A sudden market pivot has introduced US Bitcoin and Ethereum ETFs again into favor after latest turbulence.

The turnaround follows hints from Federal Reserve Chair Jerome Powell that rates of interest may very well be minimize earlier than year-end, injecting optimism into digital asset investments.

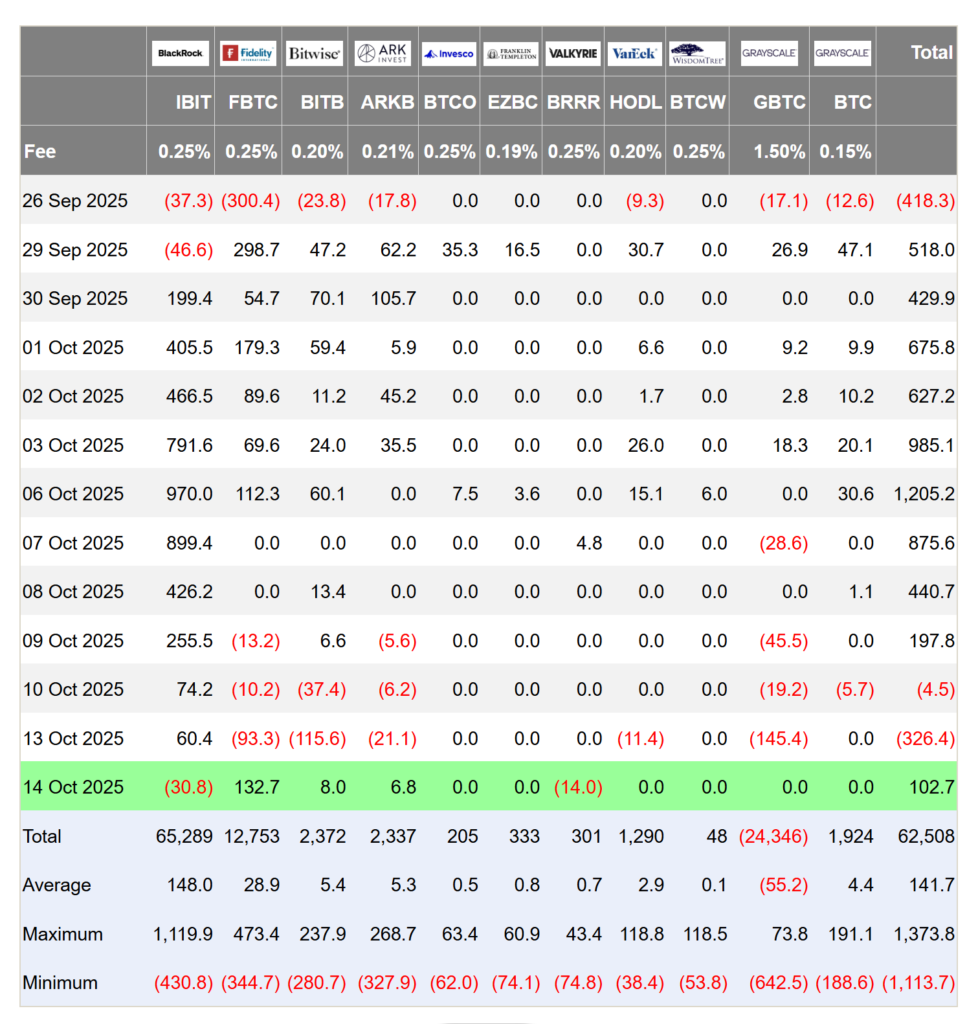

Bitcoin ETFs, after a day of heavy outflows, regained traction with over $100 million transferring again into the funds. Constancy’s Clever Origin Bitcoin Fund led the cost, whereas BlackRock’s flagship iShares Bitcoin Belief noticed minor withdrawals. Ethereum ETFs mirrored this pattern, with inflows surpassing $230 million, signaling renewed confidence in crypto publicity amongst institutional traders.

The restoration highlights how delicate digital asset flows are to macroeconomic indicators. Analysts level out that whispers of easing financial coverage encourage capital to hunt higher-yielding alternatives, and crypto ETFs are more and more seen as an environment friendly channel for this.

Even amid final week’s market shocks-driven by US-China commerce tensions – crypto funding merchandise proved remarkably resilient. Whereas tens of billions in positions have been liquidated throughout exchanges, fund outflows have been minimal, and inflows continued, pushing complete investments for 2025 previous $48 billion.

This rebound underscores a broader shift: traders are step by step treating Bitcoin and Ether as mainstream portfolio parts fairly than speculative bets. With institutional-grade merchandise gaining traction and regulatory readability enhancing, digital property are carving out a extra steady and legit function within the monetary ecosystem.