Bitcoin is testing a essential help stage close to $110,000 after being rejected from the $116,000 provide zone, a stage that has now grow to be a serious level of rivalry between bulls and bears. The market stays fragile following the historic volatility from Friday’s crash, which erased billions in leveraged positions and triggered widespread uncertainty.

Associated Studying

Whereas the worth has managed to stabilize above key shifting averages for now, momentum seems to be weakening as consumers wrestle to soak up continued promoting strain. Some analysts warn that if Bitcoin fails to carry this zone, a deeper correction towards the $105,000–$107,000 area may comply with, marking one other shakeout earlier than a possible restoration.

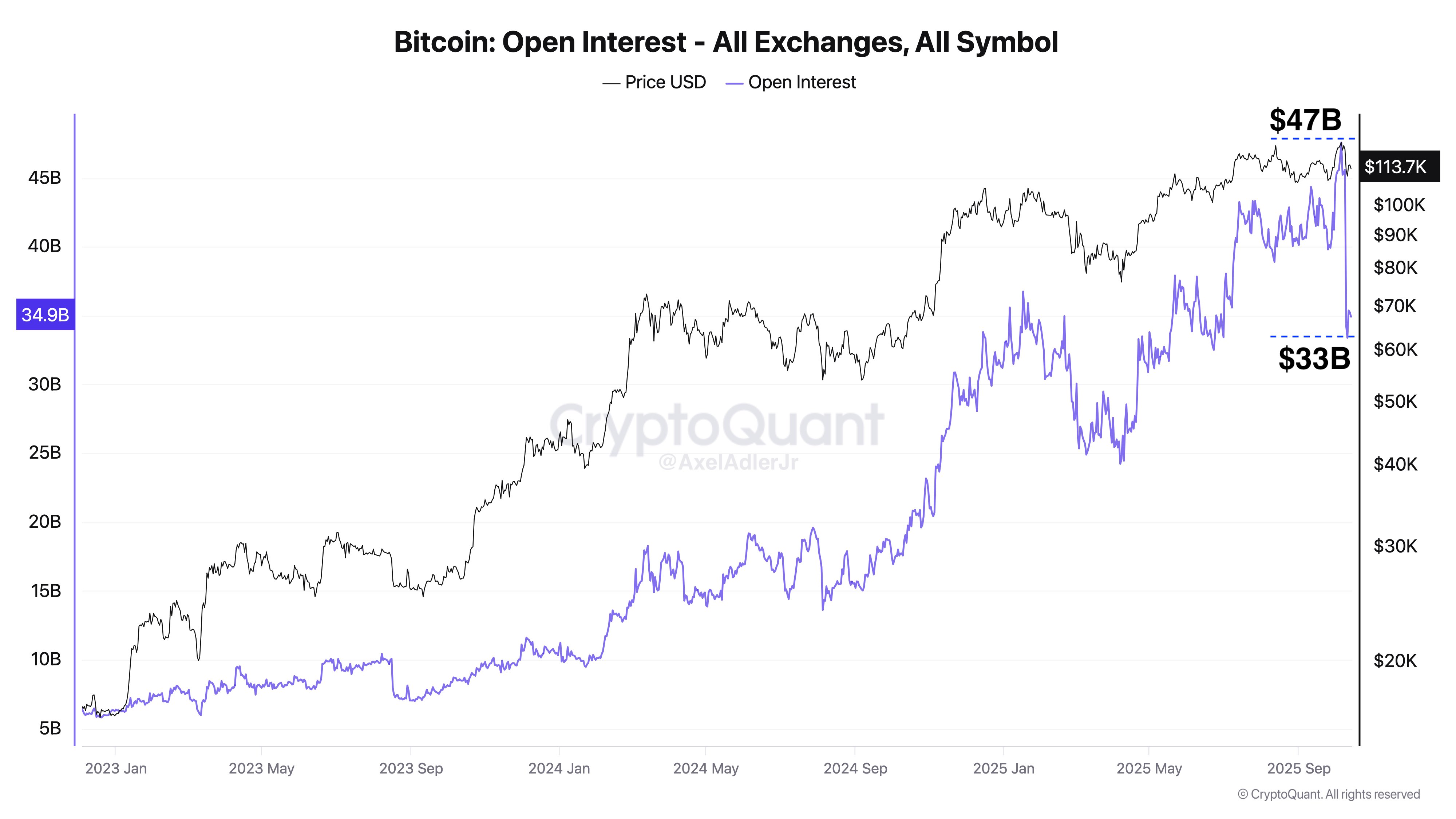

Prime analyst Axel Adler shared new information shedding gentle on the magnitude of Friday’s occasion. In line with his evaluation, spot buying and selling quantity surged to $44 billion, nearing cycle highs, whereas futures quantity hit $128 billion. Extra notably, open curiosity declined by $14 billion, but solely $1 billion of that was from BTC lengthy liquidations. Adler explains this was a managed deleveraging occasion, not a liquidation cascade — suggesting that market members decreased danger manually somewhat than being pressured out. Nonetheless, volatility stays elevated as Bitcoin fights to keep up structural help.

A Managed Reset Amid Rising Worry

In line with Axel Adler, the latest market crash revealed an necessary but underappreciated side of Bitcoin’s maturity. Information reveals that 93% of the $14 billion decline in open curiosity (OI) throughout Friday’s sell-off wasn’t pressured — which means it wasn’t the results of automated liquidations. As an alternative, merchants and establishments selected to scale back leverage manually, closing positions to guard capital. Adler describes this as a “managed deleveraging”, a stark distinction to earlier cycles the place comparable crashes typically triggered chaotic cascades of liquidations.

This habits marks a turning level in Bitcoin’s market construction. It signifies that members — particularly institutional gamers — are managing danger extra prudently, reinforcing a extra steady and mature buying and selling setting. In previous cycles, sharp liquidations typically prompted excessive volatility, magnifying losses throughout the board. This time, nonetheless, the market dealt with unprecedented stress with relative self-discipline.

Nonetheless, regardless of this signal of structural maturity, the emotional panorama has shifted dramatically. As Bitcoin loses worth and hovers close to the $110,000–$112,000 help zone, concern is spreading throughout the market. Many short-term merchants are exiting positions, whereas long-term holders are reassessing publicity amid rising uncertainty. Adler notes that this part — the place concern peaks and confidence wanes — typically defines the subsequent market course.

If demand returns at these ranges, Bitcoin may affirm a wholesome reset earlier than the subsequent rally. However failure to carry help could take a look at buyers’ conviction, doubtlessly pushing BTC right into a deeper corrective part earlier than broader accumulation resumes.

Associated Studying

Bitcoin Holds Key Help, However Momentum Weakens

Bitcoin is presently buying and selling round $110,300, sitting immediately on a key help zone after one other spherical of promoting strain hit the market. The 4-hour chart reveals BTC struggling to keep up upward momentum after failing to interrupt above the $116,000–$117,500 resistance vary, a stage that beforehand acted as robust demand throughout earlier rallies.

The rejection from this space triggered a pointy pullback, pushing BTC beneath each the 50 EMA (blue line) and the 200 EMA (crimson line) — an indication of weakening short-term construction. The worth is now testing horizontal help round $110,000, which aligns with the late September consolidation vary. A clear breakdown beneath this stage may expose Bitcoin to additional draw back, with the subsequent potential help round $106,000–$107,000.

Associated Studying

Regardless of the bearish tone, oversold indicators are starting to seem on decrease timeframes, suggesting {that a} short-term rebound is feasible if bulls defend this zone efficiently. For a sustainable restoration, Bitcoin should reclaim $114,000 and re-establish itself above the short-term shifting averages. Till then, the market stays in a fragile equilibrium — with bulls defending key help and bears sustaining management of short-term momentum. The subsequent few periods will likely be decisive for BTC’s course.

Featured picture from ChatGPT, chart from TradingView.com