XRP is below renewed promoting stress after knowledge confirmed huge holders are transferring massive sums out of the market.

Based on CryptoQuant analyst Maartunn, on common whales have been internet transferring about $50 million per day away from XRP holdings. That move has coincided with renewed worth weak spot and sharper swings than seen in latest weeks.

Value Slips After Early October Rally

After pushing above $3.00 on October 3, XRP slid again sharply. Studies present the token fell beneath $2.50 roughly per week later.

Since that dip the very best print has been $2.83, whereas XRP is buying and selling close to $2.40 on the time of reporting. Value motion has been blended over completely different horizons — XRP is down about 20% over the past seven days however stays within the inexperienced on the 14-day chart.

JUST IN: $XRP whales are offloading

Whale Stream (30DMA): -$50M/day.

Promote stress persists. pic.twitter.com/Hcnys9vCCV

— Maartunn (@JA_Maartun) October 10, 2025

Whale Flows Turned Detrimental After Accumulation

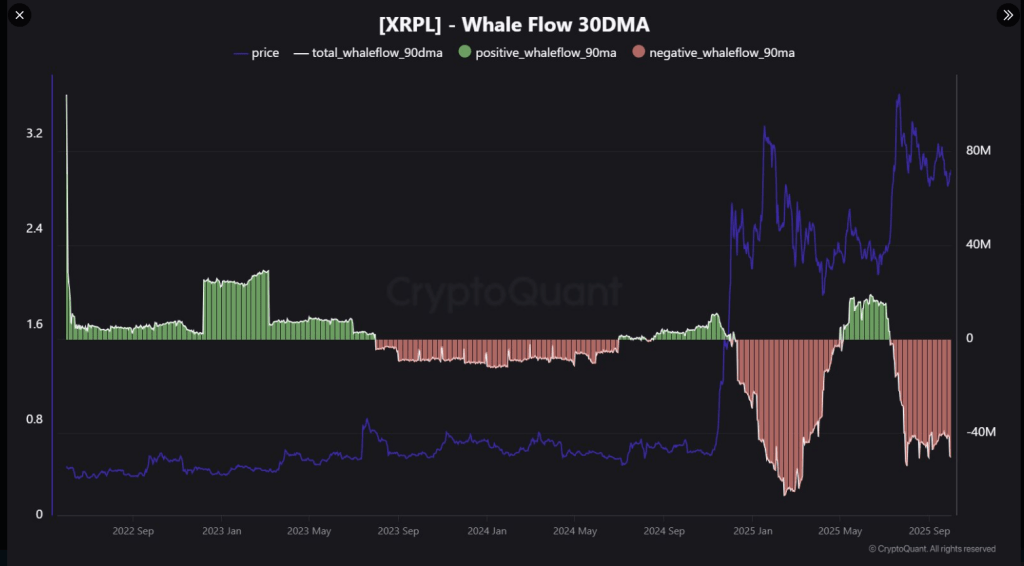

Based on on-chain knowledge shared by Maartunn, whale move measured on a 30-day transferring common swung from constructive to unfavorable throughout the previous 12 months.

Throughout 2022 and into early 2023, massive transfers recommended accumulation, a interval that tracked with relative worth calm. Mid-2023 by way of the primary three quarters of 2024 confirmed a transparent unfavorable development in whale move, and that sample returned in power after a later surge in inflows.

Studies have disclosed that essentially the most excessive unfavorable studying on the chart appeared throughout a worth spike in mid-January, when XRP reached as excessive as $3.4 on January 16, 2025, and enormous holders took income.

Accumulation On Dips, Revenue-Taking On Rallies

The on-chain image shouldn’t be uniform. There was a quick window of accumulation in April when XRP slid towards the $2 assist stage. That purchasing continued into late June because the token recovered above $2.

Following that restoration, promoting stress resumed as holders locked in beneficial properties. The present 30DMA studying sits close to unfavorable $50 million per day, a sustained internet outflow that alerts distribution by some huge accounts.

If we shut over $3.1150 by Sunday, it’ll be essentially the most bullish $XRP weekly candle in historical past.

— Patrick L Riley (@Acquired_Savant) October 10, 2025

Market Response And Potential Paths

What this implies for worth shouldn’t be set in stone. Continued heavy promoting into skinny bids may push XRP decrease towards close by helps round $2.20 to $2.50. However, if patrons step in and soak up the outflows, XRP may commerce sideways with sharp intraday swings.

Based mostly on stories, veteran investor Patrick L. Riley added a conditional bullish notice: a weekly shut at $3.11 would produce a really robust weekly candle and will appeal to recent demand. That situation would require significant shopping for to beat present promoting by massive holders.

Featured picture from Meta, chart from TradingView