Be a part of Our Telegram channel to remain updated on breaking information protection

Ripple CEO Brad Garlinghouse referred to as banks “hypocritical” for demanding crypto corporations strictly adjust to anti-money laundering guidelines and different safeguards whereas additionally blocking them from banking system infrastructure.

“You possibly can’t say one after which fight the opposite,” he stated, whereas talking at DC Fintech Week. ”It’s hypocritical, and I believe all of us ought to name them out for being anti-competitive in that regard.”

Ripple has utilized for a nationwide belief constitution and a Federal Reserve grasp account, which, if authorised, would give it larger entry to US banking infrastructure.

Ripple’s Brad Garlinghouse: Coverage, Innovation, and the Way forward for International Financ

At DC Fintech 2025 pic.twitter.com/SQngi5pfmb— 𝗕𝗮𝗻𝗸XRP (@BankXRP) October 15, 2025

Garlinghouse’s remarks come after crypto-native corporations together with Ripple, Circle, Clever, and Erebor Financial institution filed for nationwide financial institution or belief charters.

A nationwide belief constitution would let the businesses conduct restricted fiduciary and custody actions underneath the oversight of the Workplace of the Comptroller of the Forex (OCC) with out conventional deposit or lending features.

Ripple, by its subsidiary Commonplace Custody & Belief Firm, has gone a step additional and likewise utilized for a Federal Reserve grasp account. If its utility is authorised, this could give the corporate direct entry to the funds system.

Banking Coverage Institute Says Crypto Companies Shouldn’t Get ‘Backdoor Entry’

The Banking Coverage Institute (BIP), a lobbying group representing huge US banks, has raised considerations about granting non-banks and crypto corporations entry to nationwide financial institution or belief charters.

The BIP argues that crypto corporations mustn’t get “backdoor entry” to the Federal Reserve funds system until they meet full regulatory necessities. The group has additionally urged the OCC and Federal Reserve to maneuver cautiously and even reject some purposes.

Garlinghouse stated granting crypto corporations comparable to Circle and Ripple grasp accounts will contribute to extra regulatory oversight, extra stability and threat mitigation.

Banks Beginning To Take Ripple Extra Significantly

Nonetheless, Garlinghouse stated that monetary establishments are beginning to take Ripple, and different crypto corporations, extra significantly.

“I had conferences yesterday in New York Metropolis, the place banks that may not have talked to us three years in the past at the moment are leaning in and saying, how may we companion round this?” he stated.

That’s as Ripple’s RLUSD stablecoin begins to realize traction following the signing of the GENIUS Act into legislation in July, offering regulatory readability for stablecoin corporations.

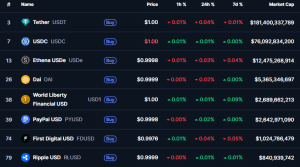

Since that act was signed by US President Trump, the stablecoin market cap has gone on to soar previous $300 billion, knowledge from DefiLlama exhibits.

The market capitalization of Ripple’s RLUSD stablecoin has soared greater than 73% to $840.1 million because the GENIUS Act handed.

Prime stablecoins by market cap (Supply: CoinMarketCap)

That ranks it because the eighth-largest stablecoin.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection