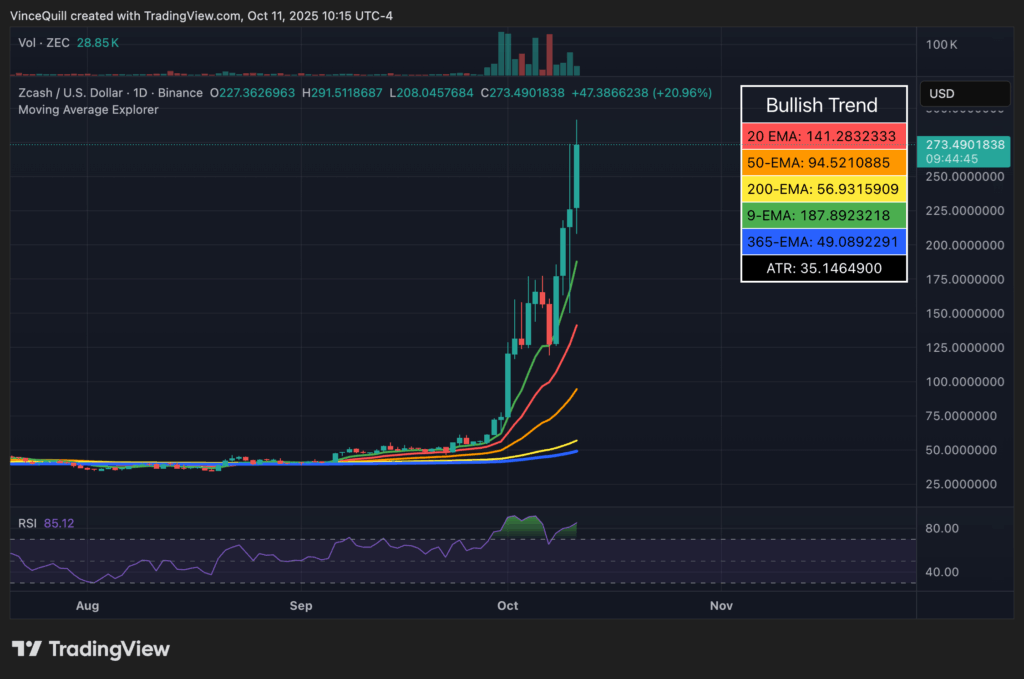

- Zcash plunged 45% after Trump’s tariff announcement however bounced again to $291 earlier than stabilizing close to $270.

- The crypto market noticed over $20 billion in liquidations, making it one of many worst single-day crashes in crypto historical past.

- Regardless of the chaos, ZEC turned one of many few cash to completely get well, showcasing sturdy resilience amid market turmoil.

Zcash’s restoration has been nothing in need of wild. After the crypto market nosedived on Friday, the privacy-focused coin, ZEC, pulled off a full comeback—touching $291 earlier than cooling down across the $270 vary. For a coin that was in freefall only a day earlier, that’s a critical flex.

From Collapse to Comeback

On Friday, Zcash plunged almost 45%, crashing from roughly $273 to $150 in a matter of hours. The trigger? A pair of fiery posts from U.S. President Donald Trump, saying a whopping 100% tariff on all Chinese language items. That single announcement despatched shockwaves by international markets, dragging your complete crypto house down with it.

However by Saturday, ZEC had clawed its manner again up. At one level, it hit a excessive of $291 earlier than barely retracing. As of now, it’s solely down about 5.5% from that native peak—fairly spectacular when in comparison with heavyweights like Ether, which remains to be sitting round 22% beneath its current all-time excessive of $4,957.

A Rocket Experience Earlier than the Fall

Earlier than all of the chaos, Zcash had already been on a tear. From simply $74 initially of October to just about $291 in below two weeks, it was one of many market’s most explosive rallies. Even after the crash, ZEC is holding its floor round pre-crash ranges, making it one of many few cash to get well this shortly. Most others are nonetheless limping alongside, ready for the following wave of inexperienced candles.

The broader crypto market, nonetheless, took a brutal hit. Friday’s meltdown became one of many largest liquidation occasions in crypto historical past—over $20 billion worn out in mere hours. Merchants throughout the board watched their positions vanish, some blaming Trump’s posts for “nuking” the charts.

When Tweets Transfer Markets

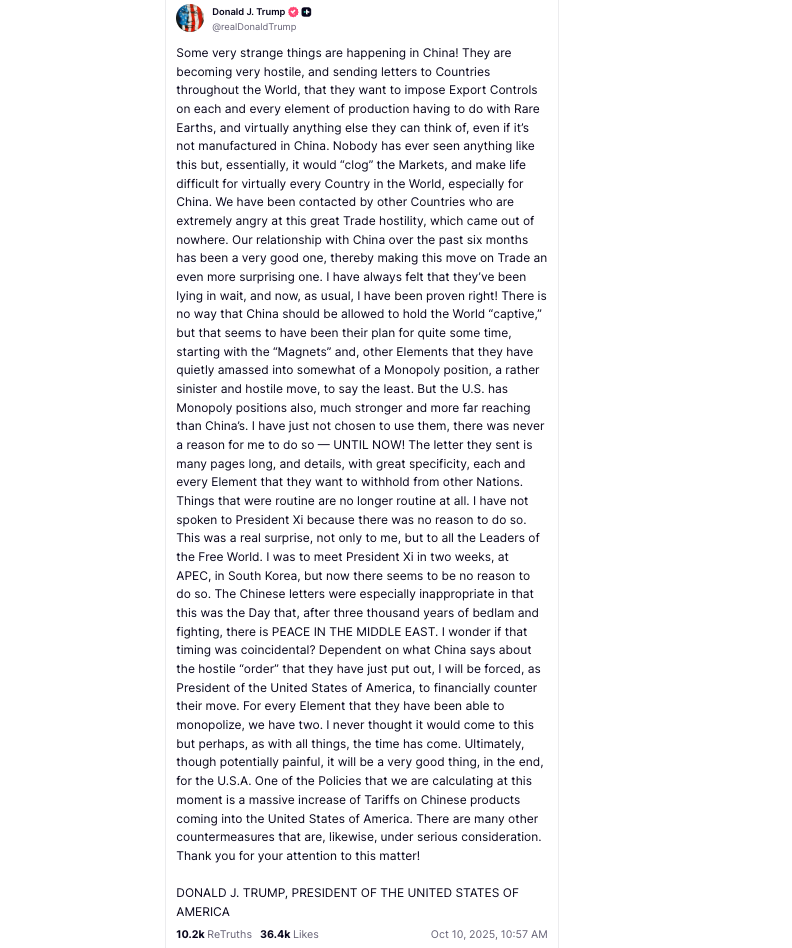

It’s wild how a lot energy two social media posts can have. In his first message, Trump blasted China’s new export limits on uncommon earth minerals—supplies important for batteries, semiconductors, and navy tech—calling them “hostile” and warning they’d “clog” international commerce. Over 90% of these minerals come from China, in line with Reuters, in order that message alone rattled buyers worldwide.

Just a few hours later, he adopted up with the true bombshell: a 100% tariff on all Chinese language imports, set to kick in by November 1, 2025. Inside minutes, shares and cryptos tanked throughout the board. By the tip of the day, billions have been gone, and chaos dominated the markets as soon as once more.

Nonetheless, in the midst of all that noise, Zcash stood out because the comeback child—rising from the ashes prefer it had one thing to show. Possibly that’s what makes privateness cash so attention-grabbing… they transfer in another way, typically even defiantly.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.