- Ethereum should increase community exercise and developer engagement to maintain development.

- Day by day Lively Addresses must rebound to sign renewed investor confidence.

- Revived Open Curiosity will assist stronger, extra sturdy value rallies.

Ethereum’s long-term dream of hitting $20,000 isn’t nearly hype or ETF headlines—it’s about proving actual, lasting development. Positive, institutional cash is flowing in, however that alone received’t take ETH to new heights. To achieve these numbers, the community wants stronger fundamentals: extra person exercise, larger developer engagement, and a revival in speculative participation. With out these, enthusiasm fades quick.

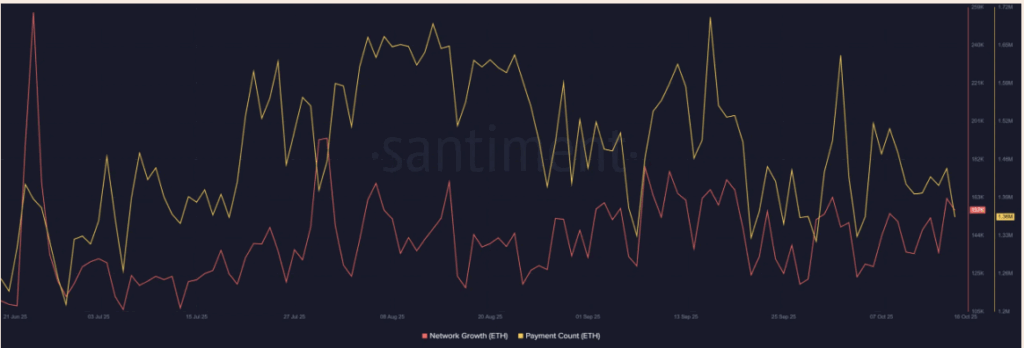

Community Development Should Catch Up

Ethereum’s community enlargement has been… nicely, a bit uneven. Present knowledge reveals round 157,000 new addresses, with every day cost counts close to 1.36 million. These numbers aren’t unhealthy, however they’re not precisely explosive both. It suggests customers are holding again, ready for the following large second.

For Ethereum to maneuver towards $20K, retail participation must chill in, together with deeper dApp adoption. The ecosystem should present real utility—transactions, innovation, and builder exercise—not simply value hypothesis. When retail and institutional vitality align, that’s when actual power reveals up.

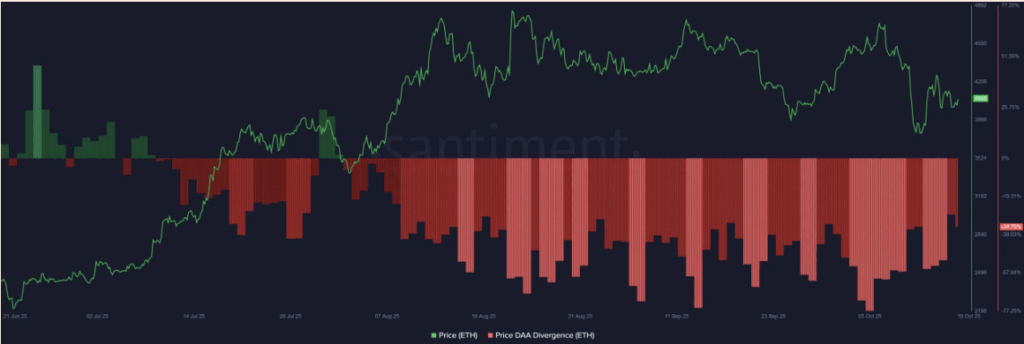

Tackle Exercise Holds the Key

Proper now, Ethereum’s Day by day Lively Addresses (DAA) present a divergence of about -34%, hinting that smaller buyers are much less energetic whilst costs stabilize. That form of drop in engagement normally alerts a interval of hesitation.

Traditionally although, when DAA flips optimistic—when customers begin shifting ETH once more—it tends to spark main uptrends. So, the comeback of tackle exercise may be the lacking spark. If extra customers begin interacting, staking, or swapping once more, it might create the right storm of conviction and liquidity wanted for a real run.

Open Curiosity Wants a Revival

Speculative vitality issues, even when nobody likes to confess it. Open Curiosity (OI) has dropped 6.41%, sitting round $43.87 billion. That’s an indication merchants are cooling off after the summer season volatility. Whereas that may decrease threat short-term, it additionally limits the potential for large breakouts.

To alter that, ETH wants regular will increase in each leverage and spot shopping for. Not reckless leverage—however the sort that alerts confidence. As soon as OI and liquidity develop collectively, rallies are inclined to last more and hit tougher.

Is $20K Actually on the Desk?

In brief—sure, however not with out work. Institutional demand offers Ethereum construction and legitimacy, however the actual gas will come from community utilization and investor engagement. ETH can’t simply depend on Wall Avenue’s urge for food; it has to match it with on-chain vitality.

If Ethereum finds that stability—between hypothesis, adoption, and innovation—the climb to $20,000 received’t simply be a dream. It’ll be the following logical step in its evolution.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.