Public cryptocurrency mining corporations are ramping up fundraising via convertible bonds, marking the biggest wave of capital elevating within the sector since 2021.

This surge may allow miners to pivot towards AI and high-performance computing (HPC), however it additionally brings dangers of mounting debt and shareholder dilution.

Report Bond Issuances

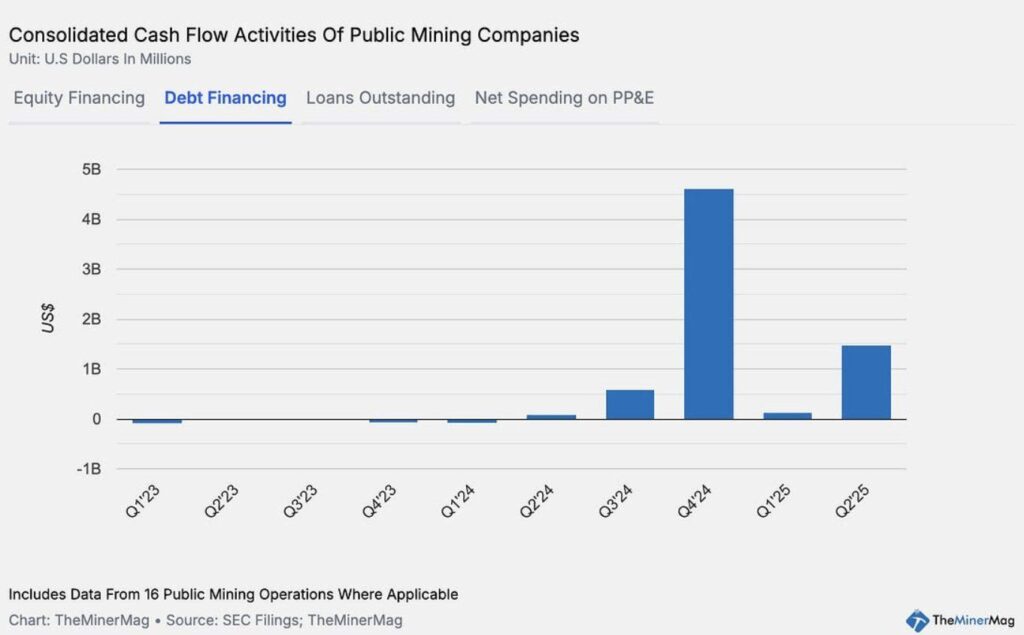

In 2025, corporations like Bitfarms and TeraWulf have introduced multi-billion-dollar bond choices. Bitfarms unveiled a $500 million convertible notice due 2031, whereas TeraWulf proposed a $3.2 billion senior secured notice to broaden knowledge heart operations. Throughout 15 public mining corporations, complete debt and convertible notice issuances hit $4.6 billion in This autumn 2024, dipping under $200 million earlier this yr earlier than rebounding to $1.5 billion in Q2 2025.

In contrast to the 2021 cycle, the place mining rigs had been used as mortgage collateral, as we speak’s convertible bonds shift monetary danger from gear repossession to potential fairness dilution. This mannequin provides corporations operational flexibility however pressures them to ship stronger revenues to guard shareholder worth.

Alternatives Past Mining

Some miners are exploring new income streams past Bitcoin manufacturing. This consists of constructing HPC and AI infrastructure, providing cloud providers, or leasing hash energy. For instance, Bitfarms secured a $300 million mortgage from Macquarie to fund HPC improvement at its Panther Creek undertaking. If profitable, these ventures may present extra secure long-term revenue than conventional mining.

The market has responded positively to debt bulletins, typically sending mining shares larger as buyers anticipate progress. Nevertheless, if growth fails to supply adequate returns, shareholders may face vital dilution, whereas the excessive mining problem and declining margins add further stress.

The sector is successfully testing the bounds of monetary engineering, balancing progress ambitions with the dangers inherent in debt-financed growth, because it seeks to evolve from purely energy-intensive Bitcoin mining to a extra diversified, data-driven enterprise mannequin.