Bitcoin reached an all-time excessive (ATH) of $126,080 on October 6, because the so-called “debasement commerce” narrative fueled a frenzy of institutional funding. Across the similar time, JPMorgan predicted that Bitcoin may attain $165,000 by the tip of 2025, saying that it’s at present “undervalued” in comparison with gold.

However after Friday’s crypto market crash, by which Bitcoin dipped beneath $109,000, does the concept of Bitcoin as a hedge towards macroeconomic dangers nonetheless maintain, or is it now exhibiting indicators of being one other high-beta speculative asset?

Bitcoin value predictions stay bullish for the market-leading cryptocurrency, pushed by its means to remain above key structural ranges regardless of the crash. Moreover, gold surpassed $4,200 an oz for the primary time ever on Wednesday, reflecting sturdy demand for laborious belongings exterior of presidency management.

Whereas the outlook for Bitcoin seems bullish, seasoned crypto natives are properly conscious of the potential for bigger returns by way of Bitcoin-related altcoins. One challenge gaining severe recognition proper now could be Bitcoin Hyper, a brand new Bitcoin Layer 2 that has raised over $23 million in its presale.

Bitcoin’s “Debasement Commerce” Narrative Nonetheless Has Room to Run

A analysis paper led by JPMorgan analysts steered that Bitcoin is undervalued in comparison with gold, concluding that BTC may attain as excessive as $165,000 to remain in parity, based mostly on volatility-adjusted comparisons. Nevertheless, this was printed when Bitcoin was rising in tandem with waning confidence within the US Greenback and rising issues about world political stability. Has its function modified after the current flash crash?

In a current interview with Decrypt, Pepperstone analysis strategist Dilin Wu outlined a possible state of affairs the place BTC may lose its safe-haven standing, however notes that with out this, it’s more likely to stay fixated as a debasement commerce.

“If actual charges climb considerably and keep excessive, the greenback strengthens long-term, or there’s a transparent outflow of institutional funds – reminiscent of giant ETF withdrawals – Bitcoin’s function as a debasement hedge can be reevaluated,” Wu mentioned, including, “Absent these circumstances, Bitcoin’s upward momentum stays very a lot intact.”

And so given the anticipation of rate of interest cuts and a weakening greenback, it seems that Bitcoin stays a viable hedge towards macroeconomic threat.

In the meantime, Elon Musk, the world’s richest man, made headlines yesterday by writing on X that “Bitcoin relies on vitality,” including that governments “can challenge pretend fiat forex,” but it surely’s “unimaginable to pretend vitality.”

Not solely does this underscore Bitcoin’s key function within the debasement commerce, but it surely suggests Musk could also be contemplating a possible BTC buy, which may enhance bullish market sentiment.

Elon Musk, the world richest man, simply mentioned that ‘bitcoin relies on vitality’

Governments can print pretend cash, however “unimaginable to pretend vitality.”

Do you assume he’s lining up one other BTC buy? 👀 pic.twitter.com/vi478af14A

— Gordon (@AltcoinGordon) October 14, 2025

Bitcoin’s scarcity-driven design, mixed with a robust, borderless infrastructure and institutional curiosity, creates a novel setup that’s laborious to seek out elsewhere, even in gold.

Choices Market Hints at BTC Transfer Towards $130,000

Analyst Crypto Seth famous that after Friday’s flash crash, the Bitcoin choices market reveals a premium cluster between $115,000 and $130,000. He says this means that “buyers interpret the pullback as a leverage reset slightly than a shift in development.”

Usually, choices market liquidity suggests short-term strikes, probably indicating that the rally to between $115,000 and $130,000 may happen throughout the subsequent few weeks, paving the best way for BTC to rally towards JPMorgan’s $165,000 goal earlier than the tip of the 12 months.

$BTC choices markets reveal a premium cluster between $115K and $130K, indicating merchants are nonetheless positioned for upside continuation.

Even after the sharp futures liquidation, name possibility demand stays sturdy, signaling that buyers interpret the pullback as a leverage… pic.twitter.com/XCH8gPtqiT

— Crypto Seth (@seth_fin) October 15, 2025

With that in thoughts, it appears that evidently there’s actual potential for Bitcoin to achieve momentum within the coming weeks and probably hit new highs. And if that occurs, it may open up new progress alternatives for ecosystem tokens as liquidity shifts – that’s the place Bitcoin Hyper is available in.

May Bitcoin L2 Bitcoin Hyper Outperform as Bitcoin Rises?

One main challenge Bitcoin at present faces is a decline in community exercise, with the variety of month-to-month lively customers dropping from a peak of 26 million in 2024 to 21 million in September 2025.

One purpose for this might be the restricted velocity and performance of the Bitcoin community, which might deal with solely about seven transactions per second and is principally restricted to sending and receiving operations.

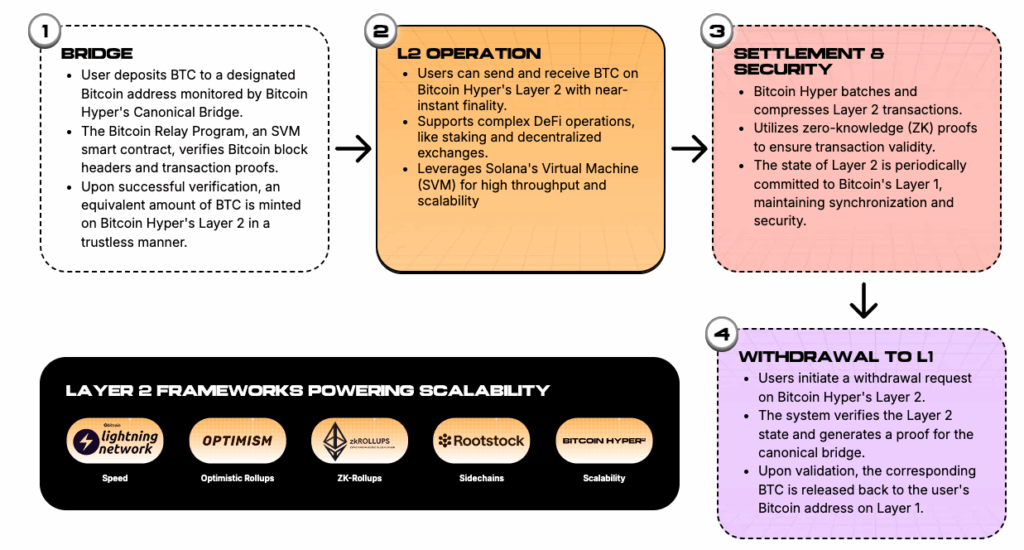

Bitcoin Hyper is growing a Bitcoin Layer 2 to handle these points straight, aiming to offer infrastructure able to processing hundreds of TPS and supporting sensible contracts, with out sacrificing the safety ensures of the L1.

Its purpose is to unlock new use instances on Bitcoin, reminiscent of DeFi, funds, meme cash, and RWAs, which may appeal to extra customers, enhance liquidity, and in the end solidify Bitcoin as a frontrunner in monetary know-how.

The challenge is gaining vital consideration throughout its ongoing presale, with Crypto Tech Gaming lately calling it the perfect altcoin for 2025.

Presently, HYPER is holding a presale, having raised $23.7 million so far. Roughly $200,000 of that quantity got here in over the previous 24 hours, indicating sturdy momentum.

With such excessive investor curiosity and a promising use case, all the pieces appears aligned for HYPER to surge as soon as it hits exchanges, and it may properly outperform BTC as a consequence of its decrease market cap.