- Over $60 billion has flowed into Bitcoin ETFs, with BlackRock’s IBIT main the cost and reshaping market construction.

- Conventional indicators like halving cycles, miner exercise, and alternate inflows are shedding relevance as establishments dominate.

- Bitcoin’s new bear market flooring is estimated between $75K and $80K, supported by ETF demand and world liquidity traits.

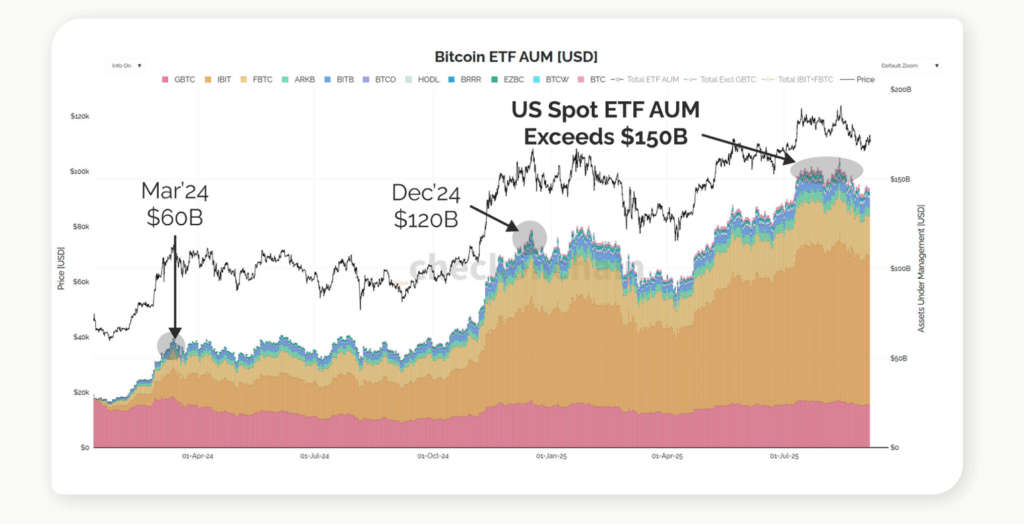

Bitcoin’s legendary halving cycle—the one which used to outline each bull and bear market—is beginning to lose its grip. With over $60 billion pouring into spot Bitcoin ETFs, led largely by BlackRock’s IBIT, the sport has modified. Institutional demand, world liquidity, and derivatives are actually pulling the strings. The outdated guidelines of “watch for the halving, then purchase” won’t imply a lot heading into 2026.

ETFs Are Rewriting Bitcoin’s Value Story

For years, miners have been on the heart of Bitcoin’s market rhythm. Each 4 years, their rewards halved, and costs soared quickly after. However now, ETFs are those driving worth formation. For the reason that US greenlit Bitcoin spot ETFs, cash has flooded in—over $60 billion price. BlackRock’s IBIT sits on the prime, not simply with the most important belongings beneath administration but additionally main in ETF-linked choices buying and selling. The U.S. alone now accounts for round 90% of all world spot Bitcoin ETF holdings.

James Test, co-founder of Checkonchain Analytics, summed it up completely: “Some holders are shifting from on-chain to ETFs… however demand’s been huge.” It’s a delicate shift that’s truly large—Bitcoin’s pricing energy is now extra about institutional flows than miner rewards.

Outdated Metrics Are Shedding Their Edge

Trade inflows was a go-to sign for market traits, however not anymore. Whilst Bitcoin hits new all-time highs, alternate inflows are sitting at file lows. Analysts say a lot of that information is flawed anyway since so many alternate wallets stay unidentified. “You gained’t see me use alternate information typically—it’s simply not an excellent device,” James admitted.

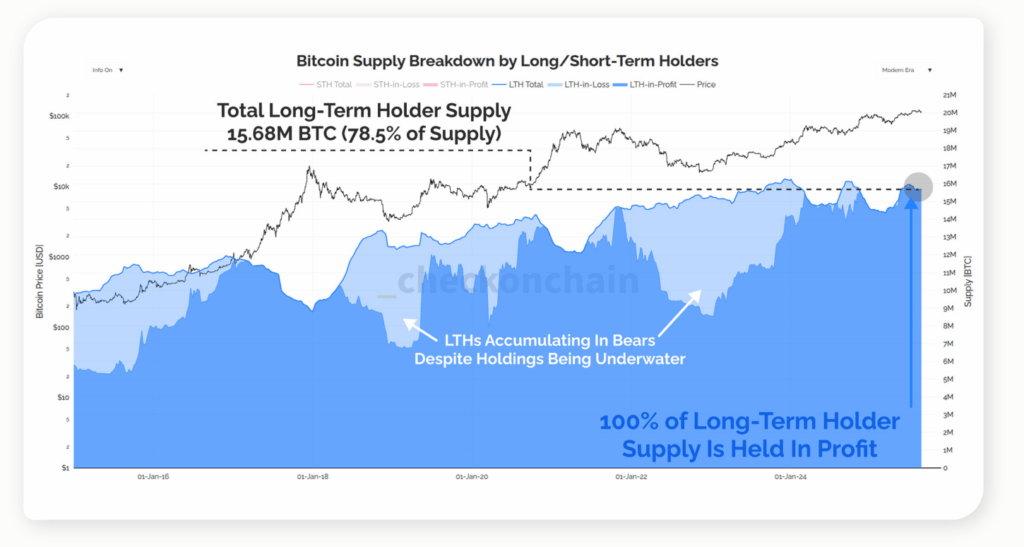

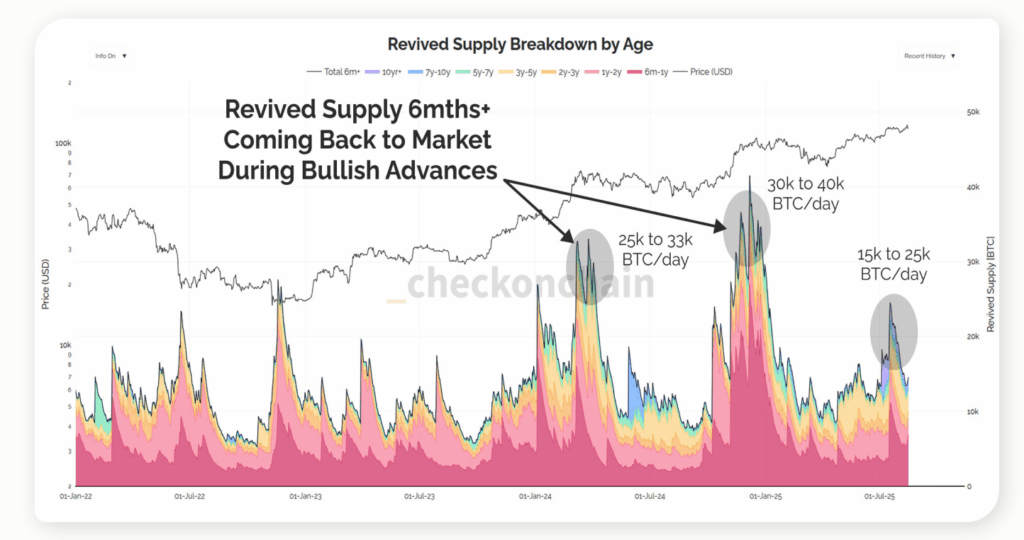

Miner promoting? Barely noticeable. With day by day issuance all the way down to round 450 BTC, it’s nothing in comparison with long-term holders who can offload tens of 1000’s directly. On-chain charts barely even register miner exercise anymore. It’s clear: the market’s route isn’t being set by miners or exchanges—it’s pushed by establishments, ETFs, and the sluggish churn of long-term holders.

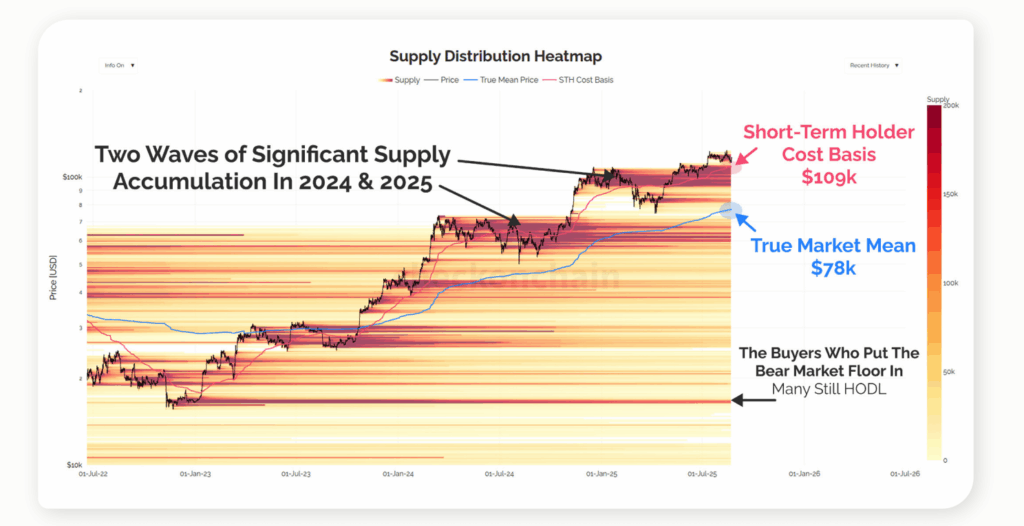

Realized Value and Market Flooring Are Evolving

Historically, traders appeared to metrics like Realized Value to identify market bottoms. However that quantity contains historical wallets—some in all probability misplaced endlessly, like Satoshi’s. Right this moment, the Realized Value sits round $52K, however nobody actually thinks Bitcoin will drop that low once more. James believes a “bear market” flooring now sits nearer to $75K–$80K, supported by ETF inflows and company treasuries shopping for at these ranges.

Even in style metrics like MVRV Z-Rating aren’t hitting the identical. They nonetheless matter, however analysts say thresholds want tweaking to mirror how deep and institutionalized Bitcoin’s market has develop into. The actual indicators now come from liquidity traits, derivatives quantity, and the way massive entities place their portfolios.

Bitcoin Follows Liquidity, Not Simply Halvings

International liquidity has develop into Bitcoin’s new pulse. As ETFs mature, choices and derivatives constructed on prime of them have gotten the actual engines of worth discovery. Vanguard is reportedly making ready its personal ETF subsequent, which may push this even additional. “The ETFs are large,” stated James, “however the choices market round them—that’s the place the actual motion is.”

Even sovereign funds and pensions are dipping their toes in. Whereas nonetheless early, their presence marks a turning level. Most of those ETFs are held via Coinbase, elevating questions on centralization, although the community’s proof-of-work mannequin nonetheless ensures safety and decentralization on the protocol stage.

At this stage, Bitcoin isn’t simply reacting to crypto-specific occasions—it’s shifting with world liquidity, rates of interest, and institutional sentiment. The outdated halving cycle? It’s nonetheless there, but it surely’s not in cost anymore. As 2026 approaches, Bitcoin’s story will probably be written by ETFs, derivatives, and Wall Avenue cash—not block rewards.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.