- Bitcoin dropped 2.6% to $111,773, seen as a wholesome post-rally correction.

- Solana held regular above $197, sustaining a bullish trendline and robust construction.

- Analysts anticipate BTC to rebound towards $130K and SOL to check $240–$250 if momentum continues.

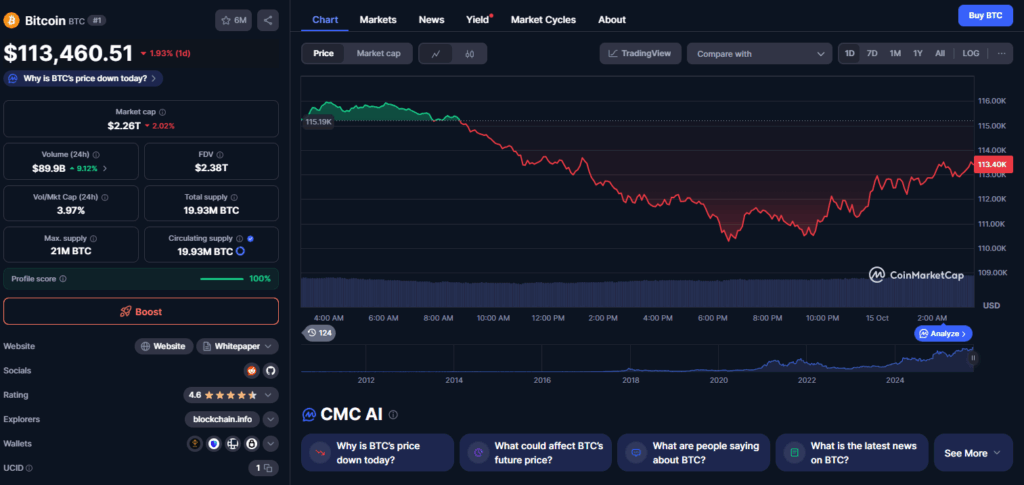

The crypto market noticed a divergence on Tuesday as Bitcoin (BTC) cooled off from its latest highs whereas Solana (SOL) continued to point out energy. In line with CoinMarketCap, Bitcoin slipped 2.6% to $111,773, whereas Solana climbed 1.36% to $197, signaling that merchants could also be rotating capital into high-performing altcoins. Regardless of Bitcoin’s pullback, analysts say the transfer displays a wholesome correction slightly than the beginning of a deeper downturn.

Bitcoin’s Correction Seen as a Market Reset

Bitcoin’s latest dip adopted an early-week surge that briefly examined the $126,000 stage earlier than heavy promoting stress set in. The correction, which pushed BTC beneath $112,000, seems pushed by profit-taking and the unwinding of leveraged positions. Knowledge from Glassnode exhibits that many merchants collected Bitcoin within the $117,000–$119,000 vary, suggesting that patrons are stepping in on the dip.

Market analysts, together with Stockmoney Lizards and Ted Pillows, notice that such retracements are widespread after sturdy rallies. Futures knowledge reveals a $4.1 billion decline in open curiosity, usually a precursor to extra steady value motion. If Bitcoin holds above $118,000, analysts anticipate a rebound towards the $125,000–$130,000 zone. On-chain indicators present investor sentiment stays regular, reinforcing the concept this can be a cooldown section earlier than the following advance.

Solana’s Bullish Construction Holds Agency

Whereas Bitcoin corrected, Solana maintained resilience, buying and selling close to $197 with a transparent bullish construction on larger timeframes. Analyst Batman highlighted a bullish Truthful Worth Hole (FVG) across the $210 space, which may act as a powerful accumulation zone earlier than Solana’s subsequent leg larger. The chart exhibits a constant upward trendline that has held since early August, suggesting agency structural help.

Batman famous that Solana may “dip barely deeper into its FVG” earlier than persevering with upward — a transfer that will supply strategic entry factors for merchants. If momentum persists, SOL may rally towards $240–$250, aligning with prior resistance ranges. Growing buying and selling quantity and robust on-chain exercise additional underscore Solana’s place as some of the technically sound altcoins within the present market.

Outlook: Divergence May Sign Rotation Into Altcoins

Bitcoin’s short-term weak spot contrasts sharply with Solana’s regular climb, reflecting a doable capital rotation inside the crypto market. Analysts imagine this divergence might proceed as merchants rebalance positions following weeks of volatility. Bitcoin’s consolidation section may lay the groundwork for its subsequent breakout, whereas Solana’s relative energy highlights rising investor confidence in its ecosystem.

For now, merchants are watching Bitcoin’s $118,000 help and Solana’s $197–$210 zone as key resolution ranges. If each property maintain agency, the broader crypto market may quickly regain its bullish footing heading into late October.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.