Be a part of Our Telegram channel to remain updated on breaking information protection

Crypto ETPs (exchange-traded merchandise) recorded $3.17 billion inflows final week regardless of the broader market crash, and likewise notched their highest-ever buying and selling volumes.

In its newest weekly report, CoinShares stated that the recent China tariff threats from US President Donald Trump final week had little or no influence on crypto ETPs, with the event solely resulting in “a paltry $159 million outflows.”

That was even because the crypto market suffered $20 billion liquidations on Friday.

The report comes after CoinShares head of analysis James Butterfill famous in an Oct. 9 X put up that year-to-date (YTD) flows into crypto funds have already surpassed final yr’s whole.

We’ve got simply seen world digital asset fund flows surpass final yr’s whole inflows with US$48.67bn year-to-date. Inflows into altcoins appear to be confined to SOL and XRP at current. pic.twitter.com/FvGC9ZkDjr

— James Butterfill (@jbutterfill) October 9, 2025

Buying and selling Volumes For Crypto ETPs Hits New Report

Along with the robust inflows, weekly volumes for crypto ETPs additionally soared to $53 billion final week. This, in accordance with CoinShares, was double the 2025 weekly common.

On Friday alone, volumes reached $15.3 billion, which the agency stated is the biggest quantity of exercise on report.

Nonetheless, the overall property below administration for crypto ETPs fell by 7% from the height of $242 billion that was not too long ago reached.

Bitcoin Inflows Led The Cost, However Are Nonetheless Down From The 2024 Complete

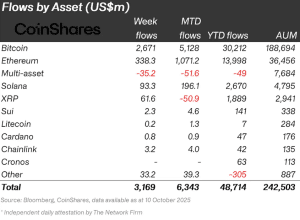

Bitcoin merchandise recorded the very best inflows final week, with traders including $2.67 billion to the funding merchandise, in accordance with CoinShares. This introduced YTD inflows for BTC funds to $30.2 billion. Nonetheless, the quantity remains to be decrease than the $41.7 billion seen in 2024.

Flows by asset (Supply: CoinShares)

In the meantime, volumes for Bitcoin ETPs soared to a report excessive of $10.4 billion for the day on Friday. Nonetheless, the merchandise’ collective flows solely got here in at $0.39 million.

Close to altcoins, the biggest of those tokens when it comes to market cap, Ethereum (ETH), noticed continued inflows of $338 million final week, but additionally noticed $172 million outflows. These adverse flows have been the biggest recorded by any digital asset on the day, which CoinShares stated alerts “traders noticed it as being essentially the most susceptible” within the latest correction.

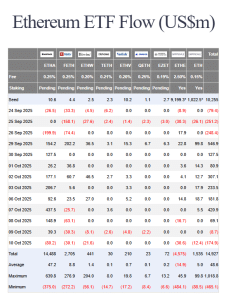

Information from Farside Traders reveals traders pulled $174.9 million from US spot ETH ETFs (exchange-traded funds) on Friday. The vast majority of these outflows have been posted by BlackRock’s ETHA.

US spot ETH ETF flows (Supply: Farside Traders)

Grayscale’s ETHE noticed the next-biggest outflows on the day, with $30.6 million leaving its reserves. Following intently was Constancy’s FETH, which skilled $30.1 million outflows. Bitwise’s ETHW and Grayscale’s ETH merchandise noticed $21.6 million and $30.6 million outflows, respectively. The remaining funds recorded no new flows on Friday.

The hype round upcoming US Solana (SOL) and XRP ETF launches appears to have cooled, as flows for merchandise tied to those cryptos slowed. SOL ETPs noticed $93.3 million inflows final week, whereas XRP ETPs noticed $61.6 million throughout the identical interval, CoinShares stated in its report.

Spot Crypto ETF “Floodgates” Will Open As soon as US Authorities Shutdown Ends

The CoinShares report comes because the US Authorities shutdown enters its third week. If no decision is reached quickly, it might delay the choice on no less than 16 crypto ETFs.

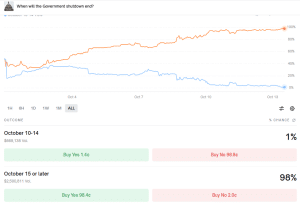

Customers of the decentralized predictions market platform Polymarket imagine that the shutdown will proceed till Oct. 15, probably even later.

Contract asking when authorities shutdown will finish (Supply: Polymarket)

A contract asking when the US authorities shutdown will finish has 98% odds on that point line. In the meantime, there are only one% odds that the shutdown will finish by tomorrow, Oct. 14.

In keeping with NovaDius Wealth President Nate Geraci, the tip of the federal government shutdown will trigger the “spot crypto ETF floodgates” to open.

As soon as authorities shutdown ends, spot crypto ETF floodgates open…

Ironic that rising fiscal debt & standard political theater holding these up.

Precisely what crypto is focusing on.

— Nate Geraci (@NateGeraci) October 13, 2025

“Ironic that rising fiscal debt & standard political theater holding these up,” he wrote.

“Precisely what crypto is focusing on,” Geraci added.

His prediction is just like one made earlier by Bitfinex analysts, who stated the potential approvals of spot altcoin ETFs might result in a rally for the smaller tokens. The analysts argued that if these funding merchandise obtain the greenlight, they are going to provide a approach to achieve publicity to altcoins with much less threat and extra regulation, which they are saying might entice extra traders.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection