- Chainlink plunged over 20% this week, monitoring Bitcoin’s broader market decline.

- $717M in liquidations intensified the selloff amid U.S.–China commerce tensions.

- Fed price cuts later this month may spark a restoration if liquidity improves.

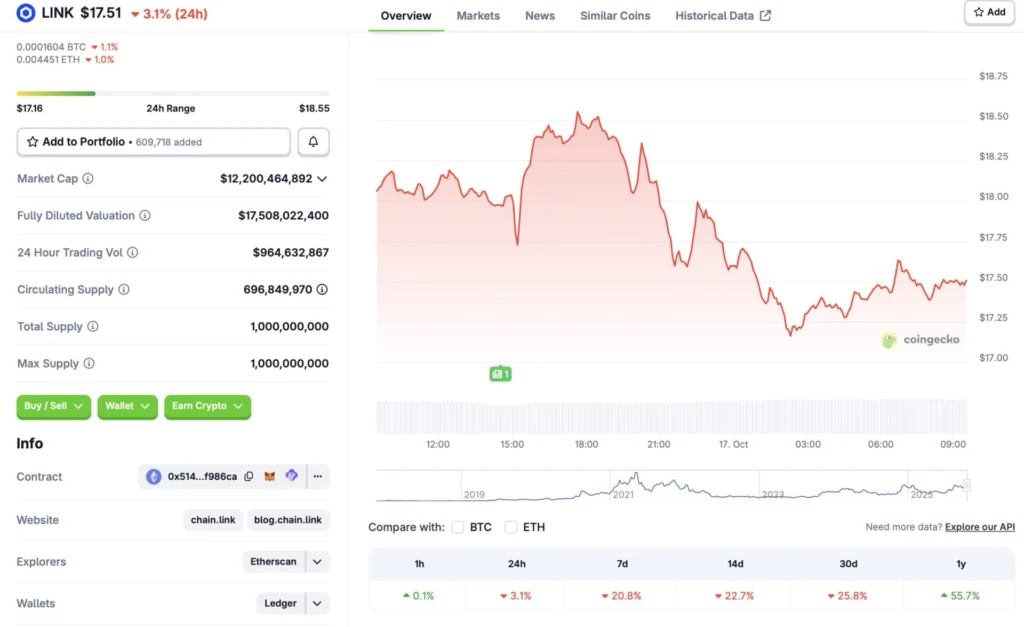

Chainlink (LINK) has taken a heavy hit this week, mirroring the broader market’s correction as Bitcoin slipped under $110,000. In response to CoinGecko, LINK is down 3.1% in 24 hours, 20.8% for the week, and practically 26% over the previous month — a steep drop that’s left many questioning if the worst is over or simply starting.

Market Turmoil and Liquidations Drag LINK Decrease

The selloff comes amid a risky stretch for your entire crypto market. An enormous $717 million in liquidations hit throughout the final 24 hours, following renewed U.S.–China commerce tensions that rattled world danger sentiment. Chainlink, like most altcoins, has adopted Bitcoin’s trajectory intently, sliding as traders de-risked throughout the board.

This wave of liquidations marked the biggest single-day occasion of the month, erasing weeks of cautious accumulation. Analysts recommend that investor nervousness stays excessive regardless of modest restoration indicators, as merchants brace for additional macro-driven turbulence.

Price Cuts Might Supply Aid for LINK and Altcoins

There’s a possible silver lining on the horizon. Federal Reserve Chair Jerome Powell not too long ago hinted at one other rate of interest lower, which might be the second of 2025. Decrease borrowing prices usually enhance liquidity and risk-taking, which may assist altcoins like LINK rebound as capital flows again into speculative belongings.

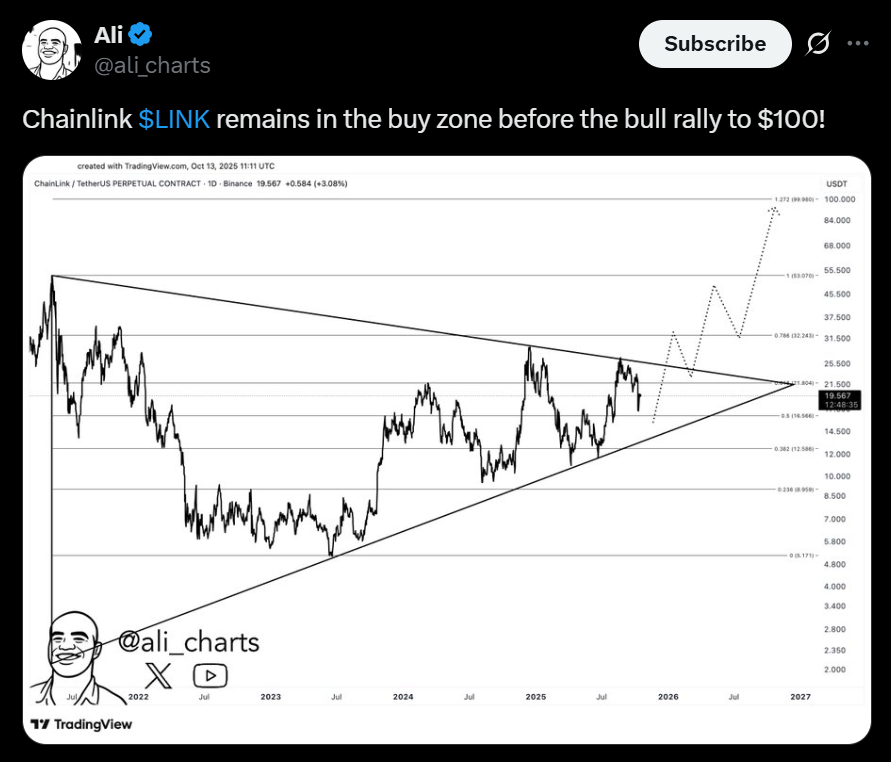

Traditionally, Chainlink has recovered strongly throughout easing cycles, as establishments re-enter the market in search of yield in decentralized finance and oracle-powered ecosystems. Nonetheless, timing stays unsure — and a shaky restoration in Bitcoin may nonetheless restrict LINK’s upside momentum within the close to time period.

What Comes Subsequent for Chainlink?

Whereas optimism round price cuts supplies a possible tailwind, market volatility stays elevated, and LINK could consolidate round present ranges earlier than any main transfer increased. The final price lower in September sparked a quick rally that rapidly reversed into one other correction. Merchants ought to stay cautious, as the subsequent bounce may very well be short-lived if macro strain persists.

Nonetheless, Chainlink’s fundamentals — from rising oracle integrations to new staking demand — stay intact beneath the market noise. If liquidity returns post-rate determination and Bitcoin stabilizes, LINK may regain footing above the $12–$14 vary by early November.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.