval have shot up from 66% in July to a staggering 95% at this time. That’s virtually a achieved deal in merchants’ eyes. If the SEC really provides the inexperienced gentle, it might open the floodgates for institutional cash to pour into Litecoin—just like what Bitcoin noticed when its ETFs launched earlier this yr.

What’s Subsequent for Litecoin?

From a technical view, the setup seems to be clear. If LTC can punch via the $140 resistance stage with robust quantity, a quick rally towards $200 seems to be probably. Past that, momentum might carry it even additional if the ETF hype turns into precise inflows.

Nonetheless, merchants are cautious. LTC’s been round lengthy sufficient to know that hype alone doesn’t maintain a rally ceaselessly. However with robust fundamentals, a possible ETF approval, and one of many longest consolidation patterns in crypto about to snap—Litecoin may simply be gearing up for its largest run in years.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.