- ETH drops 8% to $3,940, triggering $115M in lengthy liquidations.

- Analysts anticipate help at $3,800, adopted by a possible rally towards $10,000.

- Weekly bull flag sample nonetheless factors to main upside as soon as resistance breaks.

Ethereum (ETH) took successful Tuesday, falling 8% from highs above $4,300 to round $3,940, sparking greater than $115 million in lengthy liquidations. Nonetheless, sentiment amongst merchants stays strikingly bullish, with many calling the dip a “reset earlier than the run.” A number of analysts at the moment are eyeing an enormous breakout towards $10,000, offered ETH holds key help at $3,800.

Liquidations Shake Out Leverage, However Consumers Wait Beneath

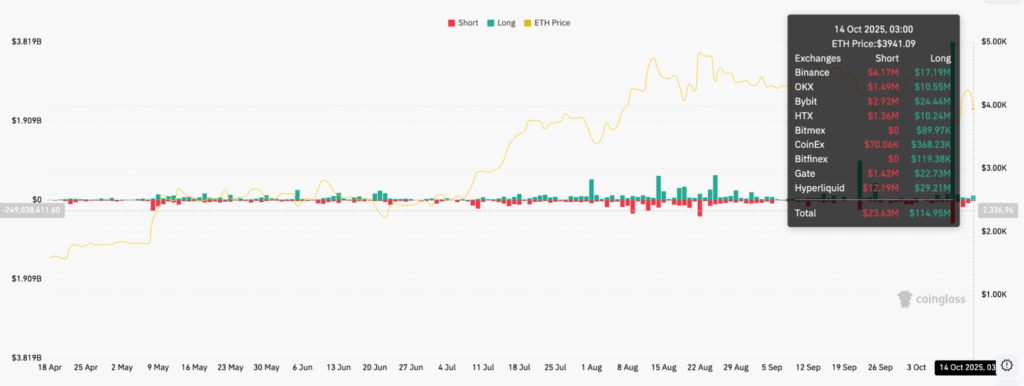

Knowledge from CoinGlass exhibits over $650 million in complete crypto liquidations over the previous 24 hours — $455 million from lengthy positions. ETH alone accounted for $114.5 million of that. The most important single liquidation order got here from OKX, price $5.5 million.

Apparently, order books reveal that purchaser curiosity clusters between $3,670 and $3,800, suggesting robust accumulation zones beneath present ranges. Analysts imagine this band might act because the “flooring” earlier than Ether gears up for its subsequent leg greater.

Analysts Say ETH Is “Loading” for a New All-Time Excessive

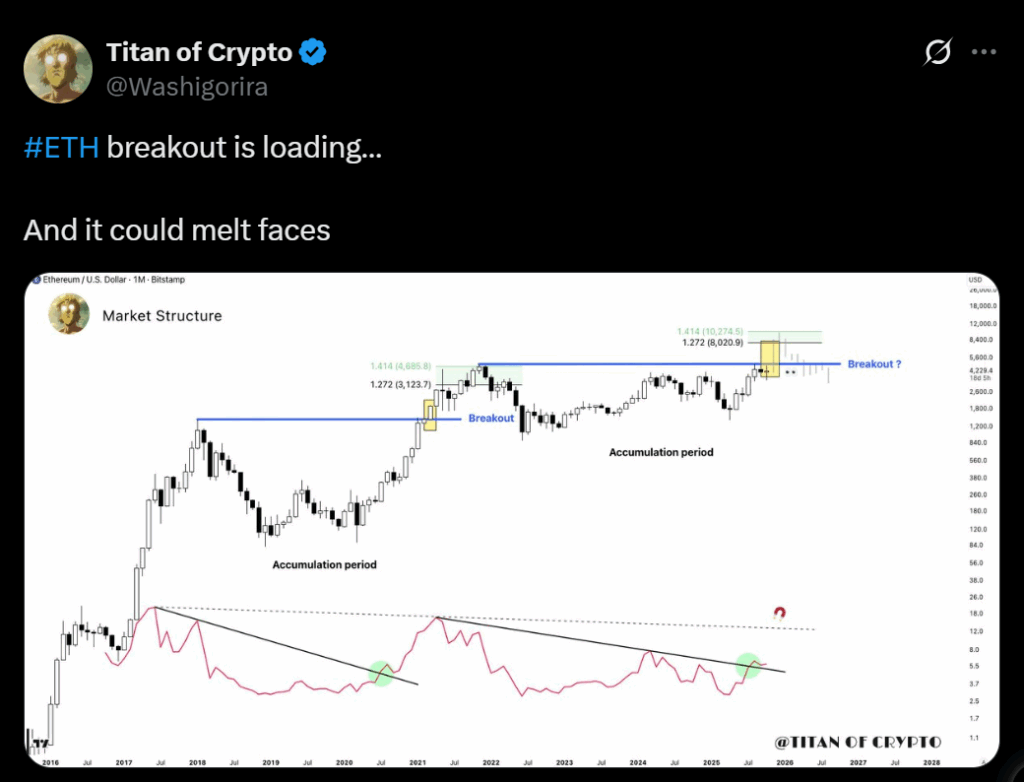

Market strategists like Michael van de Poppe and Titan of Crypto say ETH’s drop is a basic pullback inside a broader uptrend. Van de Poppe highlighted ETH/BTC’s bounce from 0.032 as a “good purchase zone,” whereas Titan of Crypto famous that ETH’s RSI has damaged out of a multi-year downtrend, a technical signal of long-term energy.

If historical past rhymes, ETH might be following a 2020-style fractal, which tasks a transfer between $8,000 and $10,300 primarily based on Fibonacci ranges. The continuing consolidation, they argue, is “merely reloading momentum” earlier than the subsequent massive rally.

The Technical Image: Bull Flag in Play

From a technical standpoint, ETH stays inside a bull flag on the weekly chart — a sample that usually resolves in one other main transfer upward. The decrease boundary of the flag sits close to $3,870, appearing as present help. A breakout above $4,440 would validate the sample and set a measured goal of $10,050, roughly 164% greater than present costs.

That mentioned, if ETH loses $3,800, it might slide to $3,500 as short-term merchants take earnings. Nonetheless, the broader setup stays bullish, with most analysts agreeing that Ethereum’s subsequent leg — when it comes — might be its most explosive but.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.