In current months, a raft of alt-L1s joined Ethereum to change into L2s, whilst different initiatives on L2s swap again to the Ethereum mainnet.

The Ethereum L1 is reasserting its declare to be the house of high-value DeFi — it has seven instances extra TVL than its nearest rival — whereas the L2 mannequin presents hundreds of thousands in potential financial savings, together with community results for alt-L1s that be part of the ecosystem.

Again in March, when bearishness across the “extractive” L2 roadmap was at its peak, cell funds community Celo quietly closed down its validator community to change into an L2. Now, it’s saving virtually $7 million a 12 months in working prices.

In August, blockchain gaming L1 Ronin introduced it was coming residence to Ethereum in early 2026, 5 years after community congestion pressured its widespread recreation Axie Infinity off mainnet.

“Ethereum has largely delivered on the scaling roadmap,” says Jeffrey “Jiho” Zirlin, co-founder of Sky Mavis, which constructed each the sport and alt-L1.

That very same month, OG DeFi challenge Synthetix, which led the cost to Optimism in 2021, revealed it might shutter its L2 franchises to faucet the big liquidity that refuses to budge from mainnet. It’s launching a Hyperliquid-style perp DEX with a flashy buying and selling competitors for high-profile influencers like Ansem and Degen Spartan.

In September, Aave introduced a proposal to shutter half of its under-performing situations, which have unfold out like McDonald’s throughout L2s and different chains like Avalanche, BNB Chain, Fantom and Concord. Regardless of 5 years of growth, 86% of Aave’s income continues to be generated on Ethereum’s L1.

And to this point this month, Consensys founder Joe Lubin has confirmed that world banking alliance Swift is constructing its crypto funds system on the Linea L2, and Polkadot AI agent challenge Phala voted to change into an L2 as a result of that’s “the place developer exercise, liquidity, and tooling are strongest.”

The motion again to Ethereum displays rising optimism that the scaling roadmap may really work, particularly now there’s a reputable plan to scale the L1 utilizing gasoline restrict will increase and ZK tech. DeFi initiatives can fortunately throw sources into constructing on the L1 with out worrying that it’s going to grind to a halt if exercise will increase.

“We imagine that there’s now sufficient of a dedication and sufficient motion that we’ve seen from the Basis and builders to scale the L1,” says lead engineer Ben Celermajer of Syntetix’s choice to return.

Tasks with totally different wants can benefit from low cost safety and better throughput on the L2s, which can stand up to an 8X knowledge capability improve in 2026.

It’s not all one-way visitors, although: fantasy sports activities NFT challenge Sorare noticed an enormous uptick in quantity after leaping ship to Solana this month, and Circle and Stripe just lately introduced competing L1s, Arc and Tempo.

However Ethereum followers take consolation in the truth that these stablecoin L1s are EVM-compatible.

“I imagine that they’ll ultimately change into an L2,” says Zirlin. “Perhaps originally, form of like us, they need the pliability in some methods to do what they need, and ultimately they’ll come residence to Ethereum.

“All EVM L1s are future L2s,” he says.

Synthetix returns to Ethereum mainnet

After spending a few years within the wilderness, Synthetix is already reaping the rewards of coming residence to mainnet, with a God candle earlier this week.

Its new Central Restrict Order Guide (CLOB) perp DEX hopes to draw consideration with its buying and selling comp this month, and goals to draw merchants with measurement when it launches on the finish of subsequent month.

It’s one more sharp flip for Synthetix, which started life as a stablecoin challenge, pivoted to artificial property to experience the yield farming growth above $30 in 2021, earlier than reinventing itself as an AMM-style perp DEX in 2023.

For many of the previous 12 months, the unwinding of its previous staking system has seen its stablecoin, SUSD, off the peg, however Synthetix v4 has recruited 80% new workforce members to begin afresh.

Founder Kain Warwick, who returned to steer the challenge once more earlier this 12 months, admits that “Synthetix misplaced its method” for a number of causes, however says that Layer L2s finally constrained its progress.

The leap to Optimism in 2021 was unavoidable, as gasoline charges for even claiming weekly rewards had been round $100 on mainnet. It later arrange store on Arbitrum and Base and began work on an app chain known as SNAXchain.

“That path was perps all over the place,” Celermajer tells Journal throughout an interview at Token2049. “They had been going to launch on Solana and Sui too.”

By the center of final 12 months, it was clear the challenge was flailing. Celermajer was introduced on board to assist proper the ship. He says a part of the issue is that what liquidity there may be on L2s is mercenary and extremely cell, “it simply goes wherever the following incentive is.”

However the huge concern was that whales by no means really embraced L2s, probably as a result of inherent threat of locking funds in bridges which can be like honeypots for hackers. Ethereum L1 accounts for 60% of your entire TVL in crypto, however the main L2 Base has simply 3.5%.

”There’s no query that there are giant market makers, liquidity suppliers, whales, who had been comfortable to dabble with L2s, however didn’t wholesale go [over to L2s],” Warwick explains. He was one in all them.

“At no level did I ever transfer greater than 5% of my Synthetix onto Optimism…. I might afford the charges, [but] due to safety. There’s an entire bunch of causes.”

However many initiatives with lower-value transactions and better throughput did shift to L2s, liberating up area.

“One of many decisions of going with this L2-centric roadmap is it’s really opened up a ton of bandwidth on L1,” he says, including, “The L1 has gotten higher within the final 5 years. Proof-of-stake and bigger block sizes — there’s a bunch of issues which have improved.”

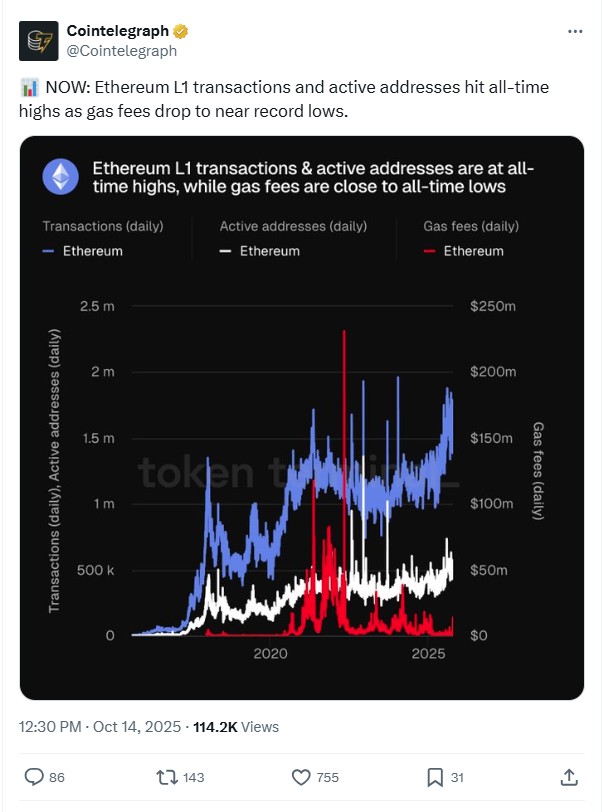

Common gasoline charges have been decreased on mainnet by 99% from the height. The L1 gasoline restrict (the quantity of computation it could possibly deal with) is predicted to extend to 60 million gasoline items per block across the time of December’s Fusaka improve “with the objective to extend this to round 100M a while after,” the Ethereum Basis tells Journal. That will equate to a most of 80 TPS (the present most is 40 TPS).

Synthetix plans to scale itself on mainnet

Whereas that’s six instances extra throughput than DeFi Summer season, it’s not sufficient to run a high-frequency CEX-style buying and selling. As an alternative, Synthetix will run an offchain matching engine able to 100,000 TPS. Because of this, will probably be nearer to Belief Me Bro than trustless.

Celermajer argues that it’s unimaginable to run a high-frequency buying and selling system on a genuinely decentralized community as a result of latency of world consensus, so it’s a crucial compromise.

“4 years in the past, when everybody was a decentralization maxi, I don’t suppose it might have flown, however we’re at a stage out there the place persons are extra prepared to simply accept these trade-offs,” he says.

Warwick envisages a transition to an “Optimistic order e book” which might primarily remodel the app into one thing akin to its personal rollup.

“Like within the optimistic rollup mannequin, whereby you do all these items [process transactions] and then you definately put up the state to blobs,” Celermajer explains.

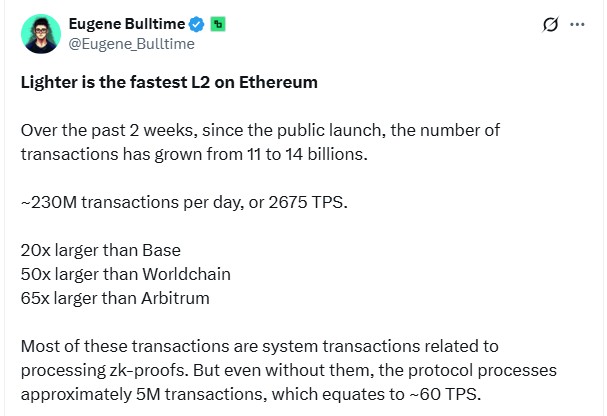

Warwick says this might be achieved utilizing TEEs. Another choice can be to repeat Lighter’s use of ZK-proofs to indicate that its offchain transactions had been carried out accurately.

It’s nonetheless extremely speculative, but it surely’s doable that in the future apps on mainnet might simply scale themselves…

Aave’s Ethereum standing: It’s difficult

Lending and borrowing protocol Aave is taking a extra measured strategy, scaling again situations on different chains with out going all-in on L1.

In September, Aave Chan Initiative founder Marc Zeller detailed how its growth technique was being revised on the Aave governance boards. From 2021 onward, Aave planted its flag all over the place from Polygon to Arbitrum, Optimism, Base, Linea, ZKsync Period, Avalanche, BNB Chain, Fantom and Concord.

Round half of all these situations are actually unprofitable and face closure. Nonetheless, since Zeller’s put up, Aave has introduced its integration with OKX’s X Layer L2 and Crypto.com’s Cronos Chain L2. It went stay on Plasma, the place it amassed a $6 billion TVL in only a few days.

Learn additionally

Options

Bitcoin’s invisible tug-of-war between fits and cypherpunks

Options

How the crypto workforce modified within the pandemic

Requested at Cointelegraph’s Longtitude occasion earlier this month if Aave would develop to Solana, founder Stani Kulechov stated the challenge will go wherever the cash and customers are.

“Properly, from Aave’s perspective, we need to see the expertise all over the place there’s customers and clearly we’ve began to construct from Ethereum, and that’s the place most of our exercise is, however down the road, clearly, we need to assist any expertise and onchain stack that will get adoption and has a a consumer base and has potential for profitability.”

Ronin returns to Ethereum as an L2

One other challenge that left Ethereum resulting from mainnet congestion in 2021 was alt L1 Ronin. The transfer enabled it to scale Axie Infinity as much as 2.8 million each day customers throughout its 2022 peak. “Axie Infinity was the primary recreation that principally hit exponential progress by migrating to a scaling resolution,” says Zirlin.

It’s nonetheless a high title, producing $1.4 billion within the first half of the 12 months. However bringing the sport again to mainnet merely wasn’t an choice.

“Ethereum mainnet is nice for perhaps DeFi and perhaps some stablecoins, and a few transfers, however gaming has fairly complicated transactions that basically require scalability,” he says.

Ronin now helps 100 video games and attracts 350,000 each day energetic addresses and 800,000 month-to-month energetic addresses.

“Transaction exercise on the chain is definitely a lot increased than it was on the peak of the Axie growth,” Jiho says.

Whereas a return to Ethereum was all the time on the playing cards, it’s solely just lately that Zirlin has had the arrogance within the scaling roadmap to come back residence.

“You’ve the idealism of the Ethereum neighborhood versus the pragmatism, proper? And I feel we’re form of within the center. That’s why we initially selected to go along with one thing that was simply working. However over time, as Ethereum additionally made sensible steps, we’re like, ‘Okay, we need to form of meet within the center right here,’” he says.

Ronin’s relaunch as an optimistic rollup within the Superchain in early 2026 will come shortly after the Fusaka improve begins to scale up blob capability by an element of eight. Information availability and value have been the key limiting elements on the Ethereum ecosystem TPS. Final week, the ecosystem peaked at 2,835 TPS for the primary time, and subsequent 12 months it’ll be capable of do way more.

Learn additionally

Options

Billions are spent advertising crypto to sports activities followers — Is it value it?

Options

Unlocking Cultural Markets with Blockchain: Web3 Manufacturers and the Decentralized Renaissance

Working an L1 prices hundreds of thousands greater than working an L2

There’ll nonetheless be sooner and cheaper chains after the Fusaka improve, however there are enormous financial savings to be made for any L1 that transforms into an L2.

Ecosystem analytics website GrowThePie co-founder Matthias Seidl (Matze) advised The Edge Podcast final month that the financial savings add as much as hundreds of thousands of {dollars} a 12 months.

“By changing into an L2, Celo really lower 99.8% of their safety prices as a result of now as an alternative of getting to pay like a set of 100 validators — I feel it was like 110 validators that they had in the long run which every obtained like $59,000 per 12 months for validating,” he stated, whereas an L2 has to solely pay a couple of bucks for settlement on the L1 and knowledge blobs.

“It finally ends up being a 99.8% lower of their prices and bringing down their earlier bills of $6.9 million per 12 months all the way down to solely like $13,000 or $13,200.”

Zirlin says working an Alt L1 community is “very complicated and expensive,” with $35 million paid out in staking rewards since 2023. These funds will now be redirected towards builders who drive income to the chain and lifelong high-value customers.

“You’re utilizing your validator rewards to incentivize safety, however in the event you can outsource that to Ethereum, now you can use the emissions to incentivize different issues,” Zirlin explains.

Different advantages of changing into an Ethereum L2: Everybody likes you

There are different advantages to changing into an L2, together with guaranteeing Ronin is “capable of keep updated with all the newest EIPs which can be built-in, and we wished to profit from the complete safety of Ethereum upkeep.”

Plus, they’ve been warmly welcomed again into the fold.

“I might positively see extra collaborations,” he says. “Once you’re a part of the Ethereum ecosystem, there’s sure individuals who wouldn’t message us or speak to us earlier than, however now are immediately ‘hey, we’re all form of a part of the identical ecosystem’.”

Subscribe

Probably the most partaking reads in blockchain. Delivered as soon as a

week.

Andrew Fenton

Andrew Fenton is a journalist and editor with greater than 25 years expertise, who has been protecting cryptocurrency since 2018. He spent a decade working for Information Corp Australia, first as a movie journalist with The Advertiser in Adelaide, then as Deputy Editor and leisure author in Melbourne for the nationally syndicated leisure lift-outs Hit and Switched on, revealed within the Herald-Solar, Each day Telegraph and Courier Mail.

His work noticed him cowl the Oscars and Golden Globes and interview a number of the world’s largest stars together with Leonardo DiCaprio, Cameron Diaz, Jackie Chan, Robin Williams, Gerard Butler, Metallica and Pearl Jam.

Previous to that he labored as a journalist with Melbourne Weekly Journal and The Melbourne Occasions the place he received FCN Finest Function Story twice. His freelance work has been revealed by CNN Worldwide, Unbiased Reserve, Escape and Journey.com.

He holds a level in Journalism from RMIT and a Bachelor of Letters from the College of Melbourne. His portfolio contains ETH, BTC, VET, SNX, LINK, AAVE, UNI, AUCTION, SKY, TRAC, RUNE, ATOM, OP, NEAR, FET and he has an Infinex Patron and COIN shares.