Following a brand new all-time excessive (ATH) of $126,199 on Binance, Bitcoin (BTC) is now consolidating within the low $120,000 vary. Newest alternate knowledge – reminiscent of Cumulative Quantity Delta (CVD) Affirmation Rating – means that BTC is benefitting from robust underlying demand.

CVD Affirmation Reveals Robust Demand For Bitcoin

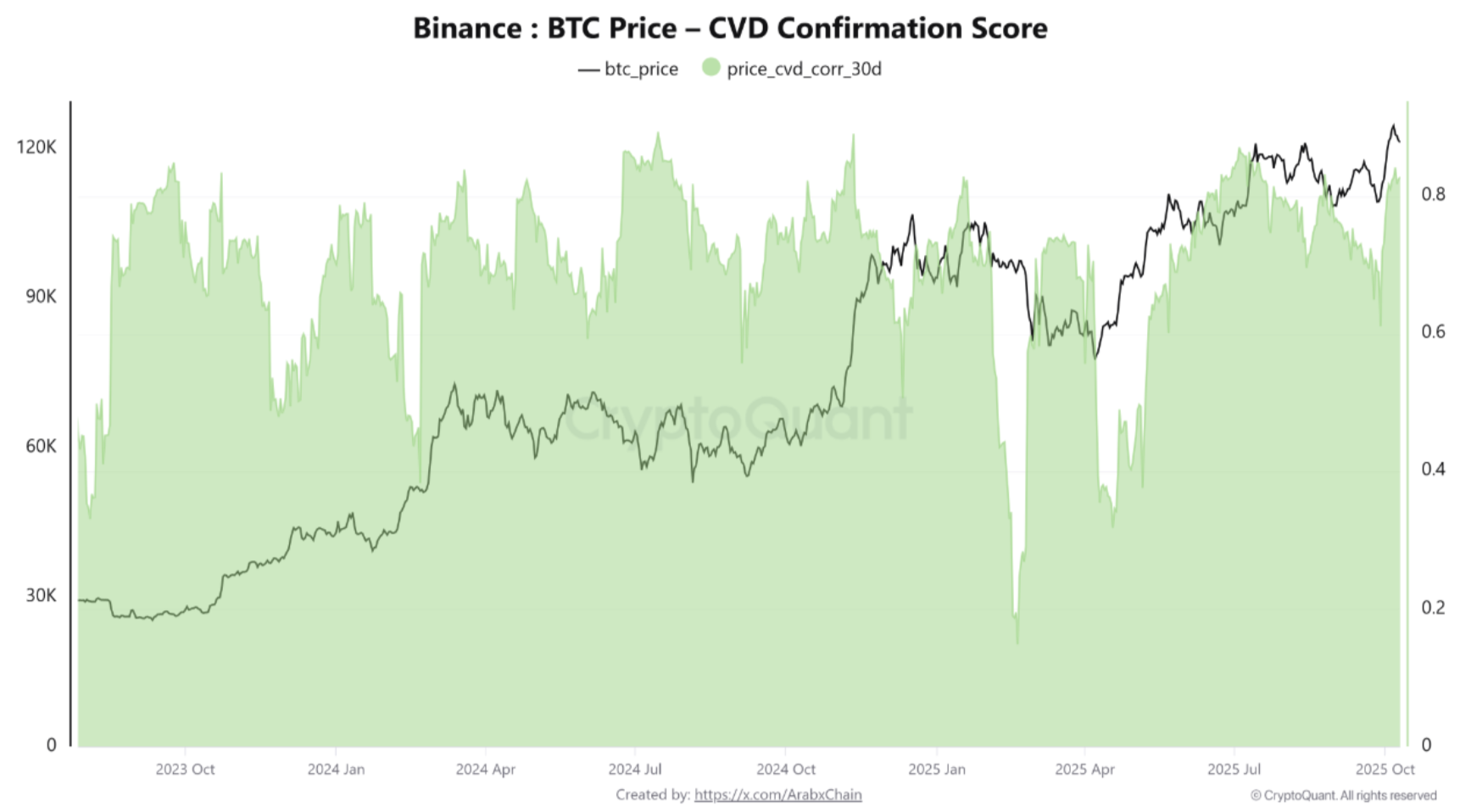

Based on a CryptoQuant Quicktake submit by contributor Arab Chain, Bitcoin’s CVD Affirmation Rating – a 30-day rolling correlation between Bitcoin’s worth and the CVD – is suggesting a robust resynchronization of the pattern.

Associated Studying

For the uninitiated, the CVD Affirmation Rating measures the 30-day correlation between Bitcoin’s worth and the CVD, which tracks the web distinction between taker purchase and promote volumes on exchanges. A excessive rating (above 0.7) signifies that worth will increase are backed by actual shopping for stress, whereas a low or adverse rating suggests weak or speculative momentum.

Newest knowledge from Binance exhibits that the CVD Affirmation Rating at present hovers round 0.8 to 0.9, indicating that the present worth surge is basically pushed by real taker shopping for reasonably than a technical bounce or a brief squeeze.

Previous knowledge additionally means that each time this knowledge level has remained about 0.7 for an prolonged interval, worth corrections are typically comparatively shallow and short-lived. It’s because new liquidity out there shortly absorbs any incoming provide of BTC.

The CryptoQuant analyst remarked that if the CVD Affirmation Rating continues to hover above 0.7 – coupled with a decisive breakout above the $124,000 – $126,000 resistance zone – then it might be on its option to a potential goal of as excessive as $135,000.

Nevertheless, any adverse divergence with BTC worth rising and CVD Affirmation Rating dropping under 0.4 must be seen as a warning signal, because it will increase the chance of distribution or liquidation stress.

Conversely, the $112,000 – $115,000 and $108,000 – $110,000 stand out as robust assist ranges for BTC. At these worth ranges, the CVD Affirmation Rating ought to stay regular to make sure the uptrend stays intact. Arab Chain added:

The underlying pattern is bullish and supported by actual inflows on Binance, the highest-volume alternate globally. Monitor three affirmation indicators: CVD Affirmation stays excessive, open curiosity stays average, and funding doesn’t grow to be extreme. Any clear imbalance throughout these metrics would be the first warning of a momentum shift.

Is BTC Due For A Correction?

Whereas bulls are hoping for an prolonged rally for BTC, some analysts aren’t fairly satisfied in regards to the digital asset surging to new highs within the close to time period. For example, crypto analyst ZVN lately said that BTC could witness a pullback earlier than its subsequent surge to $150,000.

Associated Studying

Equally, fellow crypto analyst Dick Dandy lately predicted that BTC could witness a large 60% worth correction, falling all the best way all the way down to $43,900. At press time, BTC trades at $118,791, down 1.8% previously 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com