Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin value slid 3% prior to now 24 hours to commerce at $111,910 as of three:51 a.m. EST on buying and selling quantity that plunged 23% to $73.3 billion.

This comes as a whale investor, who earned near $200 million by shorting Bitcoin and Ethereum simply earlier than Donald Trump’s tariff announcement in opposition to China on October 10, doubled down on one other brief in opposition to BTC with 10x leverage

Information from Hypurrscan reveals {that a} the whale dealer and doable ”Trump insider’ with the tackle “0xb317” on the decentralized derivatives trade Hyperliquid deposited $40 million in USDC.

Shortly after that, the whale constructed a 10X brief place in Bitcoin valued at round $340 million.

Based mostly on the account’s entry value of $116,009, it has already amassed greater than $700,000 in unrealized earnings.

BREAKING: TRUMP INSIDER WHALE IS NOW SHORT $340M $BTC

The HyperUnit Bear Whale who shorted $700M of $BTC and $350M of $ETH proper earlier than Friday’s market crash (making ~$200M complete) simply deposited $40M USDC to HL and shorted one other $127M $BTC.

He’s now brief $300M $BTC and has… pic.twitter.com/b2rpzmkofZ

— Arkham (@arkham) October 13, 2025

After some analysts prompt that the account belongs to former BitForex CEO Garret Jin, he confirmed that he’s linked to it, however stated that the account is his “purchasers’ fund,” not his private account.

Will the whale’s prediction show proper once more or can the worth maintain assist to get well?

Bitcoin Value Indicators Sign A Continued Bearish Transfer

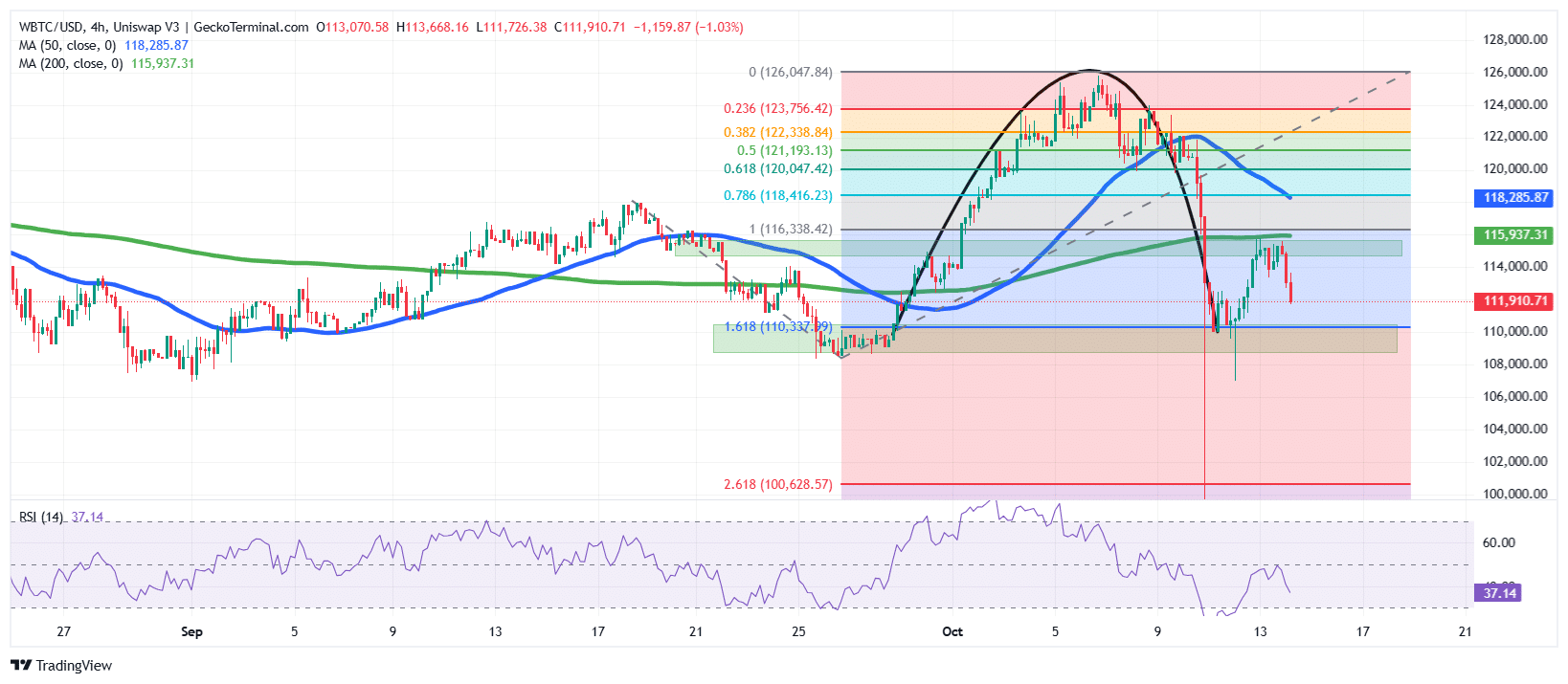

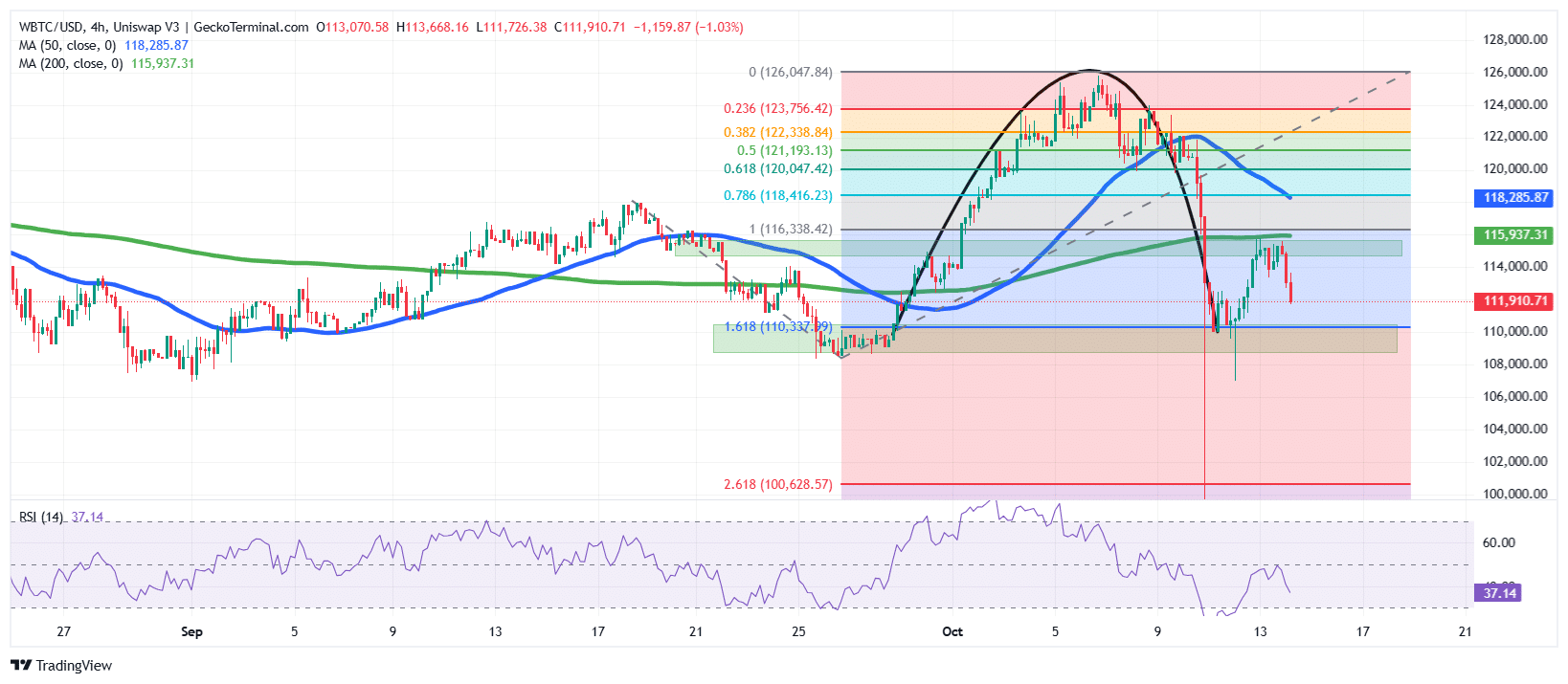

After a sustained drop from the $118,000 resistance to the $108,600 assist in September, the BTC value recovered effectively by the tip of the month.

This allowed the Bitcoin value to the touch the all-time excessive (ATH) at $126,080 on October 6. Nonetheless, BTC shaped a rounding prime sample, which is usually a bearish sample. This pushed the worth of BTC to fall again to the assist zone round $110,337 (1.618 Fib degree).

Regardless of staging a restoration over this assist, BTC was rejected across the $115,690 space, ensuing within the present downtrend.

Bitcoin has additionally repeatedly traded under each the 50-day and 200-day Easy Shifting Averages (SMAs), indicating that the main cryptocurrency by market capitalization has been in a sustained bearish development.

In the meantime, the Relative Power Index (RSI) is retracing again in the direction of the 30-oversold degree, presently at 37 from the 50-midline vary, which might assist the general bearish development.

The Development-Based mostly Fibonacci retracement on the BTC/USD 4-hour chart reveals a powerful rejection close to the 0.382–0.5 ranges (round $121K–$122K), confirming bearish momentum.

BTC Approaches $110K Help Zone

Based mostly on the BTC/USD chart evaluation, the BTC value is presently on a sustained bearish development, which might see the asset plunge much more.

Help lies close to the 1.618 extension ($110K). RSI at 37 signifies weakening momentum and potential oversold situations. Except the worth of Bitcoin reclaims $118,000–$120,000, additional draw back towards $110K and even the two.618 extension ($100,600) stays possible within the brief time period.

This comes as Ali Martinez, a well-liked crypto analyst on X, says that the worth of BTC might revisit the $100,000 degree.

If the bull finds assist as a result of oversold RSI, the Bitcoin value might rally in the direction of the 1 Fib degree at $116,338 and even larger on the 0.786 Fib degree at $118,416.

For the bullish case, BitMEX co-founder Arthur Hayes said on the X platform that bankers have acquired a touch from Jamie Dimon (CEO of JPMorgan Chase) that it’s time to create extra credit score for the American trade.

Banksters received the trace led by the Grand Grasp Jamie Dimon, time to create credit score and lend to US trade. Extra {dollars}, extra $BTC quantity go up! QE 4 Poor Folks in motion. pic.twitter.com/dBI4fuiDoT

— Arthur Hayes (@CryptoHayes) October 14, 2025

Quantitative easing concentrating on the “poor” is underway, and the elevated liquidity of the US greenback might drive up the worth of BTC, he stated.

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection