- Ripple’s inner doc exhibits XRP demand relies on adoption, not hypothesis.

- Every transaction burns XRP to guard the community, selling actual utilization.

- The group agrees: sustained progress for XRP should come from real utility, not hype.

A resurfaced Ripple doc has caught the crypto group’s consideration after researcher SMQKE shared an inner web page titled “XRP Demand Examined.” The paper lays out Ripple’s enterprise mannequin in unusually plain phrases — exhibiting that the corporate’s long-term plan for XRP’s success relies upon not on hype or hypothesis, however on real-world demandand precise community utilization.

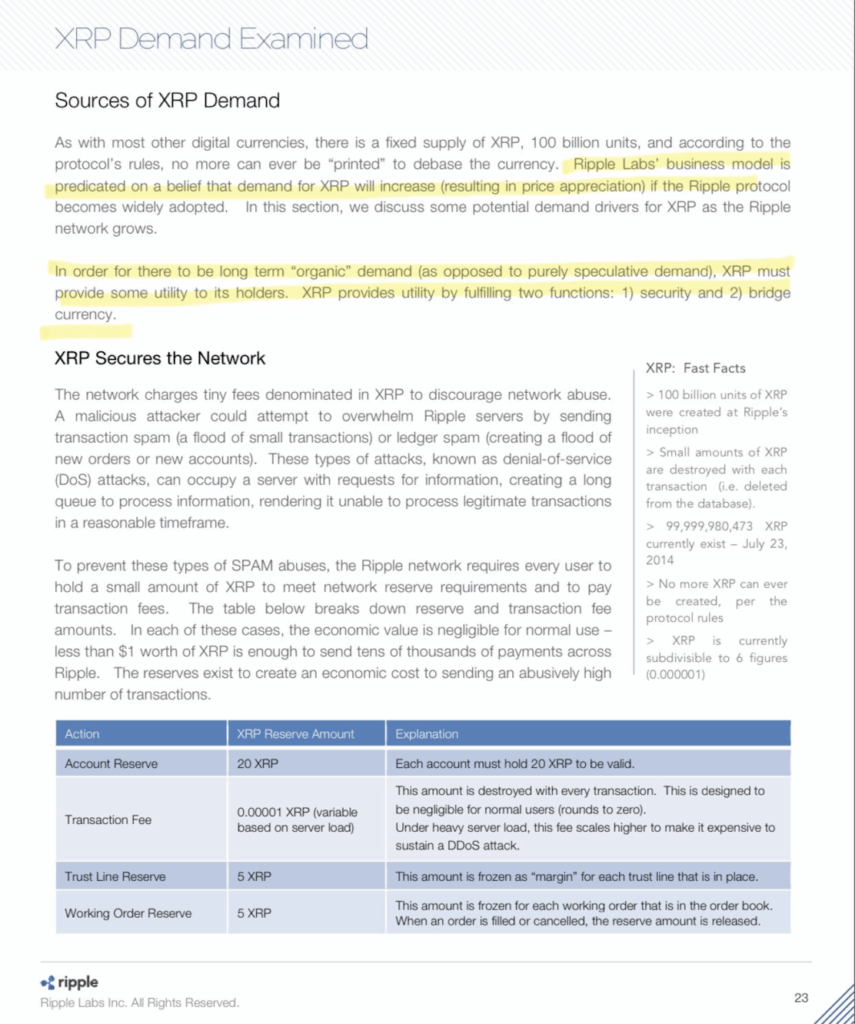

In response to the doc, Ripple’s framework is constructed on a easy however highly effective premise: if the Ripple protocol sees broad adoption, XRP demand will rise naturally — and so will its worth. It’s not about short-term worth motion or dealer pleasure. It’s about sustained utility. The corporate explicitly states that for XRP’s demand to develop organically, the asset should serve a tangible objective throughout the ecosystem. And that objective, Ripple says, comes down to 2 essential capabilities: securing the community and performing as a bridge forex for cross-ledger transfers.

Actual Utilization Over Hypothesis

The doc dives deeper into how XRP contributes to community safety. Every transaction burns a small fraction of XRP — a deliberate design selection that stops spam and denial-of-service assaults. This tiny burn price ensures that solely professional exercise passes via, retaining the community environment friendly and dependable.

Ripple’s word goes on to elucidate that XRP’s appreciation isn’t meant to occur “by default.” Worth progress, it says, ought to come from adoption — from actual companies and establishments utilizing the protocol. Hypothesis would possibly transfer costs quickly, but it surely’s not what Ripple is banking on. As a substitute, the main focus is on constructing actual utility and scaling real demand for XRP via monetary use instances like cross-border liquidity, remittances, and settlement.

In essence, Ripple made it clear that market worth ought to comply with utility, not the opposite manner round. That message contrasts sharply with what number of traders usually view XRP — as a quick-trade asset, not as a spine of monetary infrastructure.

Neighborhood Response: Adoption Is Every part

After SMQKE’s submit unfold, XRP supporters jumped into dialogue. Many highlighted Ripple’s clear acknowledgment that the corporate’s success relies upon totally on adoption, not hypothesis. One group member stated plainly that “actual utilization drives the community — not hype,” whereas one other consumer, Cedric Beau, identified that the doc “proves XRP’s worth potential is conditional on precise utility.”

Beau’s remark resonated with many: if XRP isn’t getting used at scale, there’s no natural cause for its worth to rise. This clear separation between speculative pleasure and purposeful demand reaffirms Ripple’s long-standing place — that XRP’s price will come from measurable community exercise and integration, not retail hype cycles.

The Takeaway: Utility Defines Worth

The resurfaced doc ties again to one thing Ripple has been saying for years — actual adoption is the inspiration for XRP’s future. It’s not about who’s holding the token, however who’s utilizing it. Each burned fraction of XRP, each cross-ledger transaction, and each integration with monetary infrastructure strengthens that base.

In brief, Ripple’s imaginative and prescient hasn’t modified: community exercise fuels demand, and demand determines worth. If XRP really turns into a key piece of world funds and liquidity, appreciation will comply with naturally — not due to hypothesis, however as a result of the system wants it.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.