Bitcoin’s latest drop has break up the crypto group – some worry extra ache forward, whereas others see a primary accumulation window forming.

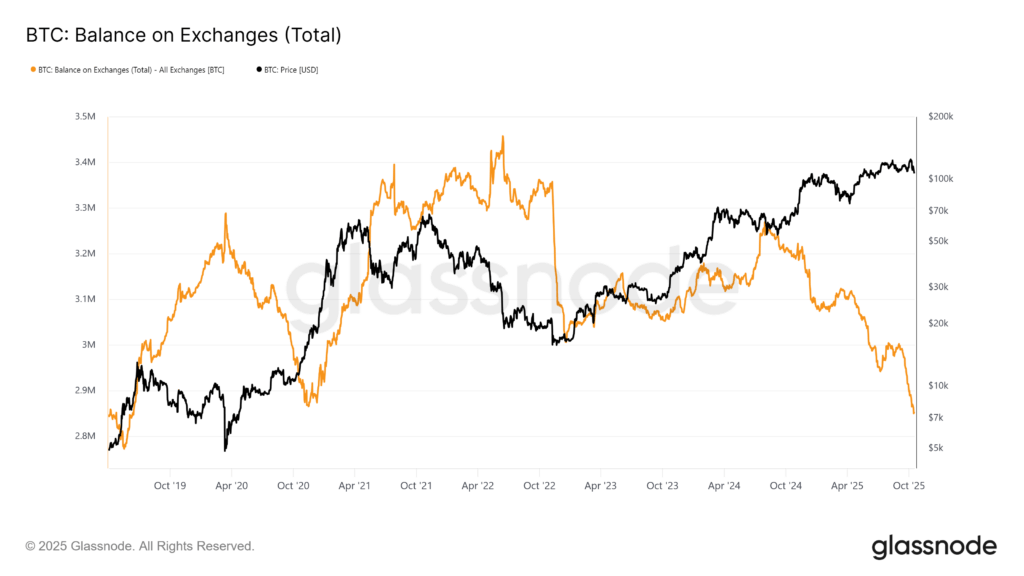

In line with onchain information from Glassnode, trade balances for Bitcoin have fallen to their lowest stage in over six years, with roughly 45,000 BTC – value round $4.8 billion – pulled from buying and selling platforms since early October.

Analysts interpret these regular outflows as an indication that long-term holders are quietly constructing positions, satisfied that present costs are undervalued.

On the identical time, the 30-day Market Worth to Realized Worth (MVRV) ratio has sunk to -7.56%, displaying that latest patrons are sitting on about 7.5% unrealized losses. Traditionally, such detrimental readings have usually aligned with accumulation phases that precede development reversals.

Regardless of short-term volatility, Bitcoin continues to hover just under $110,000 after dropping its key $108,000 help. If shopping for strain strengthens, a restoration towards $110,000 and even $112,500 might observe. Nonetheless, failure to carry above $105,000 could open the door to a different leg down close to $101,500.

For now, shrinking trade reserves and renewed whale exercise trace that long-term conviction is rising — even because the market wrestles with uncertainty over whether or not the underside is actually in.