Be a part of Our Telegram channel to remain updated on breaking information protection

A blunder by stablecoin issuer Paxos briefly despatched the market cap of PayPal USD (PYUSD) to $300 trillion, exceeding world GDP, earlier than the tokens had been burned minutes later.

Paxos stated in a submit on X that the 300 trillion PYUSD mint was brought on by a technical error throughout an inside switch and was reversed inside 22 minutes. It confirmed there was no safety breach and that buyer funds stay secure.

The minting glitch quickly disrupted DeFi markets, prompting lending platform Aave to droop PYUSD transactions as a precaution. Though the problem was rapidly resolved, it reignited issues over the dearth of safeguards to stop stablecoins from issuing token quantities that exceed collateral

PYUSD is operational and totally backed at a 1:1 ratio.

Earlier at this time, 300 trillion was minted and subsequently burned.

We have quickly frozen PYUSD markets on @aave as we examine the problem.

Funds are secure! pic.twitter.com/2x0QyvrJ7d

— Omer Goldberg (@omeragoldberg) October 15, 2025

“Whereas I respect the transparency and the extremely quick response to burn the surplus PYUSD, the preliminary minting error itself is certainly regarding, given the bedrock belief required for a dollar-backed stablecoin,” stated Rui Diao on X.

On-chain information from Etherscan exhibits that the tokens had been minted at 7:12 pm UTC.

“Paxos instantly recognized the error and burned the surplus PYUSD,” the stablecoin issuer stated. On-chain information corroborates this, with your entire quantity of the PYUSD being burned simply 22 minutes after they had been minted.

Following the minting error and subsequent burn, Paxos went on to mint 300 million PYUSD as a part of its routine operations.

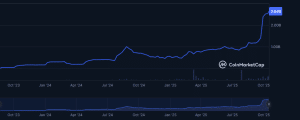

PYUSD’s Market Cap Exceeded World GDP, US Debt

Given PYUSD’s 1:1 peg with the US greenback, the incident noticed the token’s market cap briefly soar to $300 trillion. That is greater than the report US nationwide debt, which stands at greater than $37 trillion. Additionally it is greater than world gross home product (GDP), estimated to be round $117 trillion.

PYUSD market cap (Supply: CoinMarketCap)

PYUSD’s market cap stands at round $2.64 billion as of 1:12 a.m. EST, making it the sixth-largest stablecoin. Tether’s USDT is ranked first with its capitalization of greater than $181.42 billion, whereas USD is second with over $76 billion.

Ethena’s USDe token and Dai (DAI) are ranked third and fourth, respectively. Ranked one place above PYUSD is the Trump-linked World Liberty Monetary USD (USD1) with its market cap of round $2.68 billion.

PYUSD Mint Raises Group Considerations Round Stablecoin Collateral

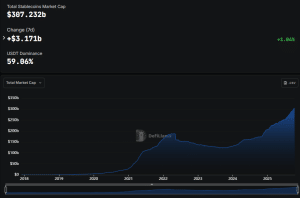

The stablecoin market has been gaining momentum since US President Donald Trump signed the GENIUS Act into regulation in July, offering regulatory readability for stablecoin issuers.

That despatched the stablecoin market cap surging previous $300 billion for the primary time, information from DefiLlama exhibits.

Stablecoin market cap (Supply: DefiLlama)

One of many key necessities for the GENIUS Act is that stablecoin issuers should keep a 1:1 backing with its reserves. These reserves additionally must encompass very liquid, low-risk belongings.

With out safeguards that stop stablecoin companies from issuing token quantities that exceed their collateral, crypto neighborhood members query how stablecoins differ from fiat forex, which a central financial institution can print as deemed essential.

“It’s not the greenback quantity try to be excited about. It’s the truth that this can be a collateralized asset that may be created with out the collateral,” stated a person on X.

Hey guys, so – uh – what precisely was this $300 trillion in “stablecoin” colaterlized by when it was minted, mistakenly or in any other case https://t.co/p0Q2iC83Vz

— zerohedge (@zerohedge) October 15, 2025

Questions round reserves and liquidity have typically been raised within the stablecoin area over time. For instance, Tether has been making ready for a third-party audit of its reserves for USDT for a number of months now, however no audit has taken place.

PYUSD has confronted neighborhood scrutiny earlier than, most notably after its market cap collapsed 40% a couple of yr in the past, elevating fears of manipulation.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection