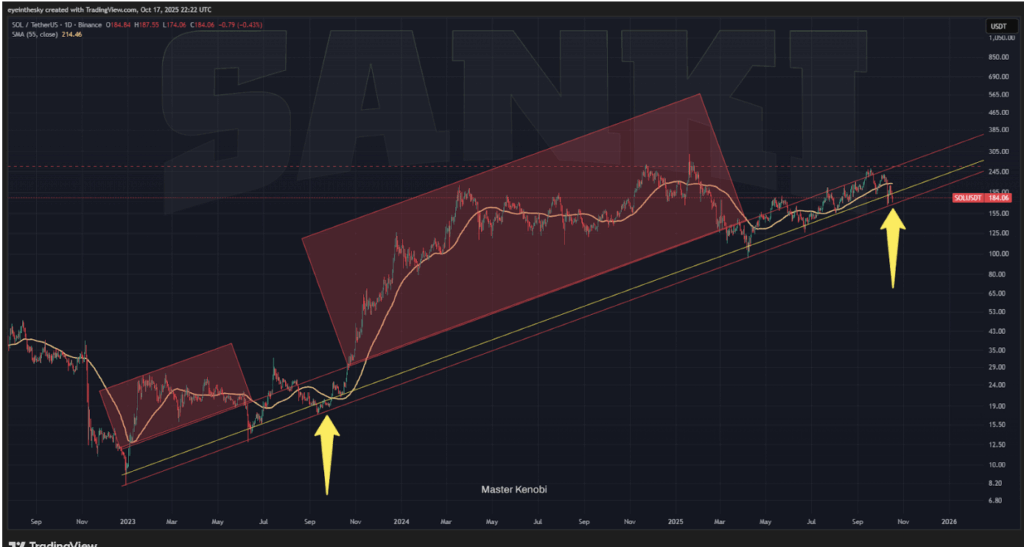

- Solana revisits the decrease boundary of a 3-year ascending development channel.

- 20-week EMA at $193 acts as key resistance, 50-week EMA close to $177 as main help.

- Analysts see similarities to final yr’s setup, hinting at attainable rebound potential.

Solana’s value has been catching loads of eyes currently after sliding again to the decrease boundary of its long-term ascending development channel — one which’s been in play for nearly three years.

Market watcher Grasp Kenobi identified that Solana has now touched this baseline six completely different instances since 2023, and each single contact thus far has marked a strong accumulation zone — moments when the value stabilizes earlier than switching course. Whether or not historical past repeats itself once more… that’s what merchants are watching carefully.

Final week, Solana opened close to $197, climbed as much as $211, after which sharply reversed to $174 earlier than closing round $186.51. That’s roughly a 5.5% weekly loss, however the lengthy decrease wick on the candle reveals one thing attention-grabbing — consumers are stepping in on the backside, scooping up cash each time value dips too far.

Market Temper and Value Construction

The present setup paints a combined image. Sellers are clearly energetic close to the highs, however consumers are nonetheless defending key ranges like $177–$180, suggesting the broader development stays alive. Actually, the rebound seems eerily just like what Solana did in September final yr — proper earlier than its main This autumn rally. Some analysts are hinting {that a} repeat won’t be too far-fetched.

Solana’s sample nonetheless matches inside its long-term uptrend, although short-term sentiment has turned barely cautious. It’s extra of a “cooling part” than a collapse.

Technical Outlook: Correction or Setup?

From a technical perspective, Solana is sitting in a mildly bearish short-term part, largely as a result of the 20-week EMA, now round $193, is appearing as resistance. Merchants are watching this line carefully — it’s the extent that should flip for the following leg upward.

Beneath that, the 50-week EMA close to $177 stays crucial help. A weekly shut above it retains the medium-term development intact. But when Solana slips under this degree, the following draw back targets come into play — the 100-week EMAround $153 and the 200-week EMA nearer to $121. These are main zones the place consumers may step again in if issues get shaky.

As for indicators, the RSI sits at 49.6, exhibiting impartial momentum, whereas the MACD remains to be constructive however regularly softening. That mixture sometimes indicators a cooling-off interval — extra consolidation than a development reversal.

Competitors Rising, Solana at a Crossroads

Solana’s incapability to retest its early 2025 highs provides a little bit of stress, particularly with BNB and XRP pushing more durable for market share. BNB, specifically, has been outperforming currently — one other signal that competitors amongst Layer-1s is heating up once more.

Nonetheless, Solana’s total chart stays constructive. So long as value stays above that 50-week EMA, bulls have purpose to remain optimistic. A clear weekly shut above $193 may reignite momentum towards $211, and presumably greater if quantity confirms. Then again, a break under $177 would counsel a deeper corrective wave, probably testing $150 earlier than any significant restoration.

For now, Solana sits proper on the sting — quiet, tense, and ready for the following decisive transfer.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.