A large wave of Bitcoin and Ethereum choices – value greater than $5 billion – is about to run out right this moment, setting the stage for heightened volatility throughout the crypto market.

Merchants are bracing for sharp value swings as each property method essential assist ranges that might decide their subsequent main transfer.

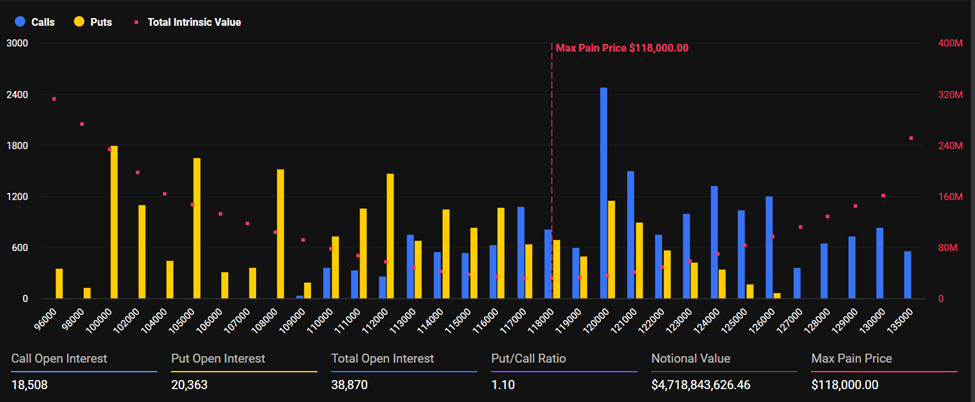

Knowledge from Deribit reveals that Bitcoin dominates the expiry occasion with roughly $4.7 billion in choices contracts coming due. The so-called max ache level, the place essentially the most choices expire nugatory, sits close to $118,000 – now seen as a key assist zone. Merchants seem evenly divided, with a heavy focus of $110,000 put choices and $120,000 calls, signaling a transparent standoff between bullish optimism and bearish warning.

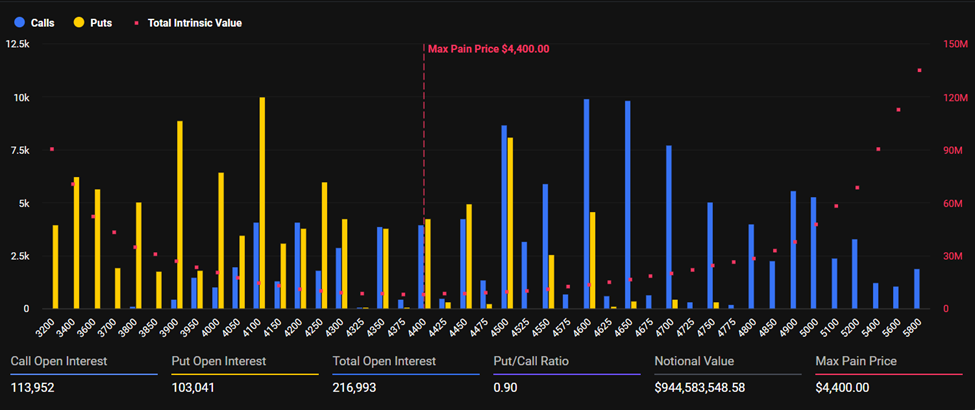

Ethereum’s setup seems considerably stronger. Round $944 million in ETH choices are expiring, with open curiosity nearing 217,000 contracts and a max ache degree of $4,400. The put-to-call ratio of 0.90 suggests a extra optimistic sentiment in comparison with Bitcoin’s 1.10, which leans towards draw back hedging.

Traditionally, massive expiries like this usually precede intervals of sharp volatility, as concentrated positions unwind and liquidity thins out.

Glassnode information reveals Bitcoin stays above its short-term holder value foundation – an indication of ongoing bullish energy but in addition a warning that the rally could possibly be overheating. Ethereum, however, continues to see rising participation from merchants, which might enlarge upcoming market shifts.

Each property are hovering close to their max ache zones: $118,000 for Bitcoin and $4,400 for Ethereum. If these ranges maintain, the market might stabilize and probably rebound as soon as the contracts expire. However a decisive break under them could set off a fast surge in volatility, particularly over the low-volume weekend.

Briefly, right this moment’s expiry marks a pivotal second for crypto markets: billions in open positions, merchants cut up between conviction and warning, and the potential for main value turbulence within the hours forward.