- ETH down 14.6% weekly, buying and selling close to $4,004 with slowing momentum.

- Bitmine buys 40,980 ETH ($157M) — a robust signal of institutional confidence.

- Analysts eye $8K–$10K targets for Ethereum by early 2026 as liquidity expands.

Ethereum’s value has been beneath strain these days, however behind the pink candles, some key gamers are quietly making strikes. During the last 24 hours, ETH slipped by 3.9%, and up to now week, it’s down about 14.6%. In the intervening time, it’s sitting round $4,004, giving it a market cap of $481.7 billion, with buying and selling quantity cooling to $50.6 billion — about 13.9% decrease than the day prior to this.

Regardless of the dip, analysts counsel this could possibly be the type of setup that usually precedes a robust restoration. And that view would possibly simply have some strong backing.

Bitmine’s $157M Ethereum Purchase Sparks Institutional Buzz

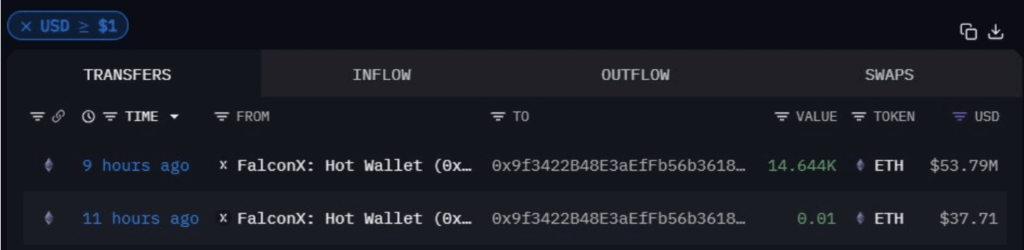

Crypto analyst Max Crypto highlighted one thing that grabbed everybody’s consideration: Bitmine simply scooped up 40,980 ETH, price roughly $157 million, proper in the course of this value decline. That’s not the transfer of an organization anticipating extra ache — it’s a wager on Ethereum’s long-term energy.

Ethereum stays the heartbeat of decentralized finance, NFTs, and Web3 infrastructure. Strikes like Bitmine’s normally spark confidence amongst retail merchants as a result of, effectively, establishments have a tendency to purchase when everybody else panics. It’s a basic case of sensible cash accumulating whereas sentiment is weak.

Analysts Set Daring Targets: $8K–$10K Potential by 2026

Market watcher Hailey LUNC believes Ethereum could possibly be gearing up for an enormous breakout cycle — with honest worth targets starting from $8,000 to $10,000 by Q1 2026. Her reasoning? Liquidity. Particularly, Ethereum’s value pattern has typically adopted the M2 world cash provide, which is predicted to increase once more later this 12 months.

Extra liquidity normally means extra capital chasing property like ETH. Mix that with potential institutional staking approvals and growing inflows, and the case for a sustained rally strengthens. As Hailey put it, this might mark the beginning of certainly one of Ethereum’s strongest market cycles but.

Technical Setup Nonetheless Exhibits Weak Momentum

On the charts, Ethereum’s near-term image stays shaky. The worth is hovering near the decrease Bollinger Band at $3,723, with resistance zones at $4,240 and $4,758. A bounce from right here isn’t unimaginable — ETH already confirmed a small restoration off $3,800 — however momentum nonetheless feels fragile.

The RSI sits round 43.38, under the impartial mark, signaling restricted shopping for energy. In the meantime, the MACD stays in bearish territory, with deepening pink bars exhibiting sustained promoting strain. Except ETH closes decisively above the $4,240 degree quickly, dangers of sliding under $3,723 stay excessive.

For now, Ethereum seems weak on the floor, however beneath the hood, accumulation from whales and establishments tells a special story. If historical past’s any information, that’s normally when the following leg of the rally begins.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.