Be a part of Our Telegram channel to remain updated on breaking information protection

BlackRock CEO Larry Fink stated tokenization will drive the agency’s ”subsequent wave of alternative,” predicting that conventional property will more and more transfer onto blockchains over the approaching many years.

Speaking in an interview on CNBC’s Squawk Field, Finok stated establishments are more likely to “begin shifting away from conventional monetary property by repotting them in a digital method.”

“I do consider we’re simply at the start of the tokenization of all property, from actual property to equities, to bonds — throughout the board,” he stated. ”We take a look at that as the subsequent wave of alternative for BlackRock over the subsequent tens of years.”

CEO of world’s largest asset supervisor…

“We’re simply at the start of the tokenization of all property.”

Sure, contains ETFs.

Larry Fink on his positively evolving perspective in direction of crypto: “I develop & be taught.”

Good lesson right here.

And a few of you *nonetheless* suppose crypto is a rip-off. pic.twitter.com/GJ8oxWF3vK

— Nate Geraci (@NateGeraci) October 15, 2025

Fink sees tokenization unlocking entry to conventional monetary markets for youthful traders.

“If we will tokenize an ETF, digitize that ETF, we will have traders who’re simply starting to spend money on markets by means of, let’s say, crypto, they’re investing in it, however now we will get them into the extra conventional long-term retirement merchandise,” Fink stated.

Fink’s remarks come after the CEO introduced in BlackRock’s earnings name that the asset supervisor plans to play a bigger function in tokenization sooner or later. Groups throughout the agency are already exploring choices on the way to broaden into the nascent tokenization area.

That potential growth will come alongside BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), which is price $2.8 billion and is presently the most important tokenized money market fund following its launch in March final yr.

Tokenization Market To Surpass $13 Trillion By Finish Of Decade

The asset tokenization area is presently price greater than $2 trillion, in accordance to information from market analysis firm Mordor Intelligence. It’s also predicted to develop considerably over the subsequent few years to surpass $13 trillion by the tip of the last decade.

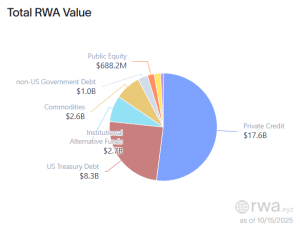

There’s additionally already over $33.84 billion in tokenized worth on the blockchain, information from RWA.xyz exhibits. Most of this worth is tokenized non-public credit score, accounting for about $17.6 billion.

Breakdown of RWA worth (Supply: RWA.xyz)

There was greater than 6% progress within the variety of holders of tokenized property in simply the previous thirty day.

Fink Adjustments His Stance On Crypto

Fink known as digital property an index of cash laundering as not too long ago as 2017. He doubled down on his criticism in 2018, and stated that none of BlackRock’s purchasers needed to spend money on the crypto market.

Now he’s within the entrance line of taking digital property mainstream.

In an interview with CBS’s 60 Minutes earlier this week, Fink stated he thinks crypto has an important function to play in a diversified investor portfolio, much like gold.

“There’s a function for crypto in the identical means there’s a function for gold; it’s another,” he stated. “For these trying to diversify, this isn’t a foul asset, however I don’t consider it needs to be a big a part of your portfolio.”

BlackRock’s IBIT Ends Its Inflows Streak

BlackRock has additionally established itself as a dominant participant within the US spot Bitcoin ETF (exchange-traded fund) area. Its product, IBIT, has recorded the very best quantity of cumulative inflows for the reason that ETFs obtained regulatory approval initially of 2024.

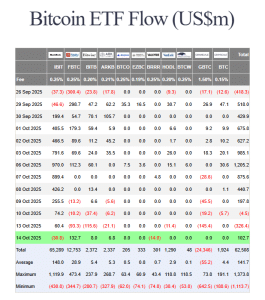

Information from Farside Buyers exhibits that IBIT’s cumulative inflows stand at $65.289 billion. That is excess of the next-biggest whole inflows of $12.753 billion, which fits to Constancy’s FBTC product.

US spot BTC flows (Supply: Farside Buyers)

BlackRock’s IBIT had been on a multi-day influx streak between Sept. 30 and Oct. 13. This was till it recorded $30.8 million in internet day by day outflows within the newest buying and selling session. Nonetheless, these destructive flows are minute in comparison with the over $4.5 billion that entered the product in the course of the inflows streak.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection