Key Takeaways

Why are extra establishments getting into the crypto area in 2025?

The approval of ETFs and rising returns on crypto treasury holdings have made digital belongings extra engaging to conventional finance gamers.

Which cryptocurrencies are main institutional treasury adoption?

Bitcoin, Ethereum, and Solana are the highest decisions, with establishments collectively holding billions in every asset.

In 2025, institutional curiosity in crypto belongings has reached unprecedented ranges, difficult long-held views in regards to the sector. This shift has led establishments to enter the market by autos like ETFs and crypto-focused treasury firms.

In consequence, extra companies are elevating important capital to accumulate cryptocurrencies as a part of their treasury reserves.

Amid this frenzy, Treasury Corporations related to Bitcoin [BTC], Ethereum [ETH], and Solana [SOL] have gained reputation.

Bitcoin treasury firms

5 years in the past, the thought of firms holding Bitcoin was extensively dismissed, as BTC was seen as too risky and speculative.

However in September and October 2020, the panorama started to shift, sparked by a daring transfer from MicroStrategy, which invested $425 million into Bitcoin, marking a turning level in institutional adoption.

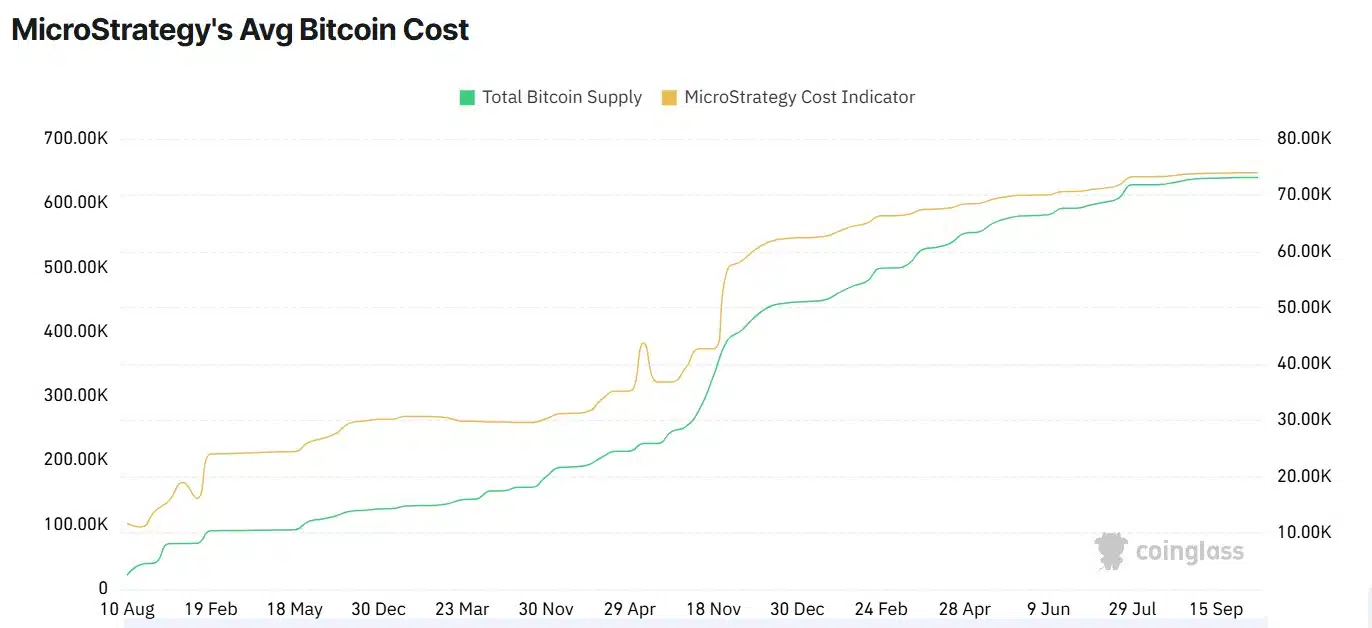

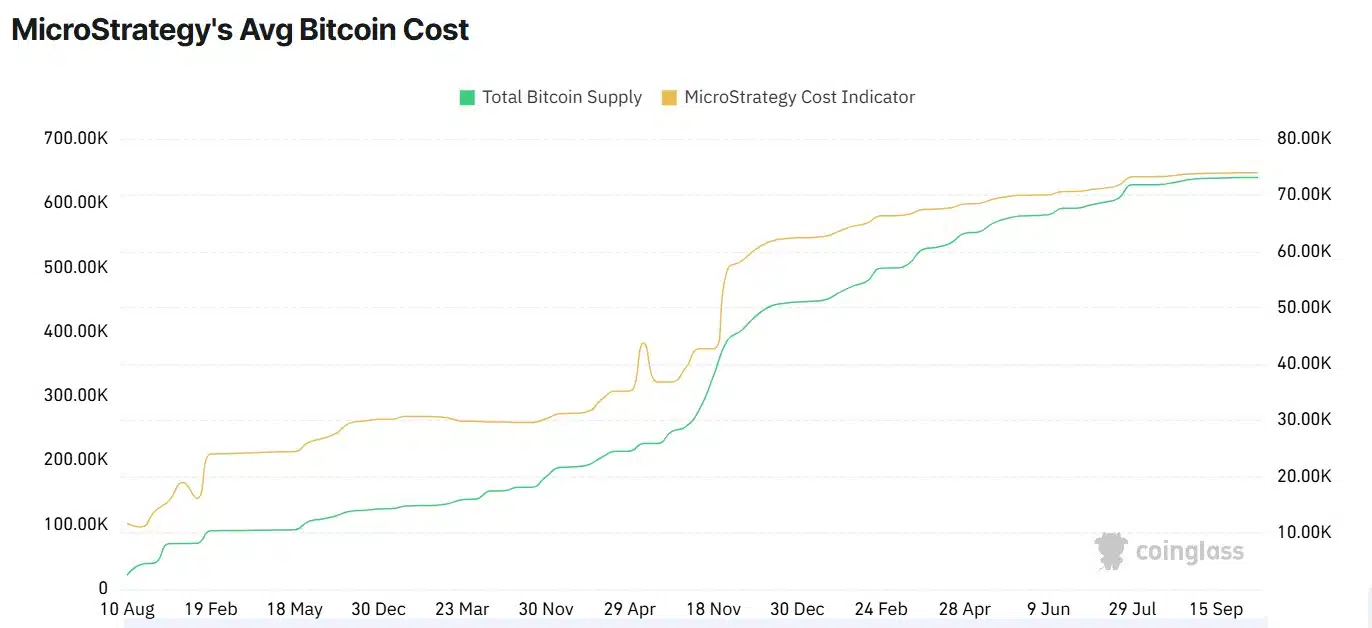

Supply: CoinGlass

Since then, Technique (previously MicroStrategy) beneath Michael Saylor has bought 640,250 BTC, acquired for $47.3 billion, which is value $73.7 billion. This marks the biggest publicly traded firm holding Bitcoin as a treasury asset.

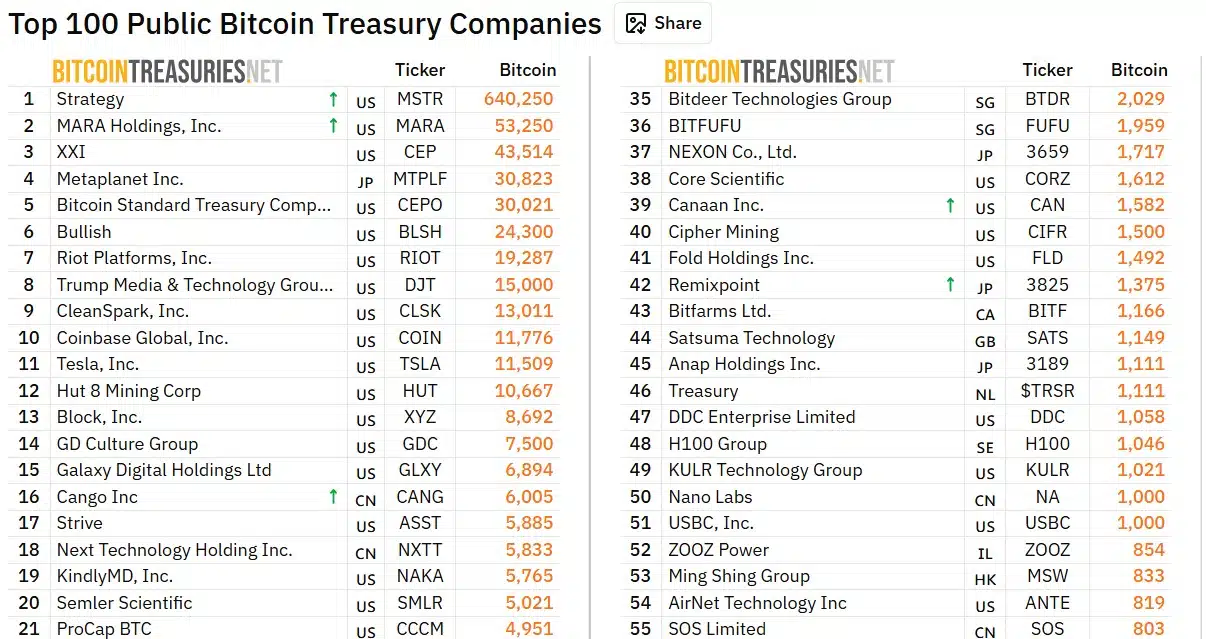

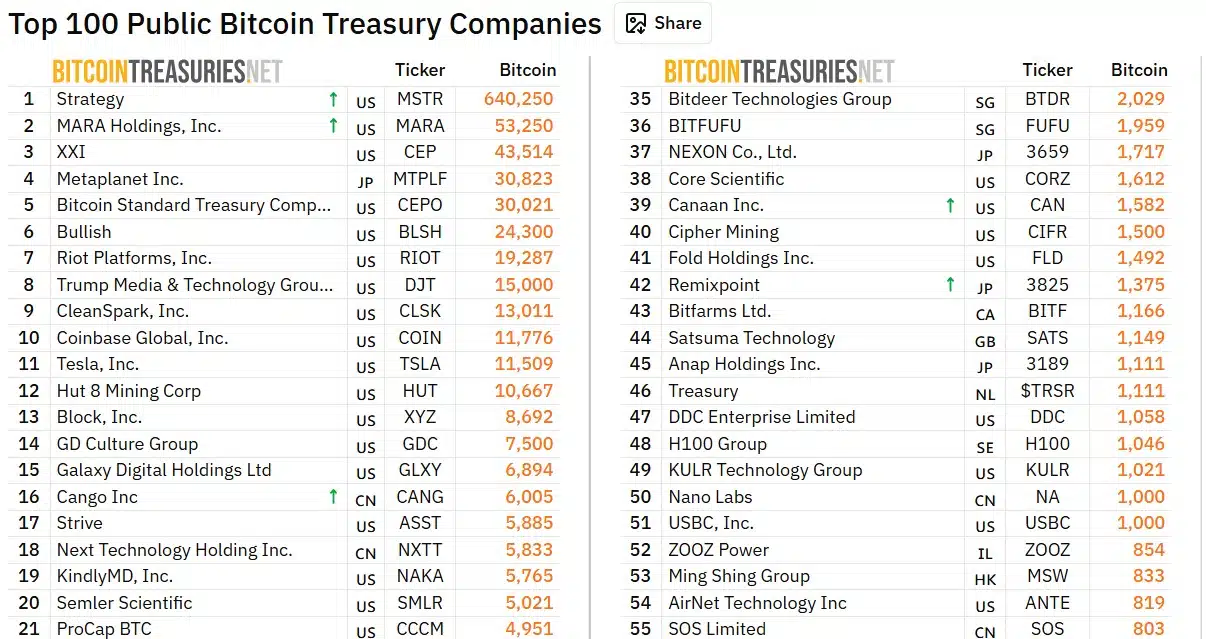

When it comes to holdings, Technique is intently adopted by Mara Holdings [MARA], which holds 53.2k BTC value $5.9 billion. In third place is CEP U.S., which holds 43.5k BTC, value roughly $4.8 billion.

Supply: Bitcoin Treasuries Internet

Japanese agency Meteplanet ranks fourth, holding 30.8k BTC valued at $3.4 billion, adopted intently by CEPO US with 30k BTC value $3.3 billion.

In whole, in accordance with Coingecko, 122 establishments collectively maintain 1,521,638 BTC, valued at $171 billion, accounting for 7.25% of Bitcoin’s whole provide.

5 years in the past, such institutional involvement in Bitcoin would have appeared unbelievable, underscoring how drastically the panorama has advanced.

Ethereum treasury firms

Treasury firms are now not targeted solely on Bitcoin; altcoins are gaining traction quickly. For the reason that approval of ETH ETFs in July 2024, the variety of firms accumulating Ethereum has surged.

By 2025, company ETH holdings may have reached an all-time excessive, with 4.7 million ETH held, in accordance with Blockworks.

Supply: Blockworks

Pushed by rising demand for Ethereum, Bitmine Immersion leads all Treasury Corporations with 3.03 million ETH valued at $12.1 billion, representing 2.5% of the overall ETH provide.

The corporate has aggressively collected 962.7k ETH up to now 30 days alone.

SharpLink Gaming ranks second with 838.7k ETH value $3 billion. In third place, Large Digital (BTBT) holds 150.2k ETH valued at $602.8 million, adopted intently by Coinbase, which owns 136.7k ETH value $548.8 million.

Supply: Blockworks

In whole, fourteen treasury firms are holding ETH value $17.8 billion, representing 3.67% of the altcoin’s provide.

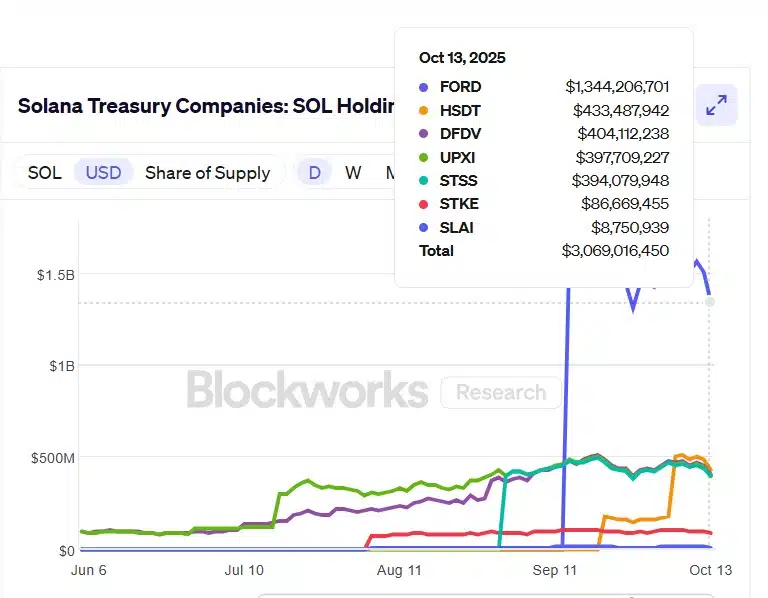

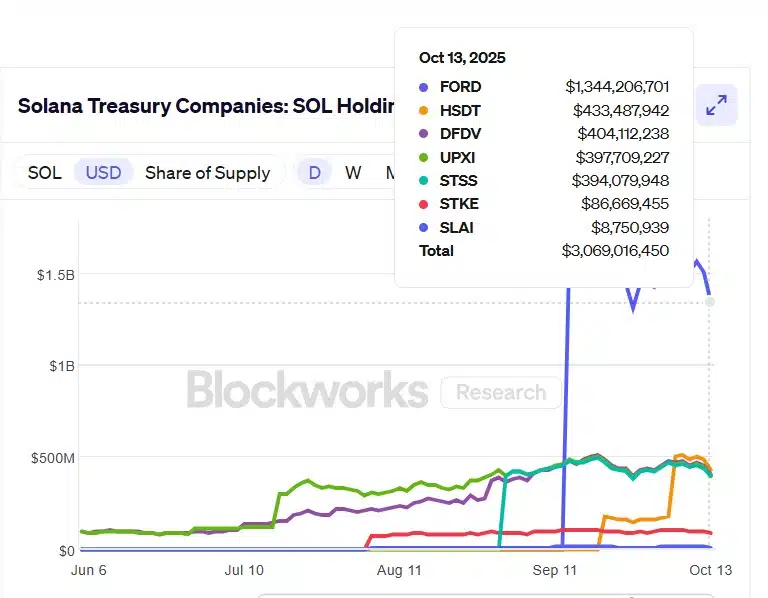

Solana treasury firms

Solana treasury firms have not too long ago entered the highlight, following the trail established by Ethereum and Bitcoin.

Over the previous month, companies led by Ahead Industries have aggressively collected greater than 6 million SOL.

Ahead Treasuries alone acquired 6.8 million SOL for $1.5 billion, although the holdings have since declined to $1.3 billion in worth as a result of current market crash, leading to a lack of over $200 million.

Supply: Blockworks

In second place is Solana Firm HSDT, holding 2.2 million SOL value $433 million as per Blockworks.

Thirdly, DeFi Growth Corp holds 2.09 million SOL, bought at $226.9 million, and is now value $410.7 million.

At fourth place is Upexi, which holds 2.08 million SOL value $395 million, adopted by Sharps Applied sciences with 2 million SOL value $391 million.

Supply: Coingecko

In whole, 9 Treasury Corporations are holding 13,441,405 SOL value $2.63 billion, representing 2.46% of the overall provide.

Are crypto treasury firms the important thing to the long run?

Undoubtedly, the crypto area has modified considerably, maturing sufficient to mingle and join with the normal finance ecosystem.

Due to this fact, TradFi has all of the incentives to enterprise into the crypto area and bridge the present hole. Actually, the Whole Asset Worth of Corporations’ crypto holdings has surged and peaked at $117 billion in October 2025.

Supply: Blockworks

This progress displays the rising worth of belongings relative to the crypto belongings held. This encourages extra companies to enterprise as their returns are more and more engaging.

Any more, extra firms might enterprise into crypto holding, impressed by the trade’s maturity and rising returns on funding.

In flip, this may increase these crypto belongings, together with BTC, ETH, and SOL, resulting in higher value appreciation and stability.