High central banks might quickly present the crypto market with much-needed respite, probably triggering a brand new bull run to all-time highs.

US Federal Reserve Chair Jerome Powell adopted a surprisingly dovish tone in his Tuesday speech on the Nationwide Affiliation for Enterprise Economics convention in Philadelphia, hinting that the Fed’s Quantitative Tightening program could quickly come to an finish.

Quantitative Tightening (QT) refers back to the Fed decreasing its stability sheet by promoting treasuries or letting bonds mature with out reinvestment, successfully draining liquidity from the monetary system, which raises borrowing prices and usually pressures danger property like shares and crypto.

The top of QT might imply extra liquidity for monetary markets, which might prolong the continued crypto bull cycle.

In the meantime, the Folks’s Financial institution of China is reportedly making ready for extra liquidity injections to spur the Chinese language financial system. This might present an extra increase to crypto costs.

Jerome Powell Adopts Dovish Stance, Right here’s What It Means For Crypto Costs

Fed Chair Jerome Powell maintained a cautious tone in September’s post-FOMC speech, calling final month’s rate of interest minimize only a “danger administration” measure.

Nevertheless, Powell seems to be lastly turning dovish, saying that the slowdown in hiring means that the US financial system nonetheless wants extra charge cuts.

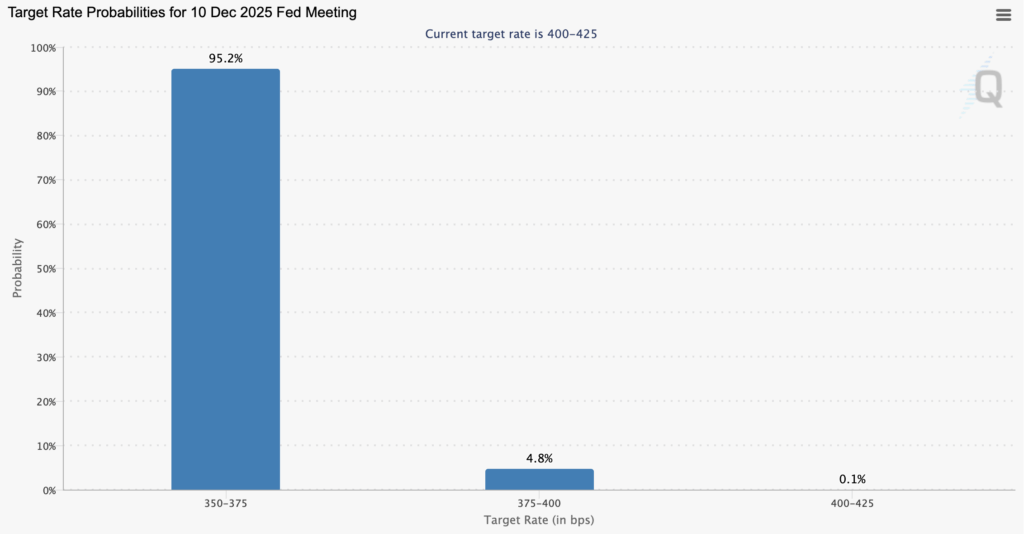

One other 25-basis-point minimize later this month is now practically a assure, whereas the CME FedWatch is signalling one more minimize in December.

Nevertheless, the truth that the Fed’s QT is now in its ultimate stretch is the largest takeaway from Powell’s deal with.

The Fed Chair admitted {that a} tightening in cash markets is now seen, a comment that outstanding macro analyst EndGame Macro interpreted as code-speak for liquidity within the system working dangerously scarce.

This isn’t the perfect backdrop for danger property and crypto, which explains the latest sluggishness in Bitcoin and large-cap altcoins.

Nevertheless, with the stability sheet contraction coming to an finish and rates of interest happening, borrowing prices are anticipated to fall. This might set off the beginning of the following crypto bull rally, and probably even prolong the bull cycle.

As such, GMI’s Head of Macro Analysis, Julian Bittel, has already signalled that the enterprise cycle might probably be prolonged to 2025 and even 2026, because it has been held again because of the excessive charges. This indicated {that a} crypto cycle high remains to be far off.

Greatest Cryptos To Purchase For The Subsequent Rally

Bitcoin continues to be a pretty funding for the following bull rally, particularly because it seems to match and outperform Gold’s 60% year-to-date progress.

Specialists imagine that the BTC value might probably hit $150,000 by year-end.

Nevertheless, altcoins would seemingly lead the rally. Into The Cryptoverse’s Benjamin Cowen claims that the Ethereum value is about for a brand new all-time excessive, particularly because it has examined and efficiently defended its bull market assist band close to the $3,700 mark.

Cowen claims that the ETH value might hit as excessive as $7,700, however no less than $5,300.

Altcoins exhibiting a robust correlation with BTC and ETH might additionally dominate. As an example, the brand new BTC layer-2 coin, Bitcoin Hyper (HYPER), has raised practically $24 million in presale funding.

With BTC nonetheless on the centre stage, altcoins in its ecosystem are being seen as engaging investments. Furthermore, layer-2 cash are likely to have excessive upside potential. Bitcoin’s Stacks (STX) reached a peak valuation of over $5 billion.

Contemplating that HYPER is a low-cap coin, it’s no shock that whales are stacking it throughout its ongoing presale. Just lately, a whale bought over $500k value of Bitcoin Hyper in a single day.

Whale demand is indicative of fantastic upside prospects, with many viewing HYPER as the following 10x crypto.

Equally, Ethereum meme cash like Pepe and Floki are closely undervalued and are engaging investments. A low-cap meme coin Pepenode has additionally raised practically $2 million in its ICO, owing to its distinctive mine-to-earn utility.

PEPENODE holders can actively take part in its mine-to-earn ecosystem by buying digital Miner Nodes, constructing server rooms, and upgrading amenities to spice up their mining output. In contrast to conventional mining, the method requires no GPUs or electrical energy, making it accessible to everybody.

Furthermore, deflationary tokenomics, passive staking rewards and audited sensible contracts make Pepenode among the finest low-cap cryptos to purchase.