As US markets brace for a pivotal week — with recent CPI knowledge anticipated quickly, a probable Fed fee reduce in direction of the top of October, and Jerome Powell’s remarks anticipated to steer international sentiment — merchants are watching how crypto reacts to shifting coverage indicators.

Among the many property in focus are Made in USA cash, which frequently transfer sharply round main US occasions. Some now trace at early recoveries, whereas others danger deeper pullbacks, however not with twists.

Solana (SOL)

Amongst Made in USA cash, Solana continues to face out as one of many extra resilient altcoins regardless of current volatility. The token is down 23% month-on-month, primarily as a result of October 10 “Black Friday” crash.

Sponsored

Sponsored

But, it has gained over 2% up to now week, signaling regular restoration efforts.

The broader construction nonetheless seems bullish. Solana has been shifting inside an ascending channel sample since Could — a setup that always helps continuation traits.

If the Solana value breaks above $204 (an 8.4% rise), it might goal $223 and $238 subsequent. A clear transfer above $253 might probably open the trail towards new highs within the quick to mid-term.

Need extra token insights like this? Join Editor Harsh Notariya’s Day by day Crypto Publication right here.

The Relative Energy Index (RSI) — which tracks how briskly and robust value actions are — provides extra weight to this view. Between August 7 and October 11, Solana’s value made the next low, whereas RSI made a decrease low.

This hidden bullish divergence normally confirms that the bigger uptrend stays intact, even throughout short-term dips.

Nevertheless, a every day shut beneath $174 (the decrease trendline of the channel) would weaken the sample. It might ship the Solana value towards $155 and even $142, marking a short lived lack of construction for one of many main altcoins in focus this October.

Sponsored

Sponsored

Chainlink (LINK)

The following on the checklist of Made in USA cash is Chainlink, one of many few altcoins displaying early indicators of restoration regardless of sharp losses this month.

LINK has fallen over 30% up to now 30 days, hit by October’s market-wide crash, but it surely has managed to shut the previous 24 hours in inexperienced, hinting at early shopping for curiosity.

A part of this renewed momentum comes from robust on-chain accumulation. Whaler Discuss knowledge exhibits that over 270,000 LINK tokens (price greater than $4.6 million) had been lately moved out of Binance wallets — an indication that enormous holders are probably making ready for long-term positions.

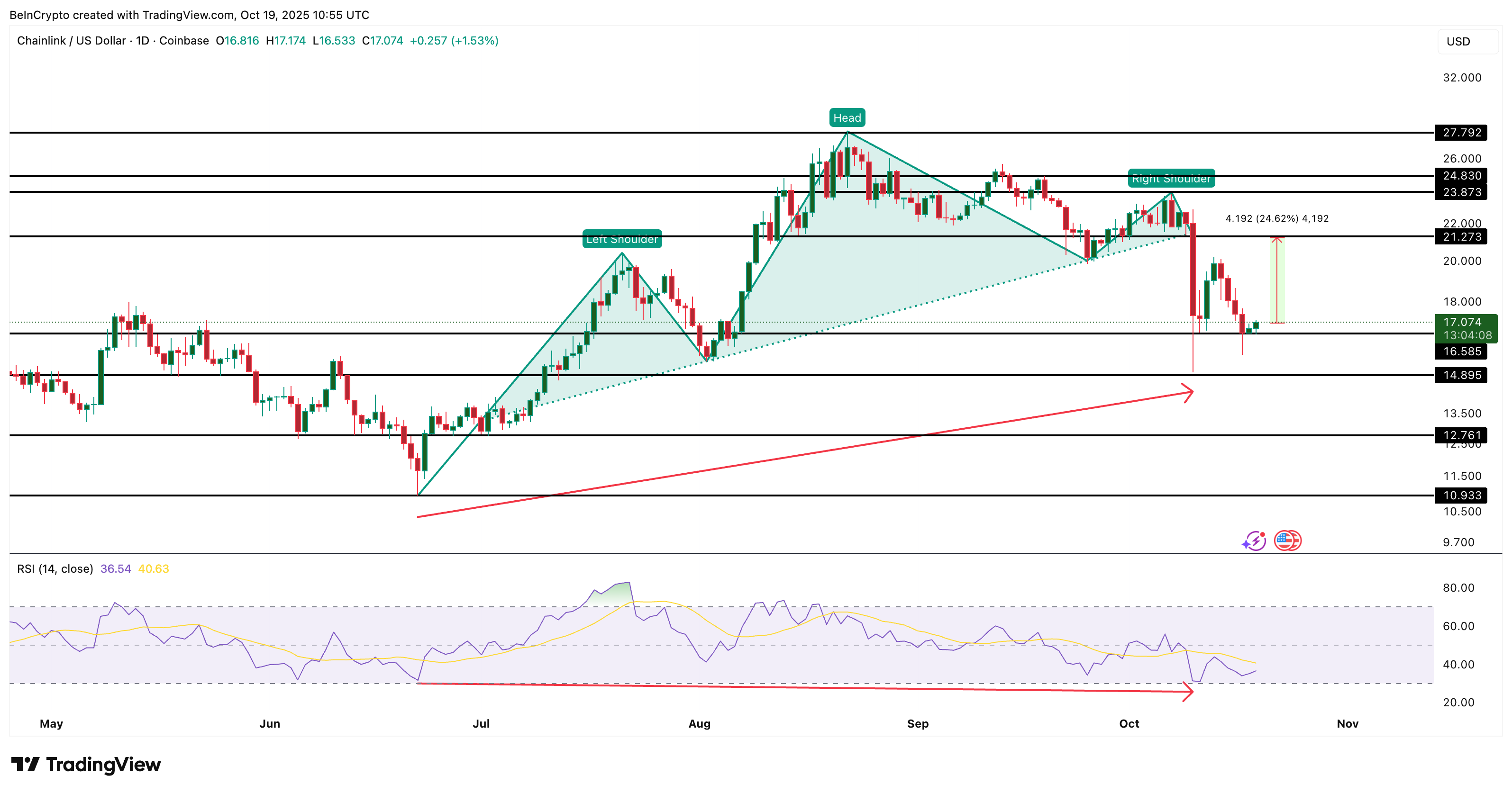

Technically, Chainlink broke beneath a head-and-shoulders sample on October 10, with a neckline close to $21, which led to a steep correction towards $14.

Nevertheless, LINK has since rebounded, taking help at $16, a stage that’s now proving to be a essential base for potential restoration.

Between June 22 and October 10, LINK’s value made the next low whereas the Relative Energy Index (RSI) made a decrease low. This hidden bullish divergence means that the bigger uptrend, supported by LINK’s 50% yearly achieve, stays intact regardless of current weak spot.

Sponsored

Sponsored

If LINK can shut a every day candle above $21, it might set off a transfer towards $24 and even $27. That might mark a minimal potential 24% near-term rally.

Nevertheless, if the worth dips beneath $16, the bullish construction might weaken. That may open a path to $14 and even $12, as soon as once more.

Stellar (XLM)

Among the many Made in USA cash, Stellar (XLM) stands out for its rising real-world asset (RWA) focus. But, it’s presently flashing a extra advanced setup, making it one of many extra unstable altcoins in focus for October finish.

XLM trades close to $0.31 and continues to see regular whale inflows. The Chaikin Cash Move (CMF), which measures cash getting into or leaving a token, has stayed above zero since October 7, displaying that enormous buyers are nonetheless including positions regardless of the crash.

Nevertheless, their optimism could also be examined quickly. On the every day chart, the 20-day Exponential Shifting Common (EMA), the crimson line — a line that smooths short-term value knowledge — is near crossing beneath the 200-day EMA (deep blue line), whereas the 50-day EMA (orange) is nearing a crossover beneath the 100-day EMA (sky blue). These crossovers normally sign that sellers are gaining management.

Sponsored

Sponsored

If these two demise crossovers take form, it might reinforce bearish momentum, pushing XLM towards key help at $0.27 (an 11.4% dip).

A break beneath this stage might expose $0.22 and even $0.18. However then, the bearish momentum might lose steam if the XLM value breaks $0.35 first.

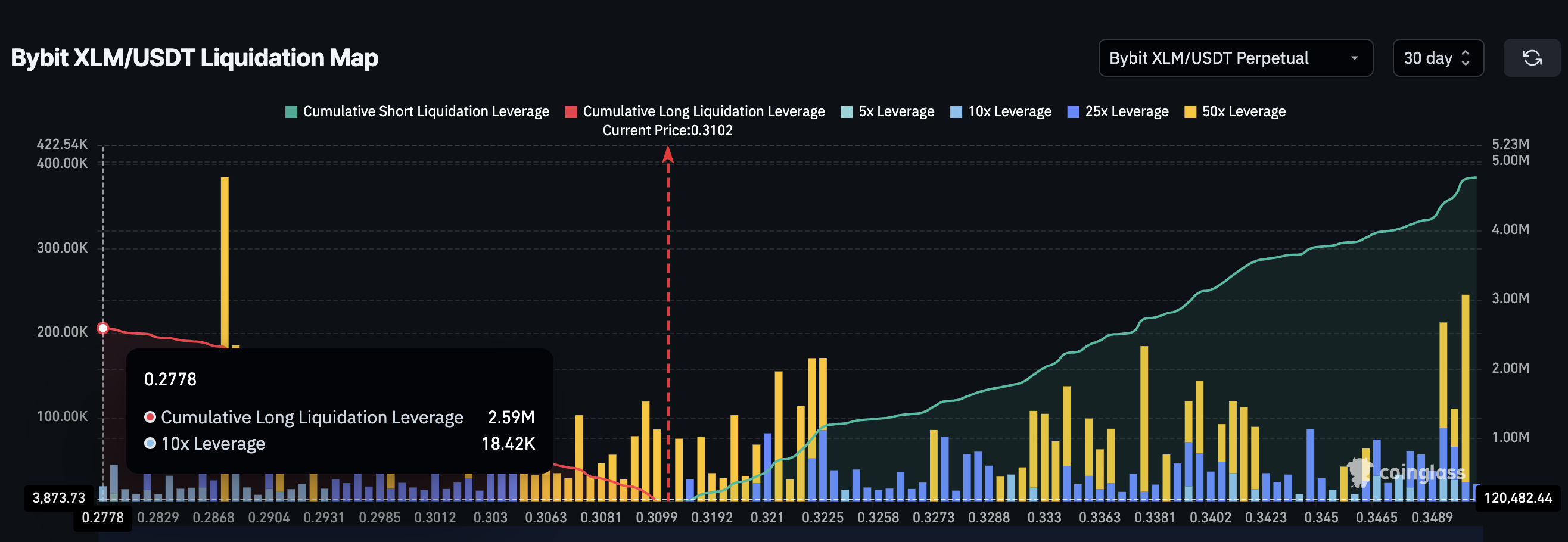

The twist lies within the derivatives market. Bybit’s liquidation map exhibits $4.74 million briefly leverage in opposition to XLM, signaling that almost all merchants are betting on a decline.

However there’s additionally $2.59 million in lengthy leverage nonetheless lively. If costs drop barely, these lengthy positions might get worn out, invalidating whale optimism.

In the meantime, if costs bounce and shorts begin liquidating, a pointy squeeze might push XLM larger — particularly if fee cuts are available in.

For now, Stellar (XLM) stays the wild card amongst Made in USA cash. It’s a token strolling a high-quality line between misplaced confidence and a possible quick squeeze.