Be part of Our Telegram channel to remain updated on breaking information protection

Cathie Wooden’s ARK Make investments has filed a number of functions for brand new Bitcoin ETFs (exchange-traded funds) with the Securities and Trade Fee (SEC).

In response to Oct. 14 filings, the asset supervisor has submitted preliminary prospectuses for merchandise together with the ARK Bitcoin Yield ETF, ARK DIET Bitcoin 1 ETF, and the ARK DIET Bitcoin 2 ETF.

The filings come after the SEC accepted generic itemizing guidelines for crypto ETFs, which is predicted to streamline the approval course of for such merchandise.

ARK Make investments Seems to be To Develop On Its Bitcoin ETF Choices

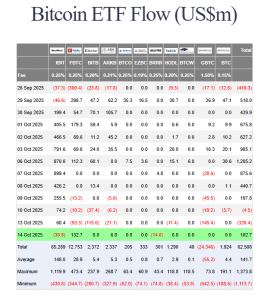

ARK Make investments already has a spot Bitcoin ETF within the US market that trades below the ticker image “ARKB.” It has gathered $2.337 billion, in accordance with information from Farside Buyers.

US spot BTC ETF flows (Supply: Farside Buyers)

Now it’s including a variety of extra merchandise.

The ARK Bitcoin Yield ETF goals to supply yield to traders from Bitcoin-linked methods and never solely observe the main crypto’s worth. ARK framed this product as a approach for traders to generate an earnings from BTC whereas decreasing volatility.

That earnings will come from the sale of choices and amassing choices over time. The fund will even be capable to put money into as much as 25% of its complete property in ARK Make investments itself, in accordance with the filings.

In the meantime, the ARK DIET Bitcoin 1 ETF will supply traders 50% draw back safety however will solely take part on the upside after a 5% enhance in BTC’s worth.

The ARK DIET Bitcoin 2 ETF will supply draw back safety to traders for the primary 10% decline. It should take part in Bitcoin’s upside when the crypto is above its worth in the beginning of a specified consequence interval.

SEC Approves Generic Itemizing Guidelines For Crypto ETFs

ARK Make investments’s newest filings come after the SEC accepted generic itemizing requirements for sure commodity-based exchange-traded merchandise (ETPs) on Sept. 18.

Below the brand new guidelines, qualifying merchandise could be listed by any alternate below generic requirements. Which means that they now not require a separate SEC evaluate below Part 19(b), which slashes the time it takes for brand new merchandise to enter the market.

Earlier than the generic itemizing guidelines had been accepted, every new crypto ETF software typically underwent a full SEC evaluate that might take so long as 240 days with no assure of approval.

Now, the timeline is predicted to be round 75 days.

With the streamlined course of, analysts have mentioned that the transfer may result in a flood of latest crypto merchandise, particularly for ETFs that stretch past Bitcoin and Ethereum.

When the SEC accepted the generic itemizing guidelines in September, Bloomberg ETF analyst James Seyffart mentioned the market ought to put together for “a wave of spot crypto ETP launches in coming weeks and months.”

WOW. The SEC has accepted Generic Itemizing Requirements for “Commodity Based mostly Belief Shares” aka contains crypto ETPs. That is the crypto ETP framework we have been ready for. Prepare for a wave of spot crypto ETP launches in coming weeks and months. pic.twitter.com/xDKCuj41mc

— James Seyffart (@JSeyff) September 17, 2025

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection